- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How to report foreign source retirement income tax credit from canadian RRSP

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report foreign source retirement income tax credit from canadian RRSP

No, you do not have an answer to my question, very unfortunately

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report foreign source retirement income tax credit from canadian RRSP

To receive a foreign tax credit on the amount you pay taxes to both US and Canada, in the TurboTax program, go to:

- At the right upper corner, in the search box, type in foreign tax credit and Enter

- Select the 1st choice on the search results - Jump to foreign tax credit

- Start with screen Foreign Taxes and select Continue to follow prompts.

To enter Canadian RRSP information, go to:

- Across the top, select tab Federal taxes / Wages & Income

- Scroll down to Retirement Plans and Social Security / Canadian Registered Pension Income, select Start

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report foreign source retirement income tax credit from canadian RRSP

To receive a foreign tax credit on the amount you pay taxes to both US and Canada, in the TurboTax program, go to:

- At the right upper corner, in the search box, type in foreign tax credit and Enter

- Select the 1st choice on the search results - Jump to foreign tax credit

- Start with screen Foreign Taxes and select Continue to follow prompts.

To enter Canadian RRSP information, go to:

- Across the top, select tab Federal taxes / Wages & Income

- Scroll down to Retirement Plans and Social Security / Canadian Registered Pension Income, select Start

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report foreign source retirement income tax credit from canadian RRSP

I followed your suggestion, and reported income under RRSP

but TurboTax2018 only let me declare the foreign tax paid for income from 1099-DIV, and not from RRSPs

should I fill out Form 116 and report the foreign tax paid on this form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report foreign source retirement income tax credit from canadian RRSP

I have the same problem, TurboTax 2019 only let me declare the foreign tax paid for income from 1099-DIV, and not from RRSPs. Is there a way for me to enter data into the form 1116 and for Turbo Tax to capture the credit (RRSP witholding amount)? How is it done? Previous answers are not sufficient.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report foreign source retirement income tax credit from canadian RRSP

Did you ever figure this out?...Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report foreign source retirement income tax credit from canadian RRSP

Here are the steps:

In TurboTax online,

- Open up your TurboTax account and select Pick up where you left off

- At the right upper corner, in the search box, type in "foreign tax credit" and Enter

- Select Jump to foreign tax credit

- Follow prompts

- On screen, "Tell Us About Your Foreign Taxes", do not check the first box ( You have no more foreign taxes to enter other than the 1099-DIV, 1099-INT, 1099-OID or a Schedule K-1) Since you have foreign taxes from other sources other than the 1099s, do not check that box.

- Follow prompts

- Choose the Income Type, select "Passive Income"

- On screen, "Country Summary", add a country to continue

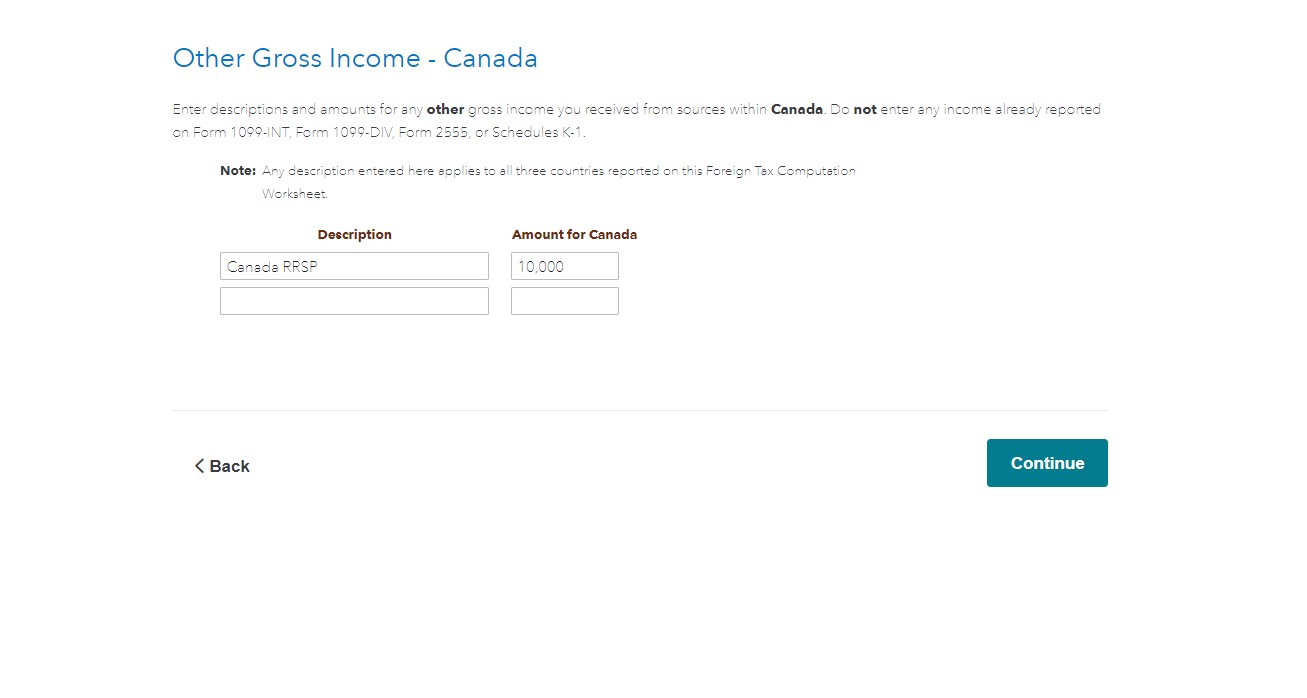

- On screen, "Other Gross Income", enter Canada RRSP and the amount and follow prompts

- On screen, "Foreign Taxes Paid", under foreign taxes on Other Income, enter the amount

- See images below

If you have paid taxes to both foreign and the US tax authorities, the IRS allows you to claim a foreign tax credit Form 1116. To learn more, click here: Foreign tax credit

If you can't claim a credit for the full amount of qualified foreign income taxes you paid or accrued in the year, you're allowed a carryback and/or carryover of the unused foreign income tax, except that no carryback or carryover is allowed for foreign tax on income included under section 951A. You can carry back for one year and then carry forward for 10 years the unused foreign tax. To read more, click here:

https://www.irs.gov/taxtopics/tc856

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report foreign source retirement income tax credit from canadian RRSP

Thanks for this...clearest response on this subject I have found. Only question is exchange rate and how I am meant to calculate. Assume its what it was at time of transfer so I can enter in USD in Turbo Tax ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report foreign source retirement income tax credit from canadian RRSP

That would be correct. Use the exchange rate at the time when the event occurred.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report foreign source retirement income tax credit from canadian RRSP

I followed the steps until get to Canadian Retirement contribution. It only allows me to enter the distribution amount I received. There is no place allow me to enter the tax withhold by Canada.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report foreign source retirement income tax credit from canadian RRSP

Here are the steps:

In TurboTax online,

- Open up your TurboTax account and select Pick up where you left off

- At the right upper corner, in the search box, type in "foreign tax credit" and Enter

- Select Jump to foreign tax credit

- Follow prompts

- On screen, "Tell Us About Your Foreign Taxes", do not check the first box.

- (First box says -you have no more foreign taxes to enter other than the 1099-DIV, 1099-INT, 1099-OID or a Schedule K-1)".

- Follow prompts

- Choose the Income Type, select "Passive Income"

- On screen, "Country Summary", add a country to continue

- On screen, "Other Gross Income", enter Canada RRSP and the amount and follow prompts

- On screen, "Foreign Taxes Paid", under foreign taxes on Other Income, enter the amount

@Mayron69

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report foreign source retirement income tax credit from canadian RRSP

Hi

I saw this article in TurboTax FAQ- which seems to state that we can just report RRSP/CPP as SSA-1099.

How do I enter my Canada Pension Plan (CPP) or Old Age Security (OAS) benefits?

dated Jan 12, 2022.

If true this would be very simple and avoid completing form 1116.

Thoughts?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report foreign source retirement income tax credit from canadian RRSP

Yes. The IRS treats Canada Pension Plan (CPP) or Old Age Security (OAS) benefits as Social Security equivalents for US taxes.

You will still need to file Form 1116 to claim a credit in USD for any Canadian income tax withheld. You cannot add that as US tax withheld in the Social Security section,

Notice 98-23 said:

Under the new rules (that is, the 1997 Protocol), Canadian social security benefits paid to U.S. residents generally will be taxable, if at all, only by the United States. The benefits will be taxed at graduated rates on a net basis as if they were benefits paid under the U.S. Social Security Act.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report foreign source retirement income tax credit from canadian RRSP

The article (from FAQ) does not list Form 1116. It seems to include the tax withholding in Box 6

- Enter the total Canadian CPP and OAS payments you received during 2021 in Box 5

- If you already have something in Box 5 from a previously-entered SSA-1099, add your CPP/OAS benefits to the amount already there

- In the uncommon situation where taxes were withheld from your payments, enter the total withheld during 2021 in Box 6

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report foreign source retirement income tax credit from canadian RRSP

We researched this issue further. You can include any Canadian tax withheld in either Box 6 or as a credit on Form 1116. Convert the amount into USD either way.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ED001

Level 1

hynrel53

New Member

dazimi

Level 3

mjmoor60

New Member

helloball3rd

New Member