- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Stimulus overpayment?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus overpayment?

Got $2900 stimulus for myself, wife, and 16 YO daughter. My daughter filed her own taxes and received a $1200 check. Dependent boxes were properly checked on each return. What should I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus overpayment?

1) you are permitted to claim your daughter under certain circumstances. Those circumstances can get quite complicated so best just to run your specific scenario through this IRS Tool. That will end any and all confusion whether your daughter is your dependent or not.

https://www.irs.gov/help/ita/whom-may-i-claim-as-a-dependent

2) Taxpayers are eligible to RECEIVE stimulus; dependents do not RECEIVE stimulus. if the tool above states your daughter is NOT a dependent, then she is a taxpayer and entitled to the stimulus. if the tool says she is a DEPENDENT, YOU are entitled to the stimulus.

Can we start there? please post back the result of the IRS tool; it'll make resolving any confusion and what you really need to do much, much easier. You may be unintentionally complicating matter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus overpayment?

IRS has stated it will not ask for mistaken payments back.

If it bothers you, you can write a check to "US Treasury", put "for US Debt" in the memo field.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus overpayment?

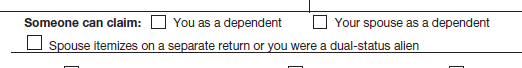

on your daughter's return, there is a question that is asked if she CAN be claimed by someone else. Can you verify if that was checked? Someone can claim "you as a dependent" should have been checked, See snippet below:

doing the right thing would be returning the $1200 to the IRS. She can simply write void on the IRS check (or it was direct deposit make a check out to the US TREASURY) and add a brief note explaining the situation.

then mail to the address from the link below, it is state dependent.

https://www.irs.gov/filing/where-to-file-paper-tax-returns-with-or-without-a-payment

thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus overpayment?

The "can be claimed" box was checked. I always keep a copy and verified that it was checked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus overpayment?

@JoandJerry - very odd.

it's an IRS error and I would still encourage doing the right thing and return the payment. I can see no reason why under the rules someone who is a dependent on someone else's return received $1200.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus overpayment?

For 2019, I had claimed my son as a dependent. For 2020, he was not a dependent. Since I had not yet turned in my 2020 taxes, they based my third stimulus check on 2019 and sent me $2800, $1400 for myself and $1400 for my son. My son had already filed his 2020 taxes, so they based his stimulus check off that and sent him $1400. Even my accountant hasn't figured out yet what to do with the extra $1400 I got. He just said not to spend it while he looks into it. I know it's not mine and I'm not even going to pretend that they won't come after it eventually.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus overpayment?

I think you'll be able to keep the 2800. I read that section of the latest bill (before it was passed) and because of the timing the IRS was to use the latest return they had on file and if things changed (like in your case) they can not ask for the money back. I do not know about the 1400 payment that your son received. I think he'll be able to keep it but I don't remember what the bill said about your situation. I'm sure your accountant will sort it out.

In my case the IRS didn't see the little box checked on my daughters return that she was claimed on my return. In my case I will need to send the money back because she should not have received the 2 payments in 2020 because she was a dependent on my return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus overpayment?

The EIP (Economic Impact Payment) or stimulus payments are non-taxable.

None of the three stimulus checks are considered taxable income. They won’t reduce your refund or increase what you owe when you file your taxes this year or next.

You may hold to the check and call the IRS. You may access the Taxpayer's Advocate website for help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus overpayment?

I am in the same situation as you. I cannot find any answers as to what to do. Have you been able to find anything out? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus overpayment?

Try this link. https://www.irs.gov/newsroom/economic-impact-payment-information-center-topic-i-returning-the-econom...

Economic Impact Payment Information Center — Topic I: Returning the Economic Impact Payment

Then there are 2 options, one for direct deposit or check, and 1 for debit card. Both have simple instructions to return the payment.

Hope this helps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus overpayment?

I wouldn't return the payment. It is most probably yours to keep.

The way the first two stimulus payments worked, and I have no reason to believe the 3rd one is any different, it was certainly possible for a dependent to get a taxpayer two payments for the same person.

Here is how that occurred:

Say there are divorced parents and their child, Johnny, is claimed in alternate years by each parent.

For the 1st two stimulus, Mom received the $1100 because she claimed Johnny on her 2019 tax return.

But on the 2020 tax return, Dad claimed Johnny as it was Dad's turn to do so, and Dad received $1100 as a recovery credit.

ALL TOTALLY LEGAL - that is the way the rules were designed.

So now that adult dependents are eligible for the stimulus, I would not be surprised if it works the same way - I have seen nothing to the contrary.

In this case Dad claimed his 18 year old student son on his 2019 tax return and had not yet filed 2020. The IRS send Dad $2800 as the third stimulus payment because it used 2019 as the basis of the stimulus.

Then Son filed his 2020 tax return and Son received $1400 as he filed independent of his father. Alternatively, there was no stimulus payment but he will be able to claim a recovery credit on his 2021 tax return .

Further, when calculating the recovering credit, the result that goes on Line 30 can not be negative, meaning you are not required to return any stimulus if the calculations indicate you were over paid.

do not return the payment!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus overpayment?

But my daughter is our dependent on our joint return and she filed her own return with the boxes for being a dependent AND being claimed as such on our return but the IRS missed this box. So the way I read it she's not eligible for her own payment. Also we had to amend her return because according to the IRS she was claimed on both returns (hers and ours). I re checked our copy of her return and the box was checked.

Do you still think I should not send the payments back? I'm good with waiting to be asked to return it. This has been all so confusing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus overpayment?

1) you are permitted to claim your daughter under certain circumstances. Those circumstances can get quite complicated so best just to run your specific scenario through this IRS Tool. That will end any and all confusion whether your daughter is your dependent or not.

https://www.irs.gov/help/ita/whom-may-i-claim-as-a-dependent

2) Taxpayers are eligible to RECEIVE stimulus; dependents do not RECEIVE stimulus. if the tool above states your daughter is NOT a dependent, then she is a taxpayer and entitled to the stimulus. if the tool says she is a DEPENDENT, YOU are entitled to the stimulus.

Can we start there? please post back the result of the IRS tool; it'll make resolving any confusion and what you really need to do much, much easier. You may be unintentionally complicating matter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus overpayment?

My daughter is and does qualify as a dependent. My confusion came from the IRS missing that box checked on her 2020 return for ty 2019. I've amended her return but still have a 3rd check incoming. I'll send it back with a note per the IRS website. And yes I did make this more complicated than it needed to be, it's what I do.

Thank you for all the help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus overpayment?

IRS will reach out to you after November 15, 2021 by mail. There’s a sweep being ran regarding overpayments and they will give two options on paying it back.

Let me know if you have additional questions.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mminderbinder

Level 2

mminderbinder

Level 2

cazamo

New Member

Novanation4life

New Member

THBSr

Returning Member