- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Why am I only getting a $150 tax credit for a new furnace/central air when I should be getting $500?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I only getting a $150 tax credit for a new furnace/central air when I should be getting $500?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I only getting a $150 tax credit for a new furnace/central air when I should be getting $500?

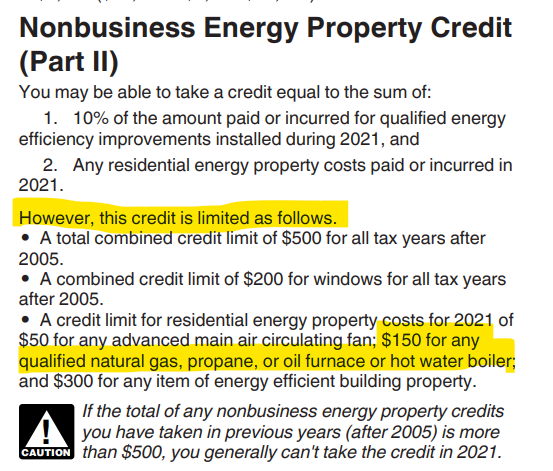

The tax credit for a new furnace is 10 percent of the cost on new qualified energy property installed, including the cost of labor and installation up to a maximum of $150. You may be eligible for an additional credit of up to $50 for an advanced air circulating fan for the furnace. That must be entered in the box above the box for the furnace.

See this TurboTax article for more details: https://turbotax.intuit.com/tax-tips/home-ownership/energy-tax-credit-which-home-improvements-qualif...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I only getting a $150 tax credit for a new furnace/central air when I should be getting $500?

The tax credit for a new furnace is 10 percent of the cost on new qualified energy property installed, including the cost of labor and installation up to a maximum of $150. You may be eligible for an additional credit of up to $50 for an advanced air circulating fan for the furnace. That must be entered in the box above the box for the furnace.

See this TurboTax article for more details: https://turbotax.intuit.com/tax-tips/home-ownership/energy-tax-credit-which-home-improvements-qualif...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I only getting a $150 tax credit for a new furnace/central air when I should be getting $500?

$150 is the limit for a new furnace. See page 2 of IRS Form 5695. https://www.irs.gov/pub/irs-pdf/f5695.pdf

$500 is the lifetime limit for all eligible categories; each category has its own limit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I only getting a $150 tax credit for a new furnace/central air when I should be getting $500?

I also don't understand this. I spent $9350 on energy efficient Air conditioner and Furnace and it states on the form that you get 10% of your purchase back up to $500. The person that sold it to me also said I would get $500 back. Where is the $150 number coming from, that's different from what the form says.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I only getting a $150 tax credit for a new furnace/central air when I should be getting $500?

Here is the information from IRS Instructions for Form 5695:

The IRS limit is $150 for a furnace. The person that sold it to you may not have read the fine print about the credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ilovesantos

New Member

2022 Deluxe

Level 1

ilian

Level 1

psberg0306

Level 2

anthonybrewington21

New Member