- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

There are no reported issues for NC or MA income issues right now, so I'm not sure what happened to your previous posts, but hopefully you will find the solutions you need below.

For the MA return. On the federal 1099-DIV entry, make sure you check the box that says A portion of these dividends is US government interest. On the next screen, enter the portion (or all) of the dividends that were for US Debt Obligations. Then, when you go through the MA state return, you will be asked how much of that portion is sourced to MA. Answer Yes to the residency question. Screenshots are below - the first 2 (questions in black type) are in the federal interview and the last 2 (questions in blue type) are from the MA state return. After you answer yes on screenshot #4, you will get 2 screens asking about additional income and then a screen where you can exclude that income from the MA return.

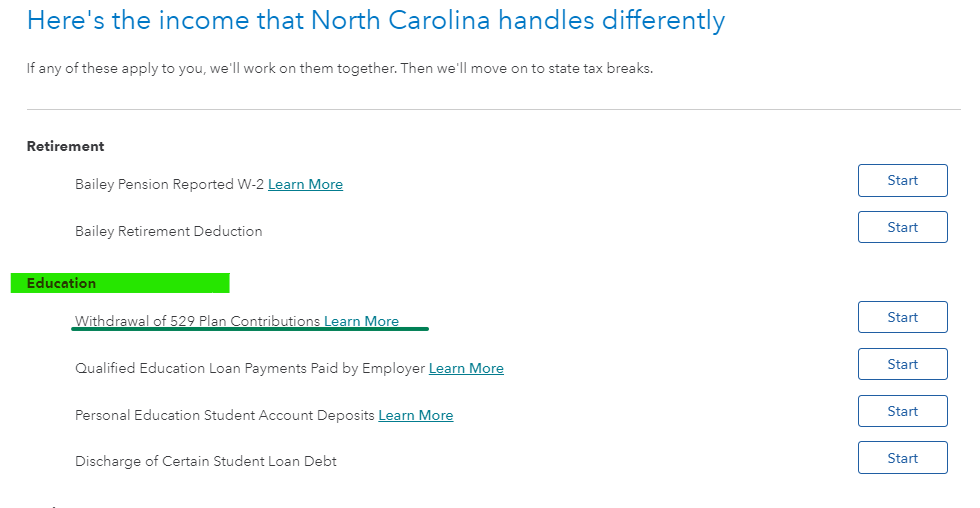

For your NC return issue, can you clarify whether you are reporting a 1099-Q distribution or did you make contributions to a 529 plan? There are no tax credits on the federal return for contributions. You can take a credit for your contributions on your state return. But you have to be a resident, so make sure you set up your personal information correctly. How to file part-year returns.

**Mark the post that answers your question by clicking on "Mark as Best Answer"