- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Turbo Tax won't let me file a schedule C

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax won't let me file a schedule C

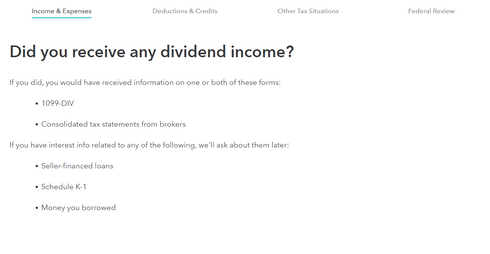

I am trying to report my Etsy shop income, but I didn't earn enough to receive a 1099-K. I believe this means I need to file a schedule C, but every time I click the Schedule C form it keeps going to the screen below. If I click "yes", it asks me to select a financial institution.

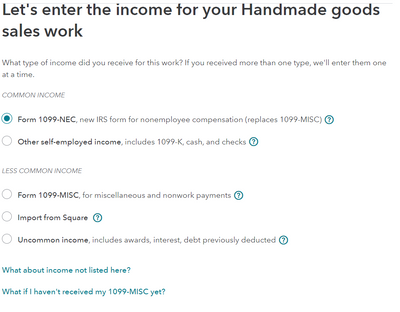

Also is it correct for me to select "Other self-employed income, includes 1099-K, cash, and checks" when adding income under my Etsy shop, even though I didn't receive a 1099-K?

"Schedule C" prompt screen

Adding income source

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax won't let me file a schedule C

You should choose No when it asked you about dividend income, it is different type of income and it only can be paid by financial institution.

You correctly selected select "Other self-employed income, includes 1099-K, cash, and checks". Since you didn't receive tax form regarding the income, it is considered Cash income. You can continue through the interview to enter your business information, income and expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax won't let me file a schedule C

I have a 1099-DIV that I do need to file for an investment unrelated to my self-employement but I haven't received the paperwork yet. After I file the unrelated 1099, will it still prompt me to file a schedule C for my self-employment?

Thank you for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax won't let me file a schedule C

You can have your income from different sources, and you have to report all of them. Your dividend income doesn't affect reporting of your self-employment income.

It is better to wait until you have all your tax forms to file your tax return in order to avoid complications and amending your tax return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

CalkinsV

New Member

jordancraigburton

New Member

lad20

Level 2

pdfusco

New Member

gigi

New Member