- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- When will form 8915E-T be ready? I have updated and installed all updates. This is the only one I need for e-filing.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915E-T be ready? I have updated and installed all updates. This is the only one I need for e-filing.

@Peppapig1113 wrote:

Why when entering the 8915E information it asks for a Fema disaster number can't get thur to file without that and it's not due to a fema disaster its the Corona issue

There is a bug in the program and you should not be asked to complete the Form 8915-E for a FEMA number. To get by this just click on the spacebar or enter None for the FEMA number. If you are also asked for dates just enter any dates in 2021.

This will not affect your reporting of the 2nd year 1/3 of the 2020 Coronavirus-related distribution on your 2021 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915E-T be ready? I have updated and installed all updates. This is the only one I need for e-filing.

ITS MARCH 30 STILL NOT RELEASED IRS RELASED ON mAR 4

WHY NOT YOU

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915E-T be ready? I have updated and installed all updates. This is the only one I need for e-filing.

@JOHNJK79 wrote:

ITS MARCH 30 STILL NOT RELEASED IRS RELASED ON mAR 4

WHY NOT YOU

The Form 8915-F was included in the TurboTax online editions in the early evening of 03/23

The Form 8915-F was included as a software update for All the TurboTax desktop editions on 03/24

If you are using the desktop editions, update your software. Click on Online at the top of the desktop program screen. Click on Check for Updates.

You must go to the Retirement Income section of the program for a Form 1099-R to be able to enter your 2nd year of the 2020 distribution -

Click on Federal

Click on Wages & Income

Scroll down to Retirement Plans and Social Security

On IRA, 401(k), Pension Plan Withdrawals (1099-R), click on the Start or Revisit button

On the screen Did you get a 1099-R in 2021? Click on NO, if you did not receive a 2021 Form 1099-R

If you had a Covid-19 related distribution in 2020 and selected to spread the distribution over 3 years -

Answer Yes when asked Have you ever taken a disaster distribution before 2021?

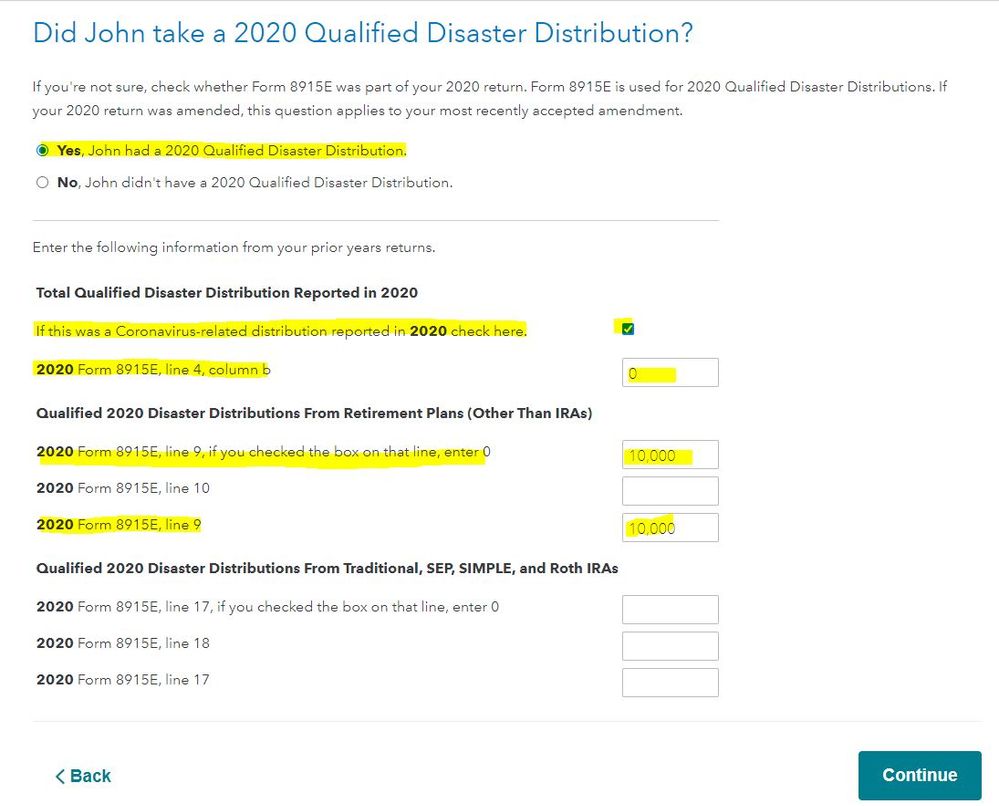

Answer Yes when asked if you took a Qualified 2020 Disaster Distribution

Check the box that this was a Coronavirus-related distribution reported in 2020

In the box 2020 Form 8915-E, line 4, column b - Enter a 0

If the 2020 distribution was from an account that was Not an IRA

2020 Form 8915E Line 9 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

If the 2020 distribution was from an IRA account

2020 Form 8915E Line 17 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

Do not enter anything in the other boxes, leave them blank (empty)

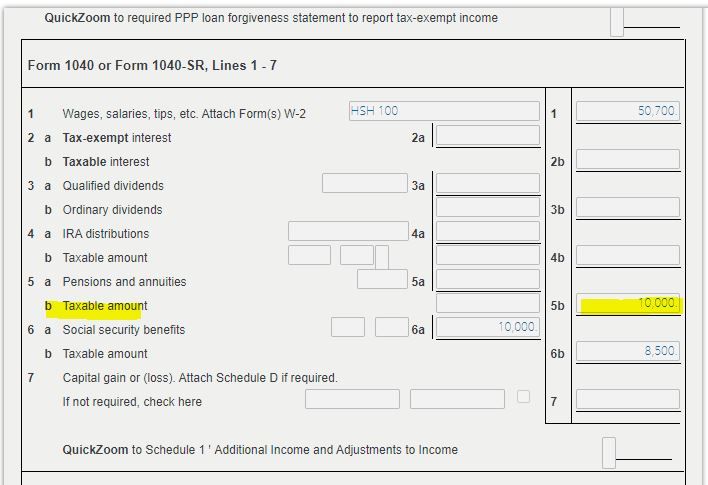

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

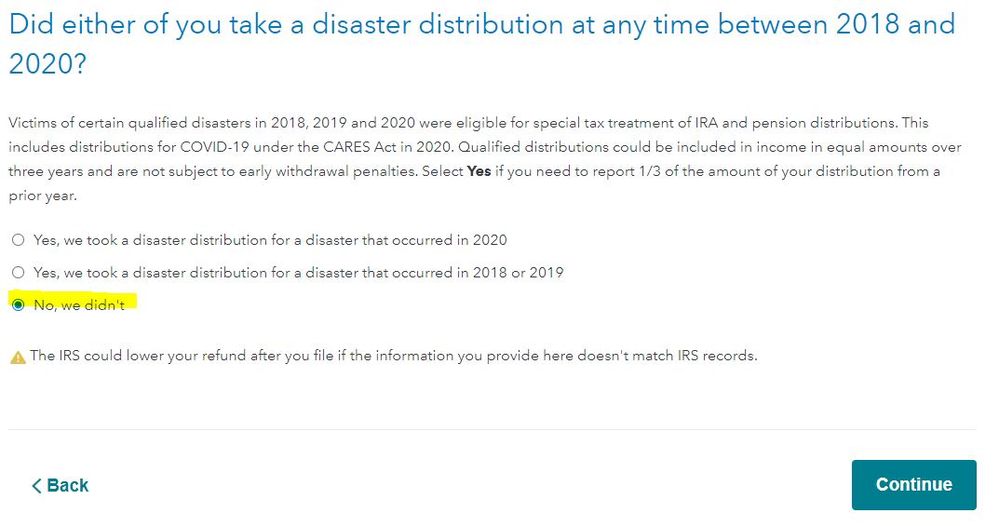

After completing the Wages & Income section you will land on a screen Did you take a disaster distribution at any time between 2018 and 2020?

Answer NO since you have already completed the entering the 1/3 of the 2020 distribution.

You can view your Form 1040 at any time using the online editions. Click on Tax Tools on the left side of the online program screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Using the desktop editions click on Forms. Open the Form 1040

Screenshots from the online editions -

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915E-T be ready? I have updated and installed all updates. This is the only one I need for e-filing.

And, if the distribution was for medical expenses not related to Covid? This issue is a hang up for everyone else. Very disappointed because my returns were rejected by the IRS and State, after waiting until the March 6 filing date, and now it seems that it will be extended once again. There is no option to skip the Covid question which is a hold up for anyone that had to take out money for another tough year.

Our illustrious government hard at work. 😠

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915E-T be ready? I have updated and installed all updates. This is the only one I need for e-filing.

The 8915-F now has a workaround available. Please see this post.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ajax010

Returning Member

gowen

New Member

mmitsch

Level 2

user17605923060

Level 2

user17602095118

New Member