- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Which option to select while paying advance taxes in IRS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which option to select while paying advance taxes in IRS

I am a resident of Canada, moved here from the USA last year. So my tax filing deadline is June 2022. After calculating my taxes for the last year, it was determined that I owe a few thousand dollars to IRS. So my Turbo Tax consultant advised me to pay the taxes on the IRS website, after which she will e-file my return.

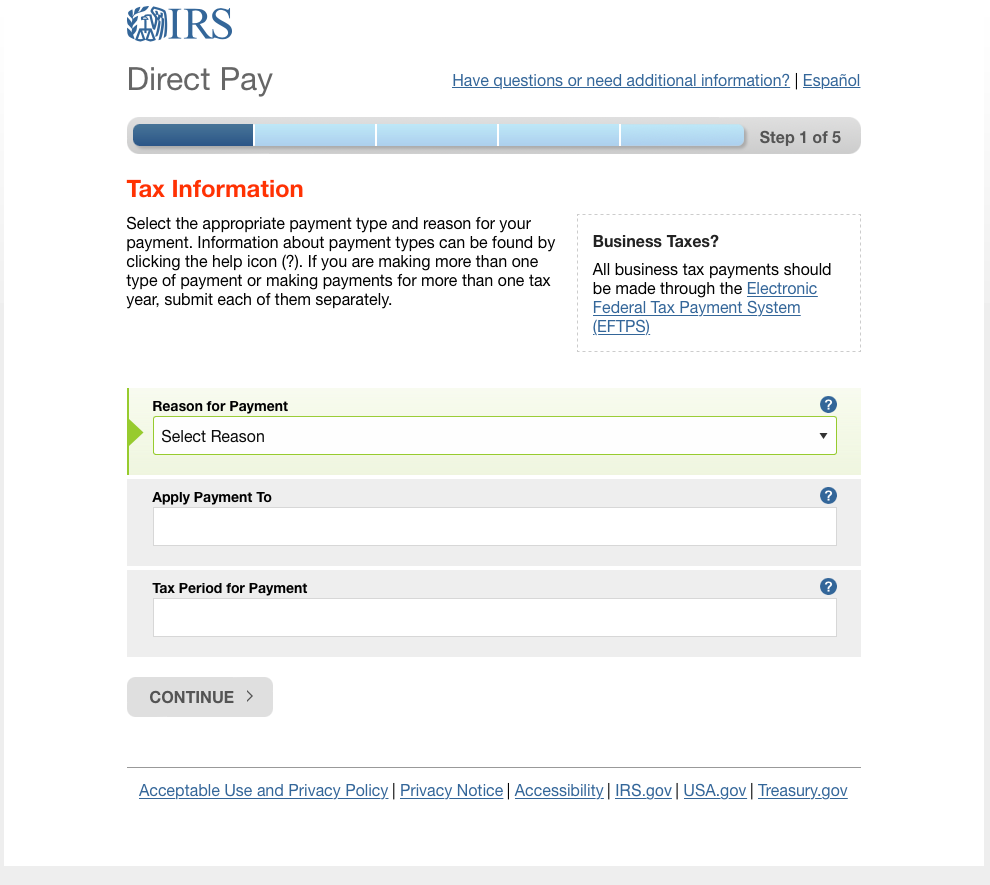

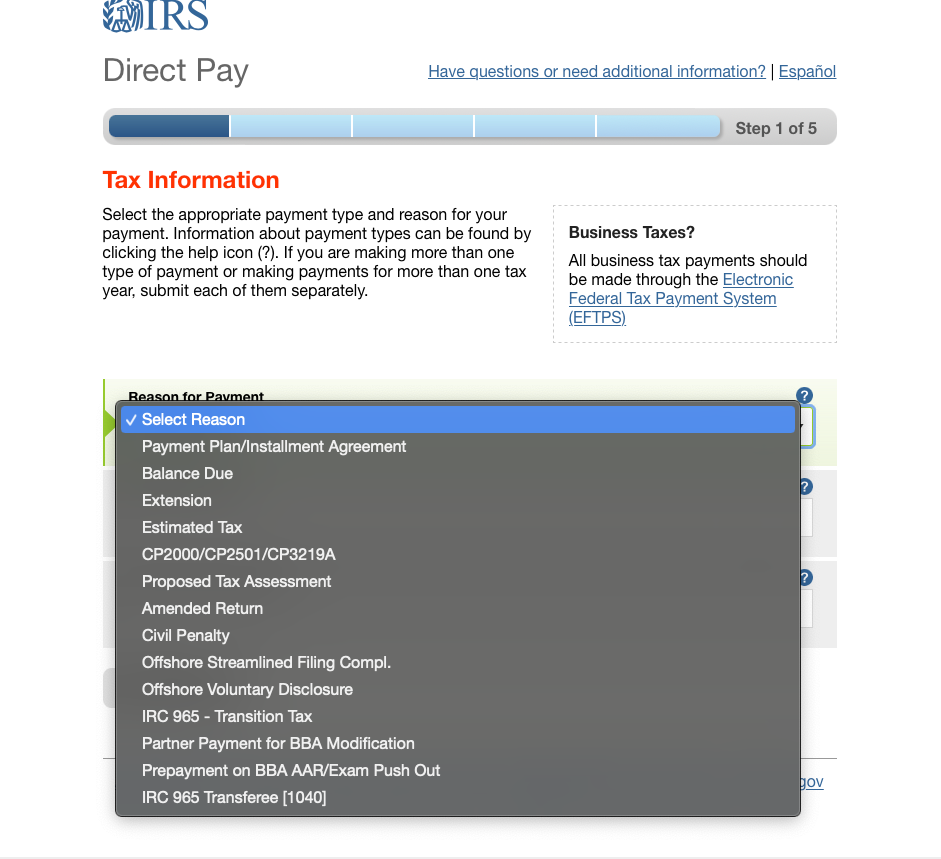

I went to https://directpay.irs.gov/directpay/payment?execution=e1s1 and I am confused about which option to select from the drop-down for "Reason for Payment". I am confused between "Estimated Tax" and "Proposed Tax Assessment". Can anyone please assist?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which option to select while paying advance taxes in IRS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which option to select while paying advance taxes in IRS

"Balance Due" is definitely the option you want to select.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which option to select while paying advance taxes in IRS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which option to select while paying advance taxes in IRS

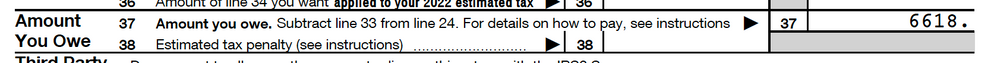

if your "rep" wants to enter your payment amount on your Tax Return, that is wrong.

if you owe taxes, your 1040 will show "amount you owe".

you just pay it on the payments page.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which option to select while paying advance taxes in IRS

@fanfare My Form 1040 shows this,

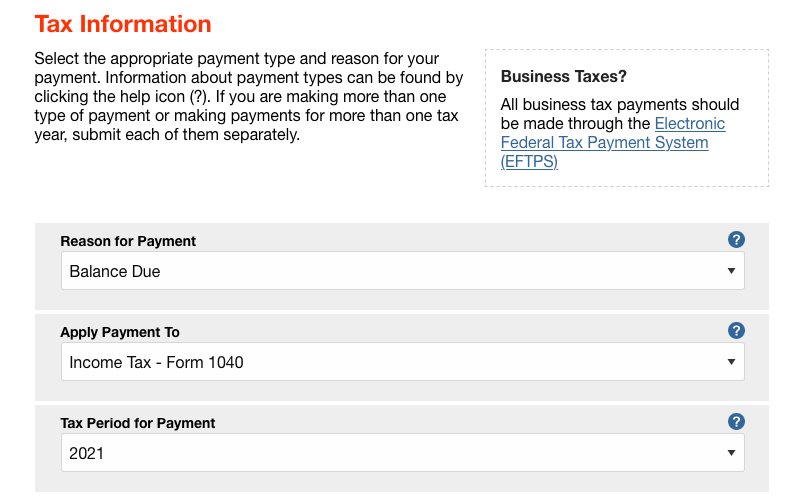

So to pay that, should I select options like this on IRS Payment page?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which option to select while paying advance taxes in IRS

Yes

The only caution I have is ---

I would e-File first and see that the filing is ACCEPTED, then pay.

Until filed, that amount is subject to change.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

paulhbg1

New Member

eveningsky5

New Member

rainglis3

New Member

xgempler

New Member

bestdad97

New Member