- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- There is a 1099-B on my brokerage statement

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There is a 1099-B on my brokerage statement

On my Wells Fargo Advisors 1099 Consolidated form there is a 1099-B. The items that I need to enter are in Boxes 1d, 1f & 1g. on the TurboTax 1099-B form these don't exist. How and where do I enter them?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There is a 1099-B on my brokerage statement

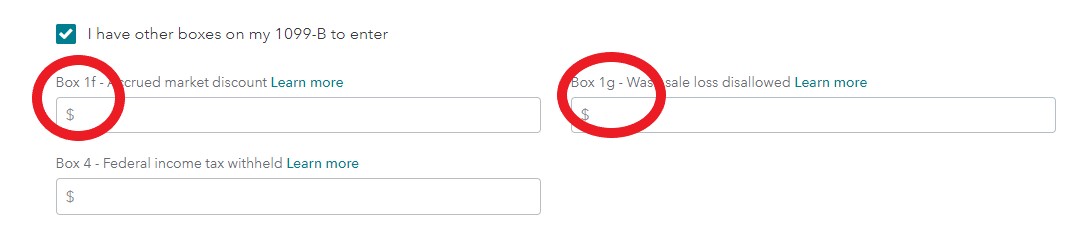

To enter Boxes 1d, 1f and 1g on Form 1099-B, click edit next to your 1099-B entries, and scroll down to Box 1d - Proceeds and enter the amount. Continue to scroll down until you see "I have other boxes on my 1099-B to enter" and then click the box to expand the screen to show more boxes. You will see Box 1f - Accrued market discount and Box 1g - Wash sale loss disallowed. Please see the screenshots below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There is a 1099-B on my brokerage statement

This does not match my TurboTax Premier 2019, I get two boxes: "Total Adjustments to gain or loss" and "List all adjustment codes". There is no explanation of what codes to apply, and the instructions say they are required.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There is a 1099-B on my brokerage statement

If you are trying to make an adjustment to the gain or loss of a transaction (or the cost basis) reported on your 1099-B and you are using the online version of TurboTax Premier, you can enter this information by following the steps below:

- In the Wages and Income section, click Edit/Add next to Stocks, Mutual Funds, Bonds, Other and then Edit next to the Company name.

- Click Continue and the click the "pencil" icon next to the transaction

- Select the box next to "The cost basis is incorrect or missing on my 1099-B"

- Continue until you get to the section "We noticed there's an issue with your cost basis...Let us know if you'd like to make any changes" and answer the questions. TurboTax will enter the correct adjustment code based on your answers to the questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There is a 1099-B on my brokerage statement

yes, but we did not sell

can't read the boxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There is a 1099-B on my brokerage statement

Check with your broker regarding whether or not it is sold. Also, if the form is illegible, ask for another one.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

fcp3

Level 3

Moonlight

Level 2

taxgirlmo

Returning Member

1881onanvil

Returning Member

Alisha1976

New Member