- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

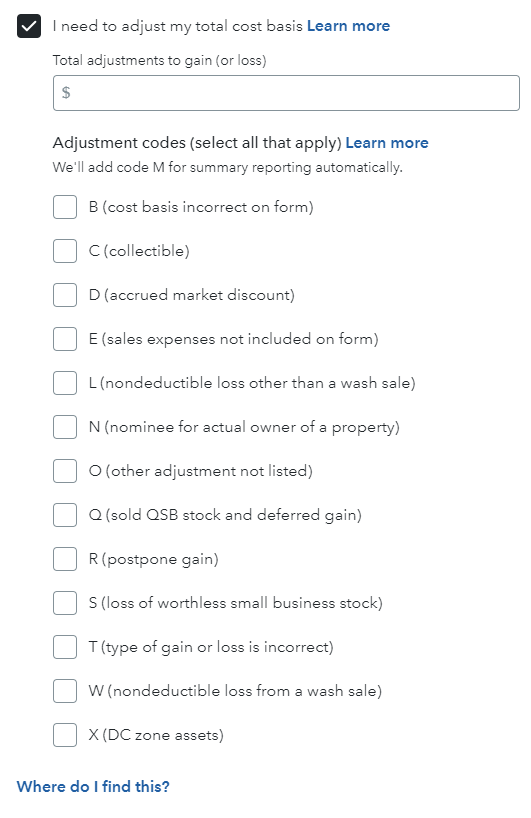

If you return to Investments and Savings, are you able to access the Adjustment codes by selecting I need to adjust my total cost basis?

If you are able to access the codes, what entries do you find?

To return to Investments and Savings, follow these steps:

- Click on Federal down the left side of the screen.

- Click on Wages & Income down the left side of the screen.

- Scroll down to Investments and Savings and click the down arrow to the right.

- Click Start / Revisit to the right of Stocks, Cryptocurrency, Mutual Funds, Bonds, Other.

If you are unable to correct your IRS form 1099-B, you may be able to delete the entry and upload the Morgan Stanley IRS form 1099-B as a PDF file.

Your brokerage statement includes a summary of your transactions, grouped by sales category, for example, Box A short-term covered or Box D long-term covered, you will enter the summary info instead of each individual transaction. Follow these steps:

- Click on Federal down the left side of the screen.

- Click on Wages & Income down the left side of the screen.

- Scroll down to Investments and Savings and click the down arrow to the right.

- Click Start / Revisit to the right of Stocks, Cryptocurrency, Mutual Funds, Bonds, Other.

- Click Add investments.

- At the screen Let's import your tax info, click Enter a different way.

- Click on Stock, Bonds, Mutual funds. Click Continue.

- At the screen Which bank or brokerage is on your 1099-B, enter the information. Click Continue.

- Do these sales include any employee stock, click No.

- Do you have more than three sales on your 1099-B, click Yes.

- Do these sales include any other types of investments, click No.

- Did you buy every investment listed on your 1099-B, click Yes. Click Continue.

- At the screen Now, choose how to enter your sales, select Sales section totals. Click Continue.

- At the screen Look for your sales on your 1099-B, click Continue.

- At the screen Now enter one sales total on this 1099-B, enter information. Click Continue.

- Repeat as necessary by clicking Add another sales total. Click Continue.

- At the screen Now we'll help you upload your 1099-B since the IRS requires a copy, select Browse.

- Download the 1099-B in PDF format from your provider.

- Upload successful, click Continue.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 11, 2024

8:07 AM