- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Schedule K-1 Box 17 Code V

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 17 Code V

I am trying to enter the information for this box; however, there are three items listed on the attached statement (ordinary income, W-2 wages, unadjusted basis) and I don't know what value is appropriate to enter. I have also been provided in the statement IRC SEC. 163(J) adjusted taxable income calculation which has values.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 17 Code V

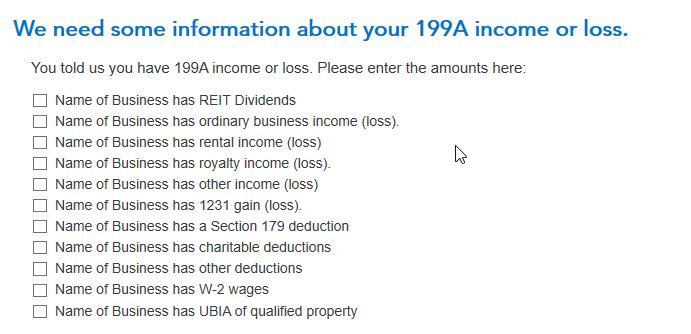

Enter the code V on the box 17 screen, but leave the amount box blank. Then, Continue through the K-1 interview after you have entered your code V on the box 17 screen. Later in the interview questions is a screen titled "We need some more information about your 199A income or loss". This screen must be completed with the box 17 code V Section 199A Statement or STMT that came with your K-1, in order for your QBI deduction to be calculated.

When you check the boxes next to the lines on that screen you need (the descriptions that match your three items), a place will open up to enter your amounts.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here is a screenshot of the screen to enter your Section 199A Statement/STMT information:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ryp5155

New Member

aussiebobaustin

Returning Member

user17690078874

Returning Member

jtalley22

Level 1

user17689614380

Level 1