- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

My fiancee's tax return fell into the trap of being eligible for additional tax credits/adjustments due to the stimulus act. Specifically, changes made after she had originally filed and received her initial refund were:

1) The amount of unemployment compensation she originally claimed as taxable income was offset by the stimulus changes. This resulted in a decrease initially in her tax liability of $237, bringing her tax liability to $0.

2) Because of Line 1, it also brought her below the income threshold to make her eligible for the EITC, which she was not eligible prior to this change.

3) Her child tax credit also changed due to the above changes.

We e-filed a 1040X for her through TurboTax back in March. On the 1040X, we provided the following info to the IRS in the "Explanation of changes" on the 1040X (I've redacted actual values):

- Lines 1, 3, 5: AGI reduced by $xxxx due to change in Schedule 1

exempting up to $10,200 in unemployment compensation for 2020.

- Line 6: Tax amount reduced due to decrease on Line 5

- Line 7: Credits reduced to prevent credits from exceeding total tax

- Line 14: Due to above changes, EIC credit taken based on now meeting

income thresholds for eligibility

- Line 15: Due to above changes, child tax credit restructured and return

now includes Schedule 8812.

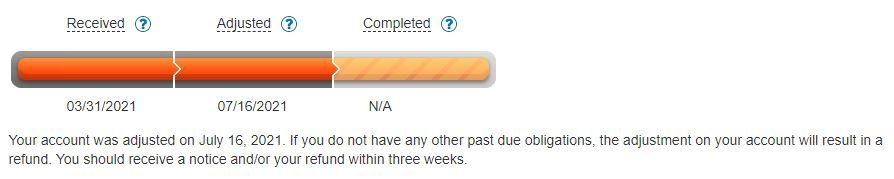

In late July, she received a mailed CP21B from the IRS with a "Decrease in tax" and the notice "We changed your 2020 Form 1040 because of recent tax laws, rulings, or regulations required us to correct your unemployment compensation. As a result, you are due a refund of $xxx.xx". She also received a direct deposit of that amount, plus interest. THIS refund only reflects the amount due solely due to removal of the unemployment from taxable income. In the letter that was received, under "What you need to do", it says if she agrees with the changes made, she should receive a refund in the next few days (which she did receive). And if she did not agree with the changes, to call to review the account with a representative. We're not sure about what happened with the 1040X in regards to the EITC. We have tried calling multiple times, but can not get through at all. When checking her 1040X status online, the below appears -- noting that the "Completed" section is still not filled in and the date says "N/A".

SO -- the question is -- they've received the 1040X and indicated they made an adjustment. However, that adjustment doesn't match what she is now eligible for on the 1040X. We're not sure if this letter was in response to the 1040X - or - if it was part of the automatic recalculation they were doing for the UCE. Are they still processing this? Do we just let things sit for a while to see what happens? Do we file another 1040X and use this now adjusted info from the IRS? I pulled her Record of Account Transcript, which shows the following:

971 Amended tax return or claim forwarded for processing 03-31-2021 $0.00

977 Amended return filed 03-31-2021 $0.00

291 Reduced or removed prior tax assessed 07-26-2021 -$xxx.xx

971 Notice issued 07-26-2021 $0.00

846 Refund issued 07-14-2021 $xxx.xx

776 Interest credited to your account 07-26-2021 -$x.xx

The next question is --- how the heck can I prepare a set of records in TurboTax now with the correct info? I would imagine I would have to enter information manually in forms mode -- and I will likely have to perform some overrides -- but I'm not sure how to do that. Fortunately I do have the full PDF outputs of both the original 1040 return and all worksheets, as well as the 1040X and all worksheets. But for NEXT year, I want to make sure I have all of the correct info to import from this year.

Thanks