- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should/could I still add additional HSA contributions for 2022?

I am part of a HSA program through my company, and in 2022 my company contributed $600 and we contributed $3,600, and we used the total amount to pay medical bills.

I received the following tax forms:

- W-2 Box 12c shows W $900 (I thought this should reflect both company and my contributions and if only company not sure why $900 and not $600).

- 1099-SA shows Boxes 1: $2,831 (distributions), 2: $0, 3: 1, 4: $0, and 5: HSA.

- 5498-SA shows Boxes 1: $0 (Employee contributions), 2: $850 (total contributions), 3: $0, 4: $0, 5: $249 (Fair market value), and 6: HSA.

- 1095-C shows we had employer-provided health insurance but doesn't have any dollar values.

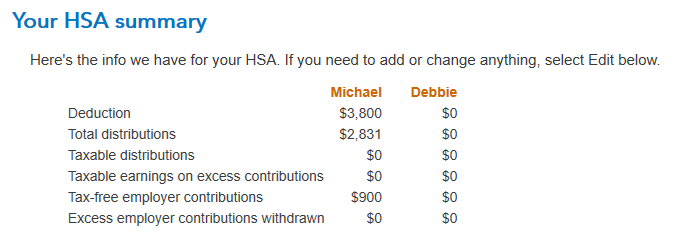

TurboTax shows the following:

- Imported the $2,831 distributions and $900 contributions, but I had to manually add the $3,600.

- Says my maximum contribution limit is $8,300.

- Shows $200 for last years Excess Contributions.

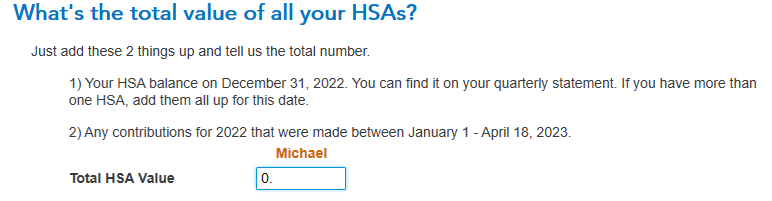

- A screenshot of the total value of all HSAs and option for 2022 contributions provided by 4/18/2023, and then an HSA summary (both shown below).

Question. Should I add more to 2022 to reflect our actual medical expenses? Any implications one should be aware of?

Thank you!

PS. I asked this same question in the Deductions and Credits Forum yesterday, however, when looking for it in the list, it wasn't shown and the only way I found it was to search for key words such as "$2,831". Am I doing something wrong?

April 16, 2023

7:04 AM