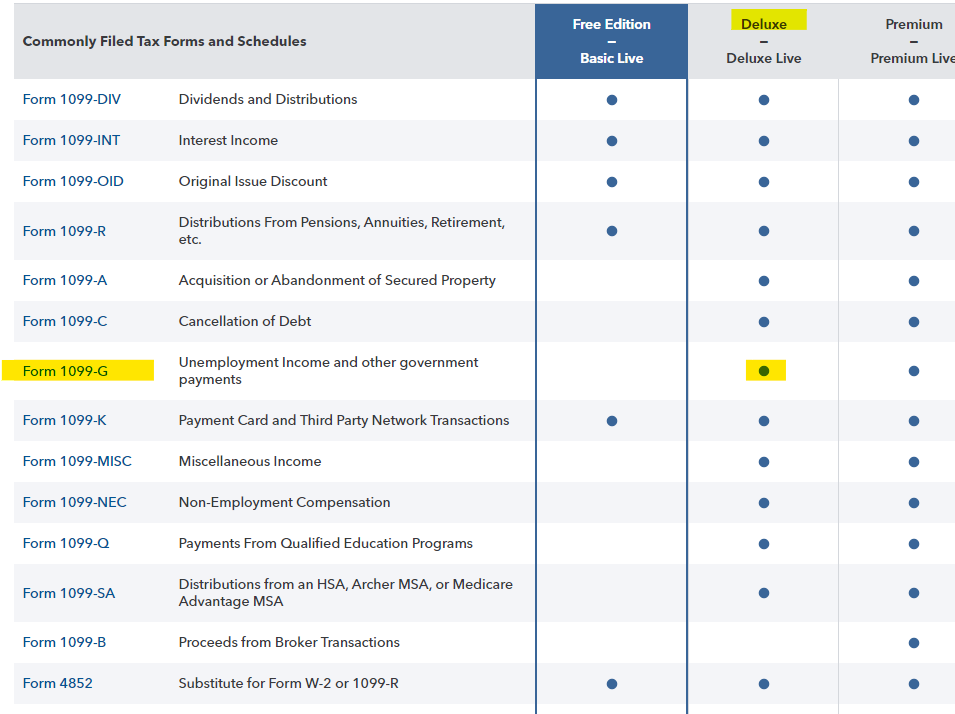

1099-G entry is not included in the Free version, please see Why do I have to upgrade?

Federal, state, or local governments file this form 1099-G if they made payments of:

- Unemployment compensation.

- State or local income tax refunds, credits, or offsets.

- Reemployment trade adjustment assistance (RTAA) payments.

- Taxable grants.

- Agricultural payments.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"