- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Where to eBay expenses, etc.?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to eBay expenses, etc.?

Hello all.

This is the first time I am reporting eBay sales so I would like your help to make sure that I do this correctly. Last year I sold about 200 items on eBay. I had to pay quite a bit for these items and I do have records/receipts to show how much I paid. However, I am unsure where to enter these costs. Should I do this under the Inventory tab? If not where?

What about those items for which I no longer have receipts? Should I use "fair market value" as my cost basis?

Lastly, where do I indicate the fees that eBay added to my "Gross Amount (Box 1a) (e.g., postage, taxes, etc.)?

Thanks in advance to all of you!!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to eBay expenses, etc.?

Yes, enter your cost in inventory. Regarding the items that you don't have receipts for, you could use, canceled checks reflecting proof of payment, account statements, credit card receipts, and statements, invoices.

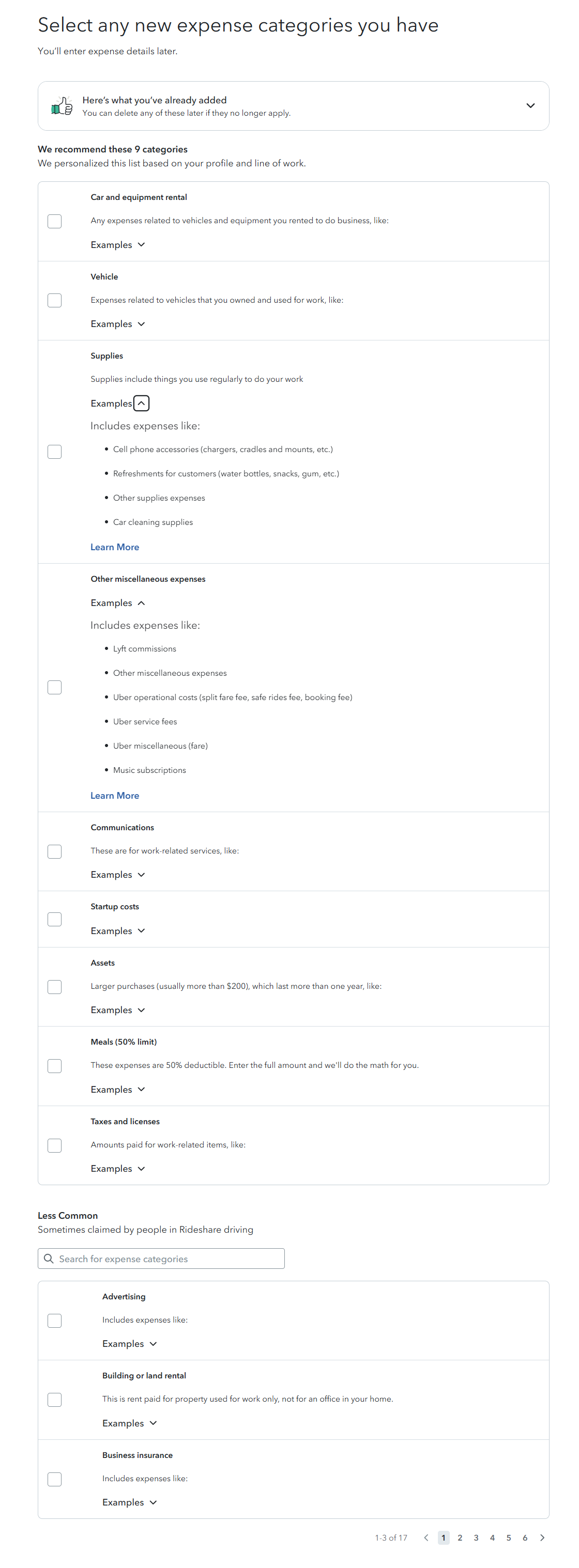

For the fees that eBay added to your gross amount, I would suggest you report it under Other Miscellaneous Expenses. To get back to your Schedule C:

- Open or continue your return

- Locate the Schedule C section

- Go to Schedule C

- Under the business you need to review, go to Review

- Change your Work description if needed

- Once make the change, continue the interview until you get to the expense categories (see the image below)

- Select Inventory the program will guide you as you enter the information

See the images below for your reference:

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

superdav

Level 2

avigo45

Level 3

dward50

New Member

Sayed

Level 2

ark

New Member