- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

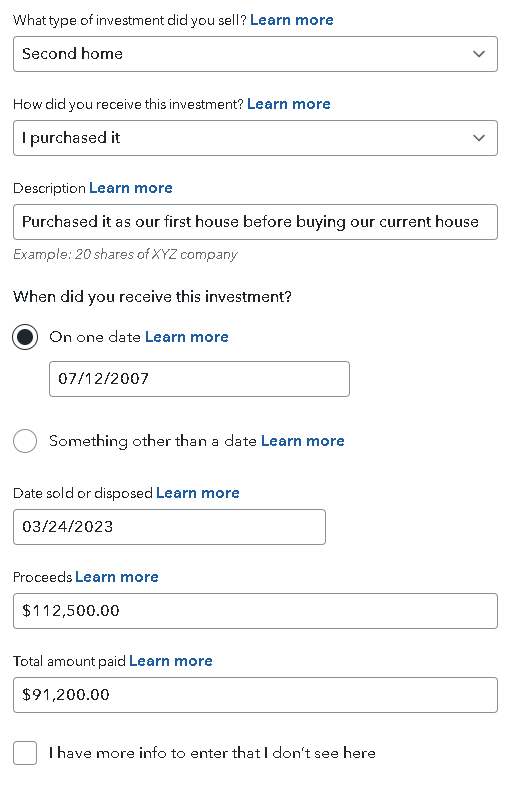

Sale of second home, making sure I'm filling this out correctly

Back story; bought our first home in 2007, lived there as our primary residence till 2017 where we bought our current home. My in-laws moved into our first home, we didn't really consider it a rental. We sold our first home last year, am I filling out this investment form correctly (screenshot below)? We weren't given a 1099-S

Original purchase: $86,500

Upgrades to first home: $3,700 (added central air)

Total Amount Paid: $91,200

Sold: $125,000

Paid for closing costs: $5,000

Realtor fees: $7,500

Proceeds: $112,500

I did these calculations based off of this article. https://smartasset.com/taxes/capital-gains-on-sale-of-second-home

Thoughts? Am I right or close on this?

Topics:

April 7, 2024

8:05 PM