- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which option to select while paying advance taxes in IRS

I am a resident of Canada, moved here from the USA last year. So my tax filing deadline is June 2022. After calculating my taxes for the last year, it was determined that I owe a few thousand dollars to IRS. So my Turbo Tax consultant advised me to pay the taxes on the IRS website, after which she will e-file my return.

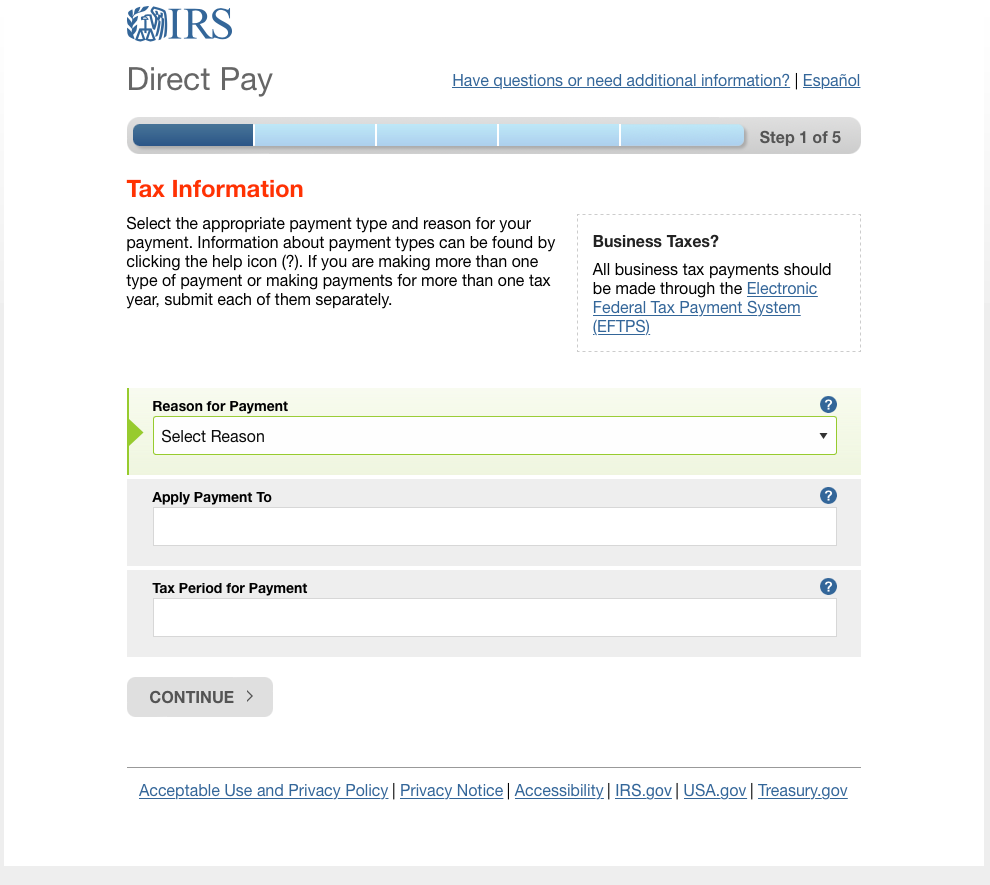

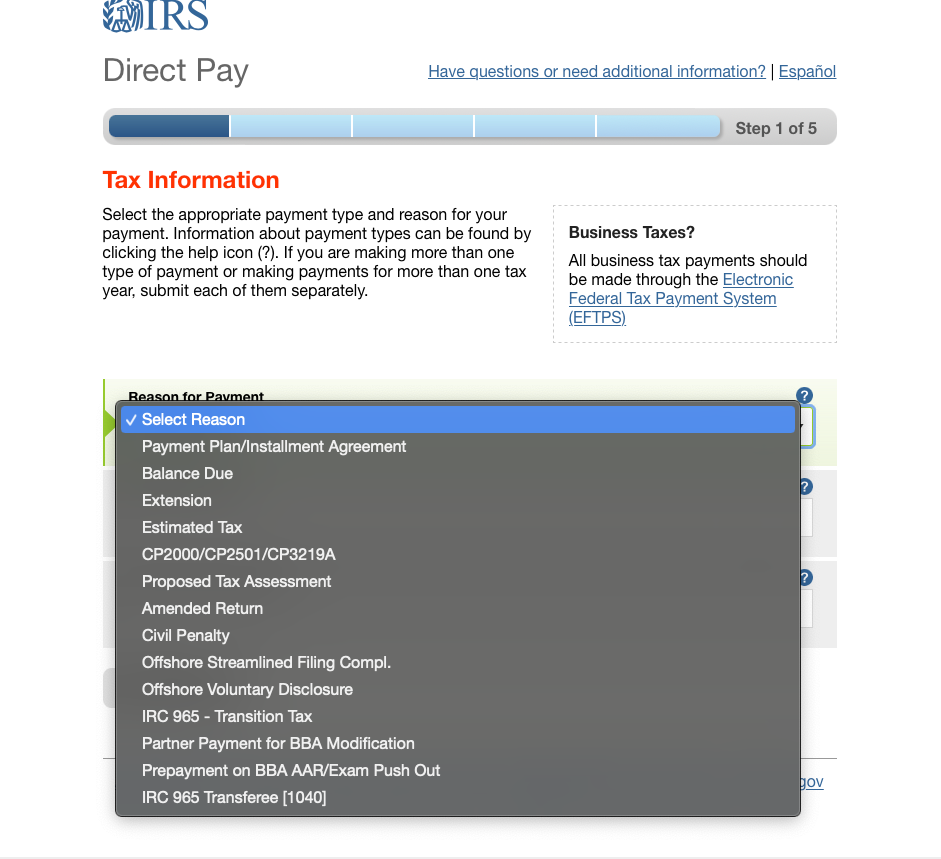

I went to https://directpay.irs.gov/directpay/payment?execution=e1s1 and I am confused about which option to select from the drop-down for "Reason for Payment". I am confused between "Estimated Tax" and "Proposed Tax Assessment". Can anyone please assist?

Topics:

May 2, 2022

12:58 AM