- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- We won't be able to e-file your return (California)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

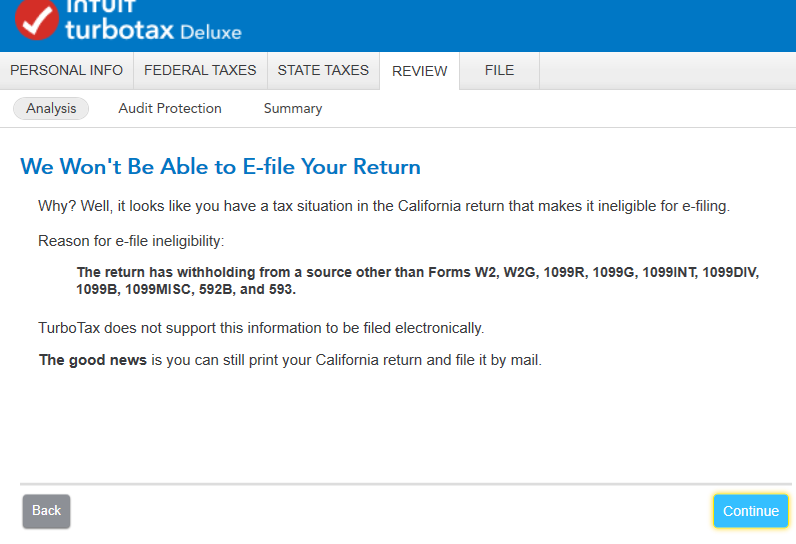

We won't be able to e-file your return (California)

Hi all,

TurboTax Deluxe 2023 (MS desktop version) told me I cannot e-file my CA return this year.

The only thing I did differently this year (for 2023) vs. previous years was that I manually logged into FTB and paid an additional tax payment for 2023 and now reported that payment in TurboTax 2023 software?

Please confirm this is the reason why TurboTax does not allow me to e-file to CA? Or something else went wrong. Please note in this year, TurboTax claimed that there was a missing value in the CA return that is related to Forms 592-B and 593. It never asked me about these two Forms in the past years and I do know anything about these two forms. I went ahead and enter Zero. Could this be a problem that causes me not being able to e-file to CA?

Note: it allows me to e-file to Fed/IRS.

Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We won't be able to e-file your return (California)

If you had no withholding to report on Forms 592-B and 593, you may need to delete those forms from your California return. Paying estimated taxes shouldn't generate either of these forms.

You can view and delete these forms using Forms Mode (see below). Review the types of income that would be reported on Form 592-B. Form 593 is withholding from a real estate sale.

Open your return and click the Forms icon in the TurboTax header. In the list of Forms in My Return on the left, find the form you need and click on the form name to open it in the large window. Click Step-by-Step in the header to return to the main screens.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We won't be able to e-file your return (California)

I opened the "Forms" list in TurboTax software and unfortunately, I do not seeing any Form 592-B nor Form 593.

So I cannot review and delete them.

I tried again and it still giving me the same message that TurboTax is not able to e-file my return for the same due to "withholding source not from a source other than Forms W2, ...

what you think I should do next? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We won't be able to e-file your return (California)

Where did you report the extra tax you directly paid to FTB in TurboTax?

That must be the issue, since there is no form attached to this additional tax.

You should report it in Federal > Deductions & Credits > Estimates and Other Taxes Paid > Withholding Not Already Entered on a W-2 or 1099.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We won't be able to e-file your return (California)

Yes. I entered the extra payments in there (for both Fed and State) per your screenshot. And I believe because of it, TurboTax does not allow me to e-file to State (but it lets me do e-file for Fed). It is odd not allowing for State but okay with Fed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We won't be able to e-file your return (California)

I decided to redo the income tax from scratch and unfortunately, I still have the exact same problem. So now I assume it is a limitation imposed by either the CA/FTB or by TurboTax (if so, it is odd). I e-filed the Fed return and mailed in the State return for 2023.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We won't be able to e-file your return (California)

Sounds like you make an Estimated payment. When did you pay it? It is not extra withholding. It is an Estimated payment. Enter it under

Federal

Deductions and Credits

Then scroll way down to Estimates and Other Taxes Paid

Estimated - click the Start or Update button

Pick the right State, enter the date and amount. If you paid it in 2023 you should also get a deduction for it on your federal return if you itemize deductions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We won't be able to e-file your return (California)

Ah, crap. I just ran into the same issue... 😱

I also don't see the two forms mentioned (so I can't delete them...)

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

pacencia34

New Member

ericgever

New Member

loyal-but---user

Level 3

latefiler5

Level 1

irilor7316

New Member