- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Which TurboTax payment method do I use having paid federal taxes through payUSAtax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which TurboTax payment method do I use having paid federal taxes through payUSAtax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which TurboTax payment method do I use having paid federal taxes through payUSAtax?

If you have already paid your taxes using one of the IRS's official payment processors outside of TurboTax (or you plan to make the payment using their site), then select "pay by check" and you can just ignore the payment voucher that prints up. Selecting "pay by check" doesn't obligate you to pay by check, it simply produces the payment voucher for you to use. You are free to then make the payment another way.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which TurboTax payment method do I use having paid federal taxes through payUSAtax?

If you have already paid your taxes using one of the IRS's official payment processors outside of TurboTax (or you plan to make the payment using their site), then select "pay by check" and you can just ignore the payment voucher that prints up. Selecting "pay by check" doesn't obligate you to pay by check, it simply produces the payment voucher for you to use. You are free to then make the payment another way.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which TurboTax payment method do I use having paid federal taxes through payUSAtax?

In that case, do we still have to mail the return forms ourselves or does TurboTax do that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which TurboTax payment method do I use having paid federal taxes through payUSAtax?

We'd love to help you complete your tax return, but need more information. Can you please clarify your question? Which return forms are you referring to? The payment vouchers or other forms from your return? Did you select to e-file your return or mail it in?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which TurboTax payment method do I use having paid federal taxes through payUSAtax?

Asking about the tax return forms (1040 and such). I understand that I will have to mail in the payment voucher with my cheque.

Not sure if I selected e-file or mail in. Is there any easy way to check now?

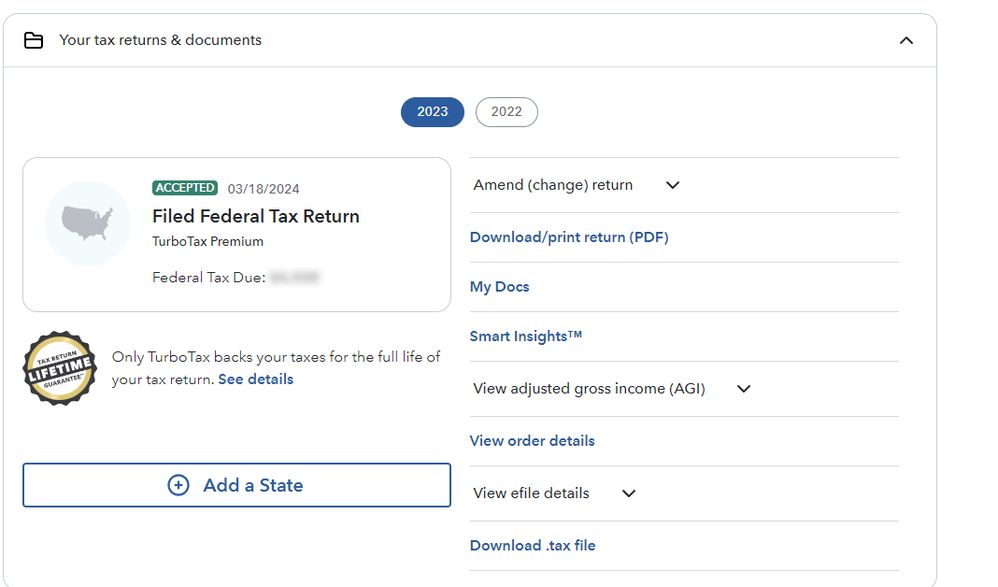

This is what I see when I login to my account.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

beccalou502

Level 1

Solar Eclipse

Level 3

LynK

New Member

tbduvall

Level 4

eschmidt1224

Returning Member