- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- TT Business does not transfer deductions to K-1 Form BUG?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Business does not transfer deductions to K-1 Form BUG?

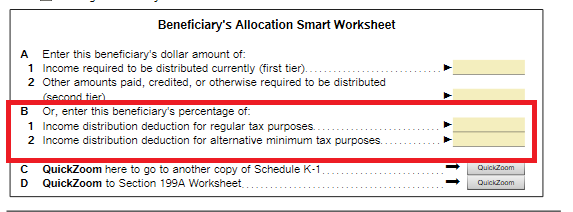

Used TT to create a return for an estate. The only "income" was a capital gains loss on the sale of the home during probate. However, none of the loss or personal tax carryover was transferred to the K-1 forms. I already reported a bug in TT, where the interview did not ask for the percentages to be distributed to each beneficiary, and those had to be entered manually on the worksheet. It seems there is a further problem.

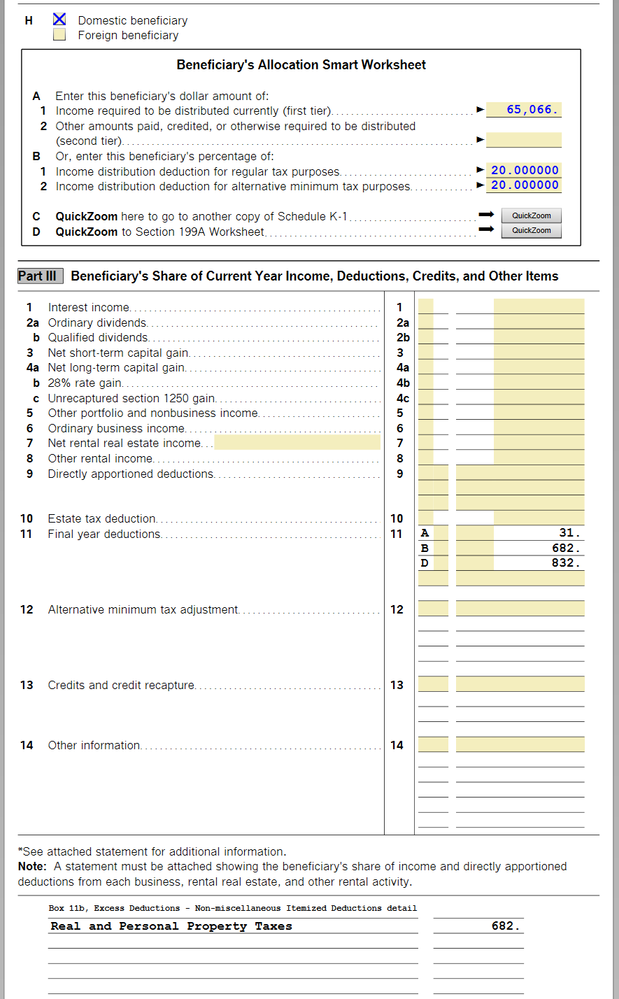

The Form View of the K-1 shows final year deductions: A: 31 B: 682 C: 832 with the note "Box 11B: non-miscellaneous itemized deductions detail" as Real and personal property taxes 682.

The "K-1 Worksheet" shows A: Excess deductions 155, B: Excess deductions non-miscellaneous itemized deductions 3414 and C: Long-term capital loss carryover 4160.

The generated K-1 forms for distribution do not have any values in any fields, however. Can someone please explain this? Why are no values being carried to the K-1 form? And since they are displayed on the Worksheet, there is no way to manually input them to get them to appear on the individual K-1s. Some of my family are already trying to do their taxes and this is holding everything up.

There are NO interview screens in TT Business for any K-1 details, other than asking for a list of beneficiary names and addresses. There are NO interviews asking anything about disbursement to beneficiaries. I would very much appreciate any help with this so I can finish the job.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Business does not transfer deductions to K-1 Form BUG?

In Forms Mode, try entering percentages on each K-1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Business does not transfer deductions to K-1 Form BUG?

That doesn’t apply to the question. I did have to go enter the percentages manually on that form, but it doesn’t change anything. The K-1 worksheet shows capital gains and tax deductions but doesn’t pass any amounts to the K-1 forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Business does not transfer deductions to K-1 Form BUG?

If you enter a percentage on the line shown (and the return is marked as final), then the figures should appear on the lines in Part III of your K-1s.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Business does not transfer deductions to K-1 Form BUG?

I don’t know how to keep saying this. I entered the percentages. The return is marked final. The amounts shown on the K-1 worksheet DO NOT TRANSFER to the individual K-1 forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Business does not transfer deductions to K-1 Form BUG?

I don't know how to keep helping you as you're clearly doing something wrong.

The procedure works for me and there is no reason it should not work for you.

There are some instances where you have to make a distribution in the program and also allocate capital gains (or losses) to the beneficiaries and to income.

Regardless, I know it works since I've done this on test copies of TurboTax Business for over 15 years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Business does not transfer deductions to K-1 Form BUG?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Business does not transfer deductions to K-1 Form BUG?

I would very much like to know what I'm doing wrong. I use TT a few years back to do an estate return and had no problems, but this year it's nothing but problems. Each beneficiary got a slightly different amount of cash from the sale of the house, as there were deductions to compensate some people for taking items instead of cash. The amount on the first line represents their actual cash distribution. TT is using the 20% number to correctly calculate the amount of gains, tax etc for each beneficiary but it doesn't transfer to the K-1 form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Business does not transfer deductions to K-1 Form BUG?

@metchy wrote:

.........but it doesn't transfer to the K-1 form.

Got it!

What you posted in your screenshot IS the K-1 form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Business does not transfer deductions to K-1 Form BUG?

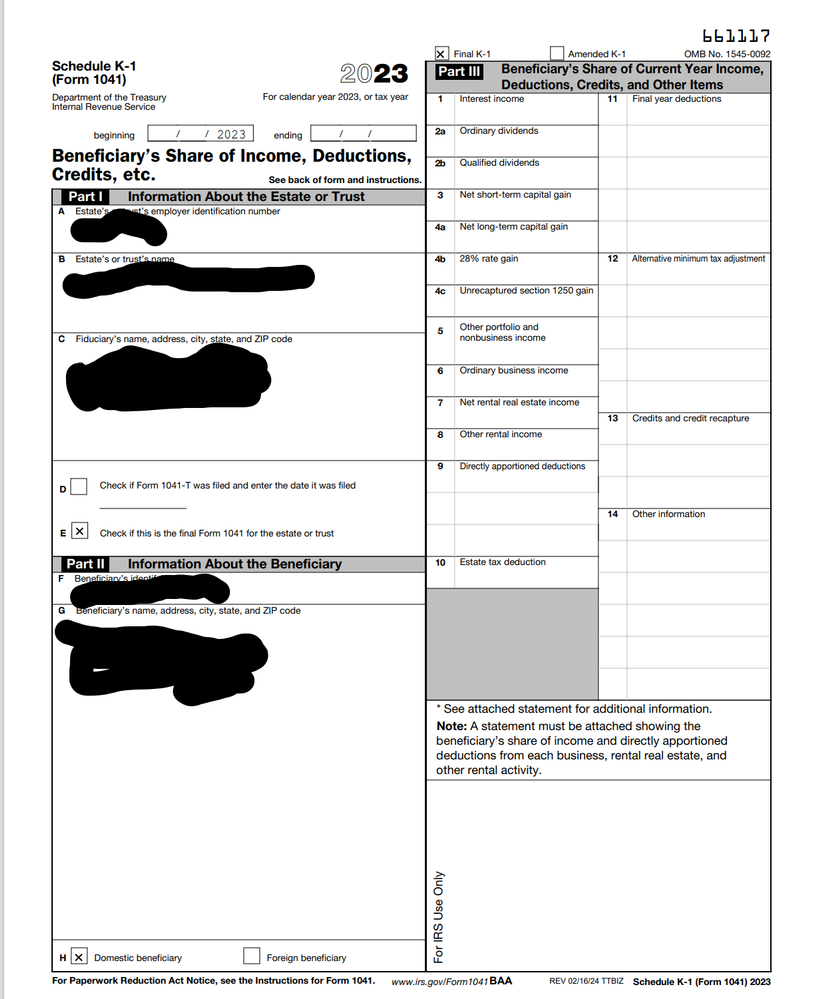

It’s not the K-1 form that TT generates for sending to each recipient. That generated form is blank - meaning it has information and fields for amounts, but the numerical values shown on the form I posted are blank on the individual forms. Does anyone test these products? If I’m entering data incorrectly that could easily be remedied by software that uses an interview process to prompt for the correct info and populate the fields for me. Why, I’d pay $150 for software like that. Oh wait, I did.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Business does not transfer deductions to K-1 Form BUG?

@metchy wrote:

It’s not the K-1 form that TT generates for sending to each recipient. That generated form is blank....

I'm not certain what you mean by "generated form is blank". That seems implausible since the screenshot you posted is the actual K-1 in the program (that happens to be populated with figures and seeming correct figures).

If the actual K-1s don't reflect those numbers and are in fact blank, then something else is going on and you need to contact Support.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Business does not transfer deductions to K-1 Form BUG?

This is what I mean. This is the Schedule K-1 form TT generated for me to send a recipient. All recipients' forms look just like this: they have the personal information but no values in any field. I have called support about this twice already and spent a couple hours talking to people who didn't know what K-1s were, people who kept reading me knowledge base articles about other versions of TT, etc and it was a waste of my time. The whole reason for purchasing a product to do a simple estate return is so that I can rely on the knowledge built in to the software and trust the expert tax advisers who created it. Except nope, it doesn't seem to work and there is no support and it seems a total surprise to everyone that people would need to create K-1 forms with numbers on them!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Business does not transfer deductions to K-1 Form BUG?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Business does not transfer deductions to K-1 Form BUG?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

KarenL

Employee Tax Expert

katehailey

New Member

discover98

New Member

MiniMe

Returning Member

malvinchip

Level 1