- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Schedule H is still missing from 2020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H is still missing from 2020

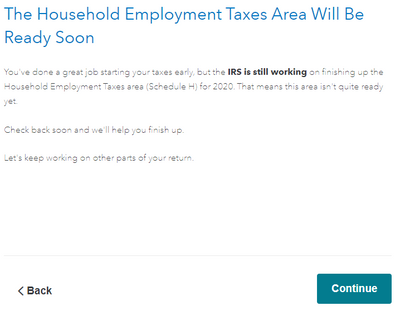

I'm trying to complete the data required to calculate Nanny Taxes in Schedule H, but when I get to that section in TurboTax, I get an error that says that the IRS is still working on it.

I can find the form on the IRS website and it looks finished to me.

What's the issue? Is this a bug or an actual feature that's still in development? The calculations are pretty straightforward.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H is still missing from 2020

The IRS has not yet finalized the Schedule H instructions for tax year 2020.

Schedule H is estimated to be available on 02/04/2021 (subject to change)

Go to this website for IRS forms availability - https://care-cdn.prodsupportsite.a.intuit.com/forms-availability/turbotax_fed_online_individual.html

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H is still missing from 2020

The IRS has not yet finalized the Schedule H instructions for tax year 2020.

Schedule H is estimated to be available on 02/04/2021 (subject to change)

Go to this website for IRS forms availability - https://care-cdn.prodsupportsite.a.intuit.com/forms-availability/turbotax_fed_online_individual.html

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H is still missing from 2020

Hi there. While Schedule H has been released, at least based on our personal circumstances, where we have provided paid Family Leave to our housekeeper under FFCRA, it appears that the Schedule H calculations in Turbotax are incorrect in that they are not following the formula's prescribed by the IRS to determine the non-refundable and refundable portion of the Family Leave credit. This could potentially impact the amount of taxes you owe. Below is a summary of the issue that I reported to TurboTax today. Flagging in case you or others are impacted by the same issue, as you may want to hold off on filing until TurboTax acknowledges / resolves the issue with a software update.

I am using TurboTax Premier (Download) for Mac - 2020. This error will not be visible to you unless you review the Schedule H in "Forms" mode.

On the "Lines 8b and 8e - Nonrefundable and Refundable Credit for Qualified Sick and Family Leave Wages Smart Worksheet" of Schedule H, Line F calls for you to add amounts from lines 8h, 8i of Part I of the Schedule H with Line E of the Smart Worksheet.

Line F is a calculated field that cannot be overwritten.

It appears that Line F is not pulling the data from line 8h (and potentially line 8i) of the Schedule H.

For example, on my return, line 8h of Schedule H has a balance of $3,634 and line E of the Smart Worksheet has a balance of $53, so Line F of the Smart Worksheet should be $3,687 ($3,634 + $53), but Line F of the Smart Worksheet is only showing $53.

Because Line F is a direct or indirect input to Lines G, H and I of the Smart Worksheet, in my instance, this is then causing Lines G, H and I of the Smart Worksheet to be underreported.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H is still missing from 2020

I have also been having issues with the FFCRA sections of Schedule H. Unlike @sensibleb, my nonrefundable and refundable portions are calculated correctly... but TurboTax is not correctly deducting the nonrefundable portion of the credit.

Line 25 of Schedule H is properly carried down from 8c, but line 26 is the sum of line 16 and line 8a! Robbing me of the credit from line 8b.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H is still missing from 2020

The IRS website is now showing that Schedule H will be available March 17. In the meantime, I am owed a substantial refund and losing money because TurboTax won't let me file my return. Is there some way to override the program and file my return now, subject to later amendment? Any other work-around so that I can get my return filed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H is still missing from 2020

Yes, you can delete everything from your return related to the schedule H. If TurboTax thinks that you don't need a Schedule H then it won't make you wait to file one.

Here's why you shouldn't do that -

The IRS is behind schedule this year. Astonishingly so. If your original return gets delayed for any reason then you won't be able to file your amended return until after the original is finished being processed. If you end up filing after April 18th your schedule H taxes - which won't be able to be withheld from your refund because you will have already gotten your refund - will have penalties and interest added to them.

And if the IRS is expecting a schedule H with your return for any reason then the fact that it is not included would be enough to delay the processing of your return for upwards of six months.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lgreene1964

Level 1

MerlinTobyPhoenix

New Member

user17711185613

New Member

bkgrant10

Level 3

Butorj1

New Member