- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Why am I still getting errors after reimporting my Morgan Stanley 1099 Consolidated form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I still getting errors after reimporting my Morgan Stanley 1099 Consolidated form?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I still getting errors after reimporting my Morgan Stanley 1099 Consolidated form?

Please clarify your question.

- What is the specific error that you are getting?

- Did you post it yourself?

- If you do REVIEW is there an area that is highlighted?

Please contact us again, and provide some additional details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I still getting errors after reimporting my Morgan Stanley 1099 Consolidated form?

The error I get is in the final review. It says, "Check This Entry Form 1099-B Worksheet (MORGAN STANLEY CAPITAL MGMT) -- Capital Asset Sales Wksht (1): Adjustment Amount must have a value when an adjustment code (other than C, M, or T) is entered."

TurboTax will not accept any input in this field, despite asking me for input.

This is after following the instructions and deleting the first set of imported Morgan Stanley Consolidated forms after they released corrected forms. This error appears with both the old and new 1099 forms from Morgan Stanley.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I still getting errors after reimporting my Morgan Stanley 1099 Consolidated form?

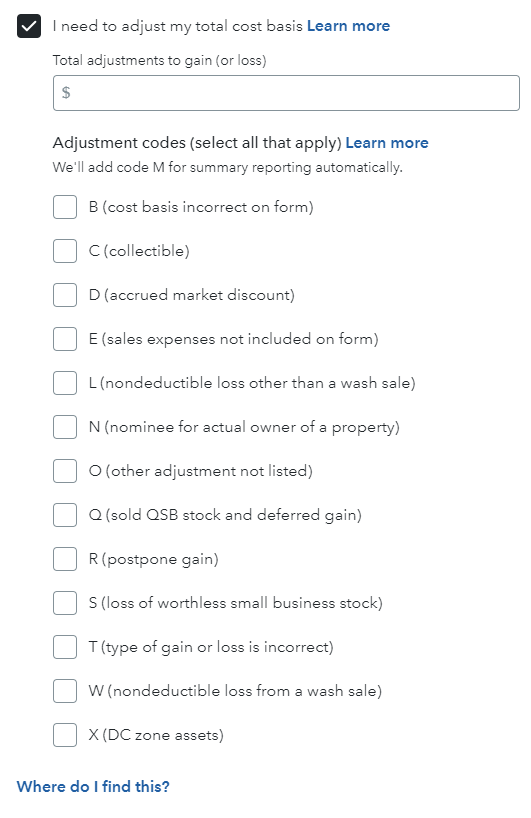

If you return to Investments and Savings, are you able to access the Adjustment codes by selecting I need to adjust my total cost basis?

If you are able to access the codes, what entries do you find?

To return to Investments and Savings, follow these steps:

- Click on Federal down the left side of the screen.

- Click on Wages & Income down the left side of the screen.

- Scroll down to Investments and Savings and click the down arrow to the right.

- Click Start / Revisit to the right of Stocks, Cryptocurrency, Mutual Funds, Bonds, Other.

If you are unable to correct your IRS form 1099-B, you may be able to delete the entry and upload the Morgan Stanley IRS form 1099-B as a PDF file.

Your brokerage statement includes a summary of your transactions, grouped by sales category, for example, Box A short-term covered or Box D long-term covered, you will enter the summary info instead of each individual transaction. Follow these steps:

- Click on Federal down the left side of the screen.

- Click on Wages & Income down the left side of the screen.

- Scroll down to Investments and Savings and click the down arrow to the right.

- Click Start / Revisit to the right of Stocks, Cryptocurrency, Mutual Funds, Bonds, Other.

- Click Add investments.

- At the screen Let's import your tax info, click Enter a different way.

- Click on Stock, Bonds, Mutual funds. Click Continue.

- At the screen Which bank or brokerage is on your 1099-B, enter the information. Click Continue.

- Do these sales include any employee stock, click No.

- Do you have more than three sales on your 1099-B, click Yes.

- Do these sales include any other types of investments, click No.

- Did you buy every investment listed on your 1099-B, click Yes. Click Continue.

- At the screen Now, choose how to enter your sales, select Sales section totals. Click Continue.

- At the screen Look for your sales on your 1099-B, click Continue.

- At the screen Now enter one sales total on this 1099-B, enter information. Click Continue.

- Repeat as necessary by clicking Add another sales total. Click Continue.

- At the screen Now we'll help you upload your 1099-B since the IRS requires a copy, select Browse.

- Download the 1099-B in PDF format from your provider.

- Upload successful, click Continue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I still getting errors after reimporting my Morgan Stanley 1099 Consolidated form?

I'm using TurboTax Premier 2023 on my Mac — things loo different than you are describing.

I do like the idea of uploading the PDF form. I think I will give that a try.

--Steve

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I still getting errors after reimporting my Morgan Stanley 1099 Consolidated form?

...and I don't see a way to import a PDF in the Mac version. Sigh.

--Steve

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I still getting errors after reimporting my Morgan Stanley 1099 Consolidated form?

At this point are my options to try the web version (presumably at additional cost) or to enter five pages of Consolidated 1099 info by hand?

--Steve

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I still getting errors after reimporting my Morgan Stanley 1099 Consolidated form?

The option to upload the PDF is only for the Online version. If you e-file in the desktop, and you used summary entries (as opposed to one by one) you will have to mail in your detailed transaction list to the IRS in 3 days. So yes, you can switch to Online and leave it in summary format and upload the PDF. Or, you use the desktop and either re-enter transactions one by one, or leave it in summary form and mail the details after e-filing. TurboTax will print out Form 8453 to include with mailing your 1099-B detail.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

degerton

New Member

bigtuna1

New Member

davesontimeevery

Level 2

Thakk

Level 1

kgalusha

Level 3