- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- 1040-x "Correct amount" Doesnt get updated

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040-x "Correct amount" Doesnt get updated

Hi,

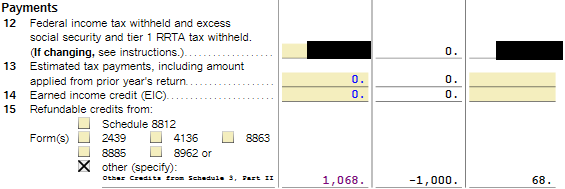

I am trying to amend my taxes for the Recovery Rebate Credit and I entered the amount in the other section of #15 in 1040-X form, using my Turbo Tax Premier 2021 Desktop Software, but I see that the "Correct Amount" doesn't update with the amount I entered.

Please help how I can adjust this amount.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040-x "Correct amount" Doesnt get updated

Did you claim the Recovery Rebate on your original return?

You cannot amend a return for the Recovery Rebate Credit since their was a Recovery Rebate credit on your original return and the IRS corrected the amount. The IRS will send you a letter regarding the change in your return, and information on what to do if you don't agree.

The following is from the IRS about amending a return for the Stimulus payment:

1) If you didn't claim the credit on your original tax return you will need to file a Form 1040-X, Amended U.S. Individual Income Tax Return, to claim it. The IRS will not calculate the 2021 Recovery Rebate Credit for you if you did not enter any amount on your original tax return, or you entered $0.

(2) DO NOT file an amended tax return if you entered an incorrect amount for the 2021 Recovery Rebate Credit on your tax return. If you entered an amount other than $0 on line 30 but made a mistake in calculating the amount, the IRS will calculate the correct amount of the 2021 Recovery Rebate Credit, make the correction to your tax return, and continue processing your return. If a correction is needed, there may be a delay in processing your return and the IRS will send you a notice explaining any change made.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040-x "Correct amount" Doesnt get updated

To add to my post above, if you still need to amend your return:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040-x "Correct amount" Doesnt get updated

You might want to contact TurboTax support, there maybe a glitch in the program.

How do I contact TurboTax?

If you're using TurboTax Online:

- Sign into your TurboTax account (if you aren't already signed in).

- Once you're in, type Contact us in the Search bar.

- Select the Contact Us button from the results.

- Select the pencil icon to enter your question and select Let's talk.

- Now choose between:

- Posting your question to our community of experts (Post a question)

- Talking one-on-one with a live TurboTax Expert or CPA (Get a call)

- Free Edition (without PLUS): This is not covered, so when you select Talk to a specialist, you'll be asked to add PLUS benefits first.

If you're using the TurboTax CD/Download software or can't sign into your TurboTax account:

- Go here to contact us.

- Ask your question, select Continue, and follow the instructions.

We're open Monday through Friday 5:00 AM to 5:00 PM PT. For October 15—17, we're extending our hours to be open from 5:00 AM to 9:00 PM PT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040-x "Correct amount" Doesnt get updated

Did you claim the Recovery Rebate on your original return?

You cannot amend a return for the Recovery Rebate Credit since their was a Recovery Rebate credit on your original return and the IRS corrected the amount. The IRS will send you a letter regarding the change in your return, and information on what to do if you don't agree.

The following is from the IRS about amending a return for the Stimulus payment:

1) If you didn't claim the credit on your original tax return you will need to file a Form 1040-X, Amended U.S. Individual Income Tax Return, to claim it. The IRS will not calculate the 2021 Recovery Rebate Credit for you if you did not enter any amount on your original tax return, or you entered $0.

(2) DO NOT file an amended tax return if you entered an incorrect amount for the 2021 Recovery Rebate Credit on your tax return. If you entered an amount other than $0 on line 30 but made a mistake in calculating the amount, the IRS will calculate the correct amount of the 2021 Recovery Rebate Credit, make the correction to your tax return, and continue processing your return. If a correction is needed, there may be a delay in processing your return and the IRS will send you a notice explaining any change made.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040-x "Correct amount" Doesnt get updated

To add to my post above, if you still need to amend your return:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040-x "Correct amount" Doesnt get updated

I already filed my taxes. So I am using 1040-x.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040-x "Correct amount" Doesnt get updated

I didnt claim the credit on my original tax return. But my problem is after I enter the amount in my 1040-x in Turbo Tax, it doesn't do the adjustments under the "correct amount" column.

It doesn't even let me manually correct it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040-x "Correct amount" Doesnt get updated

You might want to contact TurboTax support, there maybe a glitch in the program.

How do I contact TurboTax?

If you're using TurboTax Online:

- Sign into your TurboTax account (if you aren't already signed in).

- Once you're in, type Contact us in the Search bar.

- Select the Contact Us button from the results.

- Select the pencil icon to enter your question and select Let's talk.

- Now choose between:

- Posting your question to our community of experts (Post a question)

- Talking one-on-one with a live TurboTax Expert or CPA (Get a call)

- Free Edition (without PLUS): This is not covered, so when you select Talk to a specialist, you'll be asked to add PLUS benefits first.

If you're using the TurboTax CD/Download software or can't sign into your TurboTax account:

- Go here to contact us.

- Ask your question, select Continue, and follow the instructions.

We're open Monday through Friday 5:00 AM to 5:00 PM PT. For October 15—17, we're extending our hours to be open from 5:00 AM to 9:00 PM PT.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17704738120

New Member

raeledwards

New Member

julalexdvy

New Member

Eszee88

Returning Member

mitgrube01

New Member