- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Self employed IT consultant, done some stock trading, where to put Form 8949 number in TurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self employed IT consultant, done some stock trading, where to put Form 8949 number in TurboTax

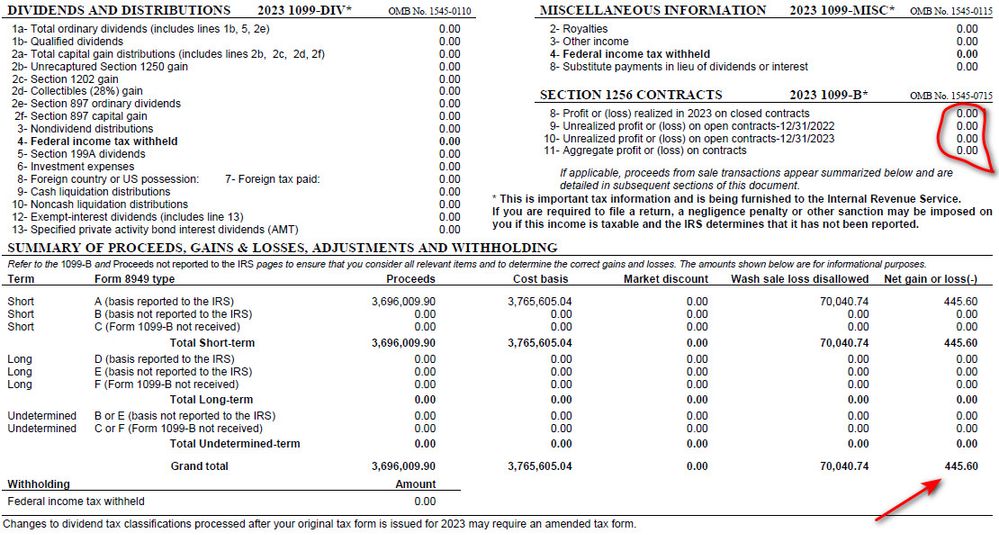

I am a self-employed IT consultant. I have done (first time) some stock trading this year. I received 1099 forms and Form 8949 from the TDAmeritrade. Only 1099-DIV has a number, all other 1099 forms are 0. The Form 8949 has a gain of $400. I am married filing jointly. I guess I will report the 1099-DIV with other 1099 forms from other banks. But I don't know where should I input the value of the Form 8949 on my Home and Business Edition TurboTax? It should not go with my Business Income, am I right?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self employed IT consultant, done some stock trading, where to put Form 8949 number in TurboTax

I think you are misreading something on the TD Ameritrade statement. They do not send you a Form 8949. They send you a Form 1099-B. You enter it under investment sales in the personal income section, not business income. Form 8949 is a form that TurboTax fills out as part of your tax return. The TD Ameritrade statement might mention certain boxes or other things that are on Form 8949, but it is not a Form 8949. Somewhere on that TD Ameritrade statement it says 1099-B.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self employed IT consultant, done some stock trading, where to put Form 8949 number in TurboTax

Thank you for your reply. You are right. It is not actually a form. It only mentions the Form 8949. The 1099-B form from TDAmeritrade is an all 0 form. Does it still need to be used in TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self employed IT consultant, done some stock trading, where to put Form 8949 number in TurboTax

If the 1099-B section of the TD Ameritrade statement is all zeros there is nothing to enter in TurboTax. It's the same as if there was no 1099-B.

In you original question you mentioned "a gain of $400." If the 1099-B is all zeros, where is that $400 gain?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self employed IT consultant, done some stock trading, where to put Form 8949 number in TurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self employed IT consultant, done some stock trading, where to put Form 8949 number in TurboTax

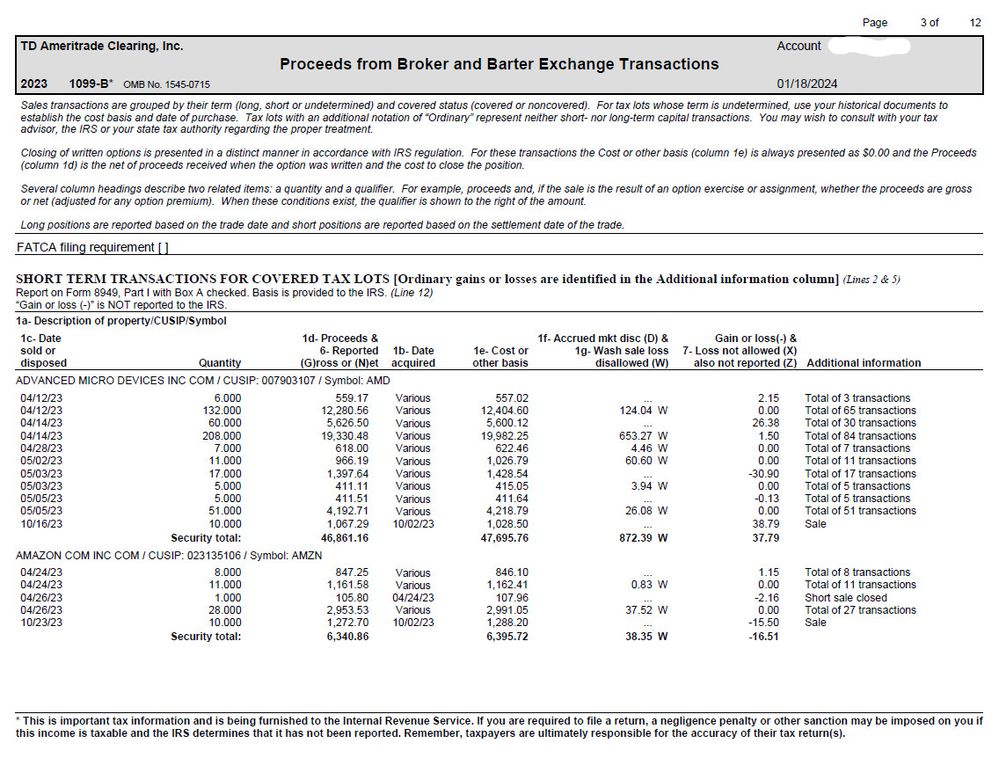

You should have another section 1099B. That is only Section 1256. You had sales. Must be on another page. You have part A sales. You have to enter all the sales from the detail sheets.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self employed IT consultant, done some stock trading, where to put Form 8949 number in TurboTax

Oh, is this an Amended or Corrected 1099? Did you get an Original 1099 earlier? It's common for companies to send out Amended 1099 forms. I'm still waiting for an amended one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self employed IT consultant, done some stock trading, where to put Form 8949 number in TurboTax

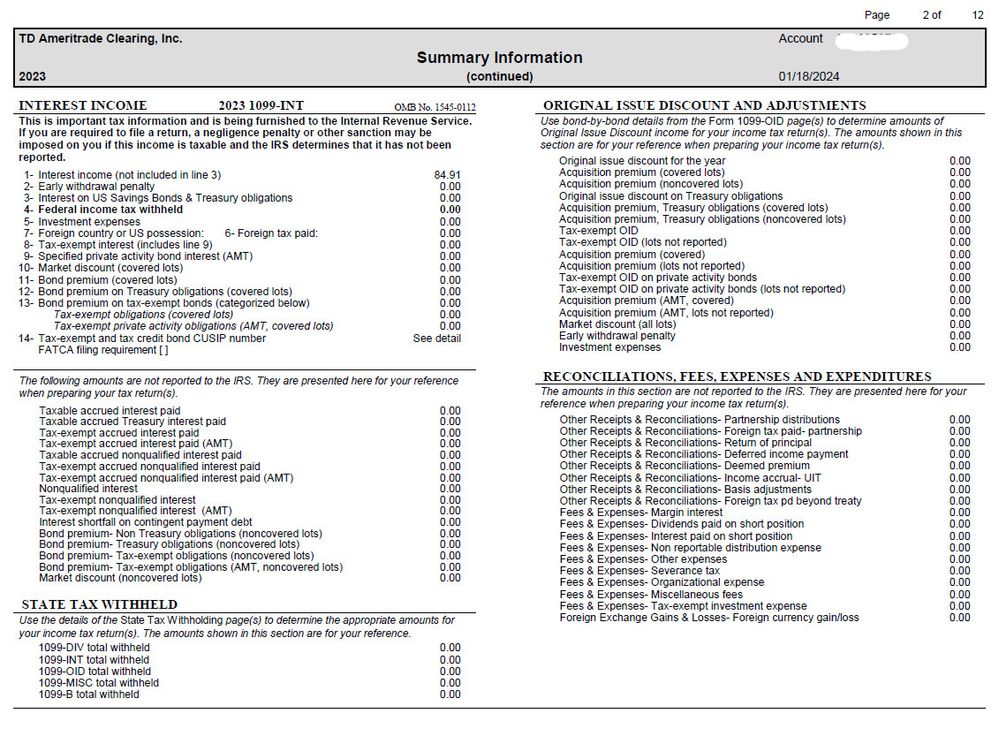

I downloaded from their website. It has 12 pages. The next page and the above page are Summary Information.

Then the detailed 1099-B is followed. I have to input all the details into the TurboTax? It is too bad if that is true.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self employed IT consultant, done some stock trading, where to put Form 8949 number in TurboTax

Probably I can import from TD instead of manually input.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self employed IT consultant, done some stock trading, where to put Form 8949 number in TurboTax

You can try to import it. If you import it be sure to check it over close and make sure the cost basis got imported and is right. How to import your 1099

https://ttlc.intuit.com/community/entering-importing/help/how-do-i-import-my-1099/00/26254

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self employed IT consultant, done some stock trading, where to put Form 8949 number in TurboTax

You don't have to enter all the details. All the sales have basis reported to the IRS, so you can make summary entries. You just enter the totals. TurboTax asks if you want to enter the sales "One by one" or "Sales section totals." Select "Sales section totals." You only have one section: short-term with basis reported, so it's very simple. Be sure to enter the adjustment for wash sale loss disallowed, on the same screen as the total proceeds and basis. The net gain in TurboTax should be the same as the statement.

Skip the import. Making one summary entry is easier.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ColoRock

Returning Member

jcanalesr92

New Member

Irasaco

Level 2

helloTT102

New Member

mpsekhon

Level 2