- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Sale of second home, making sure I'm filling this out correctly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home, making sure I'm filling this out correctly

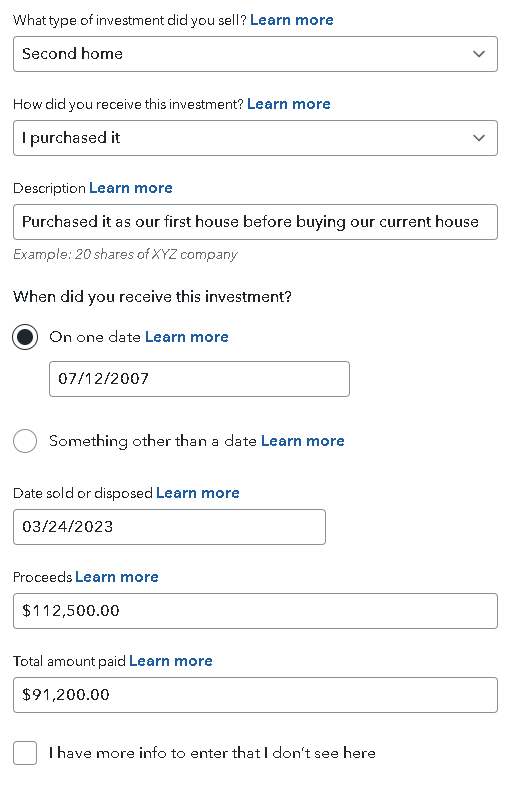

Back story; bought our first home in 2007, lived there as our primary residence till 2017 where we bought our current home. My in-laws moved into our first home, we didn't really consider it a rental. We sold our first home last year, am I filling out this investment form correctly (screenshot below)? We weren't given a 1099-S

Original purchase: $86,500

Upgrades to first home: $3,700 (added central air)

Total Amount Paid: $91,200

Sold: $125,000

Paid for closing costs: $5,000

Realtor fees: $7,500

Proceeds: $112,500

I did these calculations based off of this article. https://smartasset.com/taxes/capital-gains-on-sale-of-second-home

Thoughts? Am I right or close on this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home, making sure I'm filling this out correctly

I would look over your home records from 2007-2023. You likely have more expenses over that time span that will increase your cost basis and thus lower/eliminate your gain.

These would be expenses like the air conditioning you added that add/or improve the value of the property. Normal maintenance and repairs wouldn't qualify. Things like fencing, landscaping, roof, additions, etc.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home, making sure I'm filling this out correctly

The date for the investment should be 2017 since that marked the end of your primary residence usage and the beginning of its use as a second home.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home, making sure I'm filling this out correctly

ok, thank you. Are the numbers I'm using correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home, making sure I'm filling this out correctly

I would look over your home records from 2007-2023. You likely have more expenses over that time span that will increase your cost basis and thus lower/eliminate your gain.

These would be expenses like the air conditioning you added that add/or improve the value of the property. Normal maintenance and repairs wouldn't qualify. Things like fencing, landscaping, roof, additions, etc.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home, making sure I'm filling this out correctly

Thanks again. Adding central AC is probably the only thing that added value. Everything else was normal maintenance or appliance replacement

In 2016, while it was still our primary residence we refinanced; can we add that cost to lower our proceeds?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home, making sure I'm filling this out correctly

No, refinancing your main or second home does not add to the basis. Fencing, landscaping, adding a room, things that improve the value, add to the basis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jasmine2323-

New Member

cnc213

New Member

dimi1927

Level 3

herosareangels

New Member

tinadms1

New Member