- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Should/could I still add additional HSA contributions for 2022?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should/could I still add additional HSA contributions for 2022?

I am part of a HSA program through my company, and in 2022 my company contributed $600 and we contributed $3,600, and we used the total amount to pay medical bills.

I received the following tax forms:

- W-2 Box 12c shows W $900 (I thought this should reflect both company and my contributions and if only company not sure why $900 and not $600).

- 1099-SA shows Boxes 1: $2,831 (distributions), 2: $0, 3: 1, 4: $0, and 5: HSA.

- 5498-SA shows Boxes 1: $0 (Employee contributions), 2: $850 (total contributions), 3: $0, 4: $0, 5: $249 (Fair market value), and 6: HSA.

- 1095-C shows we had employer-provided health insurance but doesn't have any dollar values.

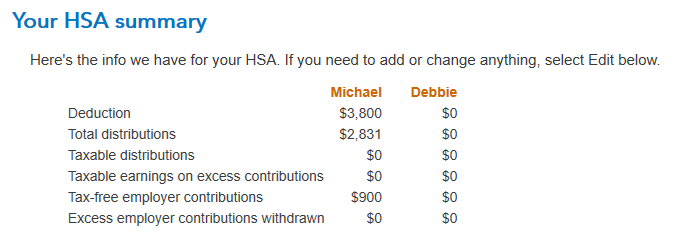

TurboTax shows the following:

- Imported the $2,831 distributions and $900 contributions, but I had to manually add the $3,600.

- Says my maximum contribution limit is $8,300.

- Shows $200 for last years Excess Contributions.

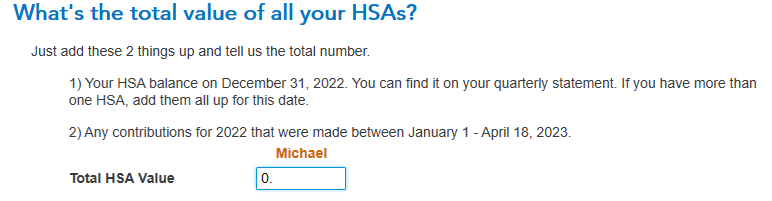

- A screenshot of the total value of all HSAs and option for 2022 contributions provided by 4/18/2023, and then an HSA summary (both shown below).

Question. Should I add more to 2022 to reflect our actual medical expenses? Any implications one should be aware of?

Thank you!

PS. I asked this same question in the Deductions and Credits Forum yesterday, however, when looking for it in the list, it wasn't shown and the only way I found it was to search for key words such as "$2,831". Am I doing something wrong?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should/could I still add additional HSA contributions for 2022?

"Imported the $2,831 distributions and $900 contributions, but I had to manually add the $3,600."

PLEASE, undo the adding the $3,600! If you did the HSA contributions through payroll deduction, then you already have the deduction. The $3,600 is removed from Wages in boxes 1, 3, and 5 before your W-2 is printed; thus, your HSA deduction is that the contributions were never in your income in the first place.

By manually adding the $3,600, you are doubling your HSA deduction. I know it is confusing - but you can confirm this by asking your payroll people about the code W amount in box 12.

"Shows $200 for last years Excess Contributions." Did you over contribute in 2021? Then since $200 plus the $600 plus the $3,600 is still less than the $8,300 limit, the $200 was "used up" this year (2022), so you are done with it.

"Should I add more to 2022 to reflect our actual medical expenses? Any implications one should be aware of?" Yes, you can add up to $3,900 to your 2022 HSA up until the filing deadline (tomorrow, April 18, 2023). BUT SEE THE NOTES BELOW:

1. Are you under Family HDHP coverage? If so, that $8,300 number if not accurate, because it will tell you and your spouse separately that you each have $8,300 (if your spouse if 55+) - but this is not accurate. Come back and tell us if this is the case.

2. If you make a contribution to your HSA by April 18, 2023, you MUST tell the HSA custodian that the contribution is for 2022 - otherwise, they will assume 2023.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should/could I still add additional HSA contributions for 2022?

Thank you Bill!

Box 12c shows only $900, and I would have expected $3,600 if it was already removed from wages. Am I missing something? Will definitely call my payroll people tomorrow.

Yes, contributed last year. Didn't think we over-committed, but could have done so.

Regarding maximum limit of $8,300, yes, I think we are under Family HDHP coverage. Not sure if relevant, but wife doesn't work and filing jointly.

Thanks for the heads up about needing to tell the HSA custodian that the contribution is for 2022!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should/could I still add additional HSA contributions for 2022?

You cannot tell just from looking at the W-2 that the HSA amount was removed from Wages in boxes 1, 3, and 5. The code W amount is the only notice on the W-2. Note that it does not matter which box 12 it is in - 12a, 12b, 12c, or 12d - it is the letter code that identifies the meaning of the dollar amount.

Having said that, do NOT ask your employer to change the W-2, it is correct.

The $8,300 limit is correct if the owner of the HSA (you or your spouse) is 55 or older.

Your wife not working is no problem.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

sunshineInTheRain

Level 3

CharlesANorris

New Member

rocba62-

New Member

Kathyyy

Returning Member

Charles Garner

New Member