- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- TurboTax Price 2020 - Desktop

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Price 2020 - Desktop

Most of the so-called "Champs" (formerly known as "SuperUsers") - none of whom are Intuit Employees - recommend that for most tax returns that are more than "simple" the Taxpayer will benefit in ease of navigating the tax program using Desktop. A truly major and valuable feature of the desktop program is the ability to switch to a view of the tax forms themselves as they are filled in and calculations are made.

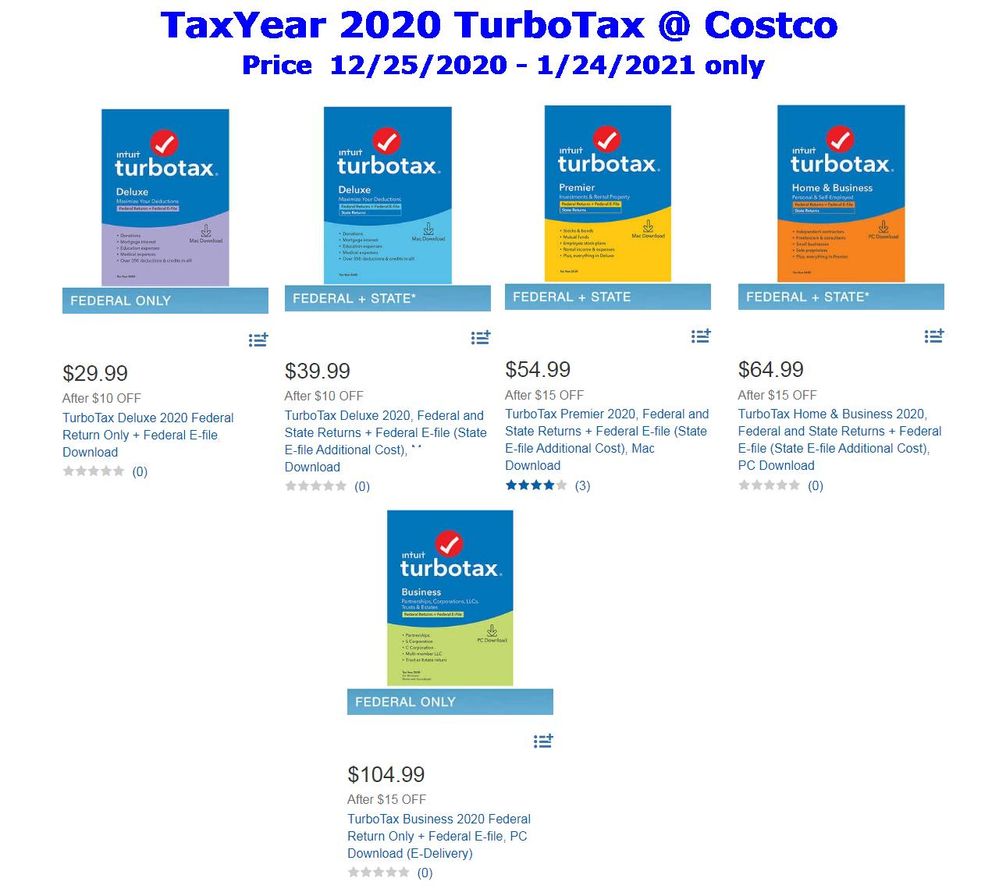

PRICING of Desktop Software for both Personal TurboTax (Form 1040) and for Business (Forms 1065, 1120, and 1041) are in the graphic - sold at these prices at Costco and for the period of 12/25/2020 - 01/24/2021

NOTE:

The Desktop products all provide FREE eFiling of Form 1040 but state eFile costs an additional $20 (at this time). The "Federal Only" Personal does not include a state program.

Personal TurboTax Desktop is sold in versions for Windows/10 PC or MAC - note the separate packaging. NOTE: Windows/7 NOT SUPPORTED! (Netframe related)

The "Business" program does not include a state module - that is an additional $50 and eFile of state an additional $20. "Business" only works on PC Windows/10.

NOT INTUIT EMPLOYEE

USAR 64-67 AIS/ASA MOS 9301 - O3

- Just donating my time

**Say Thanks by clicking the thumb icon in the lower left corner -it means nothing but makes those than answer feel wanted.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Price 2020 - Desktop

@ScruffyCurmudgeon wrote:

Most of the so-called "Champs" (formerly known as "SuperUsers") - none of whom are Intuit Employees - recommend that for most tax returns that are more than "simple" the Taxpayer will benefit in ease of navigating the tax program using Desktop. A truly major and valuable feature of the desktop program is the ability to switch to a view of the tax forms themselves as they are filled in and calculations are made.

Yes. There are some entries (and even forms) for entities in the Business edition that can only be made in Forms Mode.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Price 2020 - Desktop

Just a reminder that the "Business" product - used for Forms 1065, 1120 and 1041 - (as opposed to the Personal Form 1040 product unfortunately similarly named "Home&Business") is only available for download as a program to Windows/10. Being a desktop program, as are the various Personal TurboTax desktop programs, it as they do provide

- the "Forms Mode" feature

- as well as the ability to create unlimited hypothetical scenarios,

- ability to create and save multiple different taxpayer accounts,

- and to eFile up to the maximum number allowed by IRS (5).

N.B.: I should probably add for those unaware: Intuit has never supported the Business product on the MAC platform since the days of the introduction of "Lion" and the elimination of direct kernal calls. Complaints are made every year to no avail. So, if Business is required, please keep that in mind, in addition to the Win/10 requirement!

NOT INTUIT EMPLOYEE

USAR 64-67 AIS/ASA MOS 9301 - O3

- Just donating my time

**Say Thanks by clicking the thumb icon in the lower left corner -it means nothing but makes those than answer feel wanted.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

joebisog

New Member

Omar80

Level 3

dmitris70

New Member

ebonysimone

New Member

charles232

Level 1