- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Why are my previous posts not getting answered when TT experts were making progress weeks ago?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my previous posts not getting answered when TT experts were making progress weeks ago?

I made two posts weeks ago which received constructive comments from TT experts but I still have no solution. I realize TT support has its limitations but this is the first year out of the last 20+ that TT support (phone and Forum) failed to at least come to a conclusion. Both of my part year state returns are having problems because they are not handling Part Year income properly. I am linking my original posts below.

Can anybody confirm these are in fact TT Online bugs? I cannot file my state returns and the TT refund policy is absolutely horrible. I don't want to try the desktop version which might also have these problems and then have to pay to efile two states. At that point I would cut my $100+ loss and use other tax s/w.

1. There is no place in the MA state interview to make adjustments for US Deb Obligations carried over from the Federal Return. NC handled this part year excluded income perfectly.

MA interview wont allow me to adjust US debt Obligations for Part Year exclusion.

2. There is an error in the NC TT program which prevents Part Year taxable 1099-Q Coverdell income from being included in the total NC income. A TT worksheet is failing to add up the subtotal entries (a+b=c) which then incorrectly carries over to the NC D-400. MA handles this part year income perfectly.

NC return is not including Part Year Coverdell income

Please consider this post as unfortunate negative feedback from a very long time TT user.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my previous posts not getting answered when TT experts were making progress weeks ago?

There are no reported issues for NC or MA income issues right now, so I'm not sure what happened to your previous posts, but hopefully you will find the solutions you need below.

For the MA return. On the federal 1099-DIV entry, make sure you check the box that says A portion of these dividends is US government interest. On the next screen, enter the portion (or all) of the dividends that were for US Debt Obligations. Then, when you go through the MA state return, you will be asked how much of that portion is sourced to MA. Answer Yes to the residency question. Screenshots are below - the first 2 (questions in black type) are in the federal interview and the last 2 (questions in blue type) are from the MA state return. After you answer yes on screenshot #4, you will get 2 screens asking about additional income and then a screen where you can exclude that income from the MA return.

For your NC return issue, can you clarify whether you are reporting a 1099-Q distribution or did you make contributions to a 529 plan? There are no tax credits on the federal return for contributions. You can take a credit for your contributions on your state return. But you have to be a resident, so make sure you set up your personal information correctly. How to file part-year returns.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my previous posts not getting answered when TT experts were making progress weeks ago?

For MA:

I did exactly what you showed and there is no place afterwards to allocate the US debt transferred from the federal return. The program is transferring ALL of the US debt ($1,234 in your screenshot) to MA with NO CHOICE to allocate the proper percentage!

Please show the next screens where this would take place, you stopped too early in the interview. There should be a question "how much of the US debt transferred from Federal is allocated to MA"? What I am trying to do is to exclude some of the previously excluded income. In your screenshot I would need to exclude part of the $1,234. A future screen would allow me to exclude ADDITIONAL income but that is NOT what I need to do!

For the NC:

I am trying to report taxable 1099-Q distributions which were received while living in NC.

The portion received while living in MA was handled Perfectly by TT. Please don't just show me where the interview question is to enter the proper allocation, I see it. The problem is TT is not doing it! My link above gives a screenshot of the error in the worksheet.

Thank you for more detailed help, I honestly have never had so many problems as I had this year with the program and I have had many complicated returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my previous posts not getting answered when TT experts were making progress weeks ago?

Keep clicking through the screens. The 4th screen asks for the amount you wish to exclude. If you don't get this screen after checking YES on the exclusion question, you did not answer the residency question correctly. There is a question when you start that asks Did you receive MA income while you were a nonresident? You have to answer YES there to be able to allocate and exclude the income. After answering yes on the dividends and interest question, you get 4 screens you need to click 'Continue' on, and then you get this screen where you enter just the amount that belongs to MA.

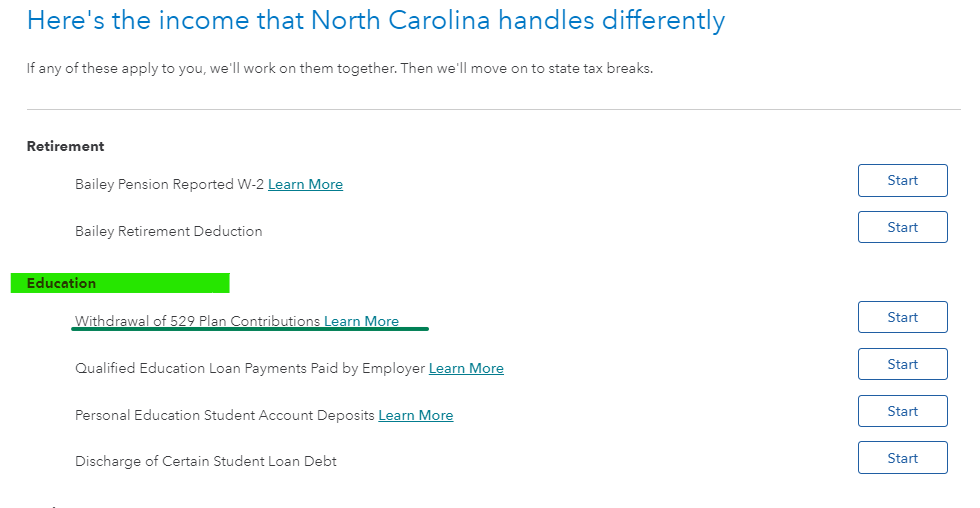

Did you enter the 1099-Q on the federal return? You only have to enter it if it is taxable. If the income was used for qualified education expenses, it doesn't get entered. If it is taxable, it is entered on the federal side, and it can be adjusted on the NC state return in the Education section.

Calculating taxable amount

If the distribution doesn’t exceed the amount of the student's qualifying expenses, then you don't have to report any of the distribution as income on your tax return. If the distribution exceeds these expenses, then you must report the earnings on the excess as "other income" on your tax return. When you pay a student’s school expenses with these funds, you cannot claim a tuition deduction or either of the educational tax credits for the same expense.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my previous posts not getting answered when TT experts were making progress weeks ago?

Unfortunately that was not helpful 🙁

For MA:

You are showing the screen of MA INCOME that needs to be included. I have already completed that screen. I am looking for the screen that allocates the EXCLUDED amount of US Debt Obligations. In your case $1234 is income and $1234 of US Debt gets excluded at the total state level. In my case I might have $400 of MA income out of the $1234 Dividend Income to enter in the screen you show but now I have to exclude $400 of the $1234 US Debt allocated while living in MA. Where is the screen to allocate the EXCLUDED US Debt For MA? NC had this exact ability to first allocate the income, then allocate the exclusion amount. TT applies all of the $1234 of US Debt Exclusion against MA which is not correct.

For NC:

Yes I did enter the 1099-Q on the federal return and I DEFINITELY DO have taxable distributions. TT calculated this properly on the Federal return and allocated the proper amount to MA but as shown in my Original NC Post Link , even though I tell TT how much to allocate to NC, the entry is IGNORED and NOT INCLUDED IN NC Income. I can see the entry in the proper NC worksheet but the the amount is not being added to the Total NC Income!

I hope my text above has been clear this has been beyond frustrating. Perhaps there have been no reported problems with NC or MA since they are Part Year returns with Excluded state Dividends and taxable Coverdell 1099-Q distributions. Currently I have two worthless TT state returns I cannot file.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

silkaton

New Member

mjsellickttx

Returning Member

maxcasey1

New Member

BL-737

Returning Member

Jayson18

Returning Member