- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- S Corp 1120S Form K1 - non deductible expenses and is it taxable on personal return and how listed items on our Shareholders Basis Worksheet looks like

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S Corp 1120S Form K1 - non deductible expenses and is it taxable on personal return and how listed items on our Shareholders Basis Worksheet looks like

My wife and I own a business we are 50/50 partners. We file tax form 1120S every year. We have a question in regards to our K-1 and shareholders basis Statement for tax year 2022.

We are showing a net ordinary income from our P/L of $40,550.00

We each take a salary and pay payroll taxes. Our combined salary for the year totaled $62K.

During the year my wife was paying personal bills from the company bank account which came to $53K. In our QuickBooks we placed those personal bill we paid in our Shareholders Distribution account on the balance sheet.

Now for 2022 our total incomed earned was $323,993.00 and we had expenses: our officer salaries, employee salaries and business related expenses which totaled $283,443.00. At the end of the year it shows our P/L Net Ordinary Income: $40,550.00

Now when it comes to our Shareholders Basis Statement and K-1 this is where we are getting a bit confused. I will list what mine looks like

Our beginning Share Holder Basis combined is $150K broken down per officer is $75K

This is what my Shareholder Basis Statement looks like and my wife's would be identical.

Line 1 Beginning Balance year: $75K (Total combined basis $150K divided by two)

Line 2 Adjustments to income: $20275.00 ($40,550 divided by two)

Line 3 Total Adjustment for income and gains $20275.00

Line 5 Non deductible expenses: $26.5K ($53K divided by two) Personal bills we paid through the business

Line 7 net increase/decrease $-6,224.00

Line 9 Increase by income: $20,275.00

Line 10 Subtotals: $95,275.00

Line 12 Subtotals: $95,275.00

Line 13 Decrease loss and deduction items: $-26.5K

Line 14 Subtotals: $68,775.00

Line 16 Balance end of year $68,775.00

Now for the K-1s, we have them listed as per owner:

Line 1 Ordinary Income: $20,275.00

Line 17 V* is $37K (wages from our employees excluding our wages. Total Employee Wages $74K divided by 2)

Here is our question: Do we pay taxes on the non deductible expenses (personal bills paid from business bank acct) my portion came to $26.5K. If so, where would be list it on the K-1 so it gets properly added to our personal 1040 tax return as taxable income.

And yes were are aware it's a no-no to made personal purchases from the business account. We don't know how to go about taking owner distributions/withdrawals.

Thank you in advance for the assistance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S Corp 1120S Form K1 - non deductible expenses and is it taxable on personal return and how listed items on our Shareholders Basis Worksheet looks like

I am going to page @Rick19744 but, with respect to distributions, you could simply take the $40,550.00 of ordinary income out of the corporation and put it in your personal account (provided you're paying yourself a reasonable salary for your services to the corporation).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S Corp 1120S Form K1 - non deductible expenses and is it taxable on personal return and how listed items on our Shareholders Basis Worksheet looks like

Seeing how we paid personal items totaling $53K and our profit was $40,550, would be then responsible for paying taxes on the difference which would be $12,450 or the full $53K or we don't pay any tax on it because we have a positive ending Shareholder Basis and we will only be responsible for the Ordinary income listed on Line 1 of your K-1 which will appear on our personal 1040 Federal Tax Return

We believe we are taking a reasonable salary for our position at our location in our State.

We can use all the assistance for this tax question. thank you for responding.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S Corp 1120S Form K1 - non deductible expenses and is it taxable on personal return and how listed items on our Shareholders Basis Worksheet looks like

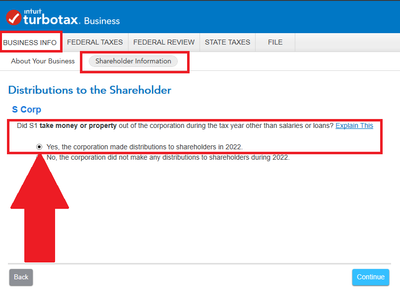

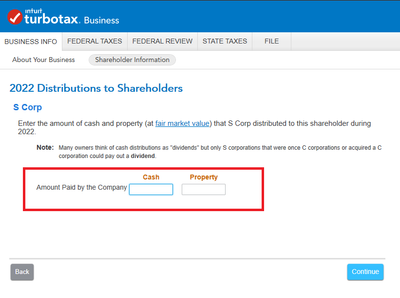

In TurboTax Business, you report distributions using the screens in the screenshots below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S Corp 1120S Form K1 - non deductible expenses and is it taxable on personal return and how listed items on our Shareholders Basis Worksheet looks like

You're fine provided the distribution does not exceed your basis.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S Corp 1120S Form K1 - non deductible expenses and is it taxable on personal return and how listed items on our Shareholders Basis Worksheet looks like

as to disproportionate distributions PLR 201236003 (PLR is private letter ruling which van not be cited by others)

The IRS looked to the underlying stock agreements, and finding that they conferred on all the shareholders equal rights to distributions and liquidation proceeds, held that despite having made several disproportionate distributions, the S corporation did not have a second class of stock, and thus did not terminate its S election, provided it make the necessary corrective distributions.

So in summary, a single distribution that is not made in accordance with shareholders’ ownership interests is not a cataclysmic event. However, the distributions should be corrected as soon as possible, and I would caution you to not make a habit of making disproportionate distributions, or you may well run afoul of Section 1361.

I also question whether payment of personal expenses should be shown as non-deductible expenses or distributions. you may be creating problems for yourselves should you be audited. it is much better to take distributions and put the money in a personal account to pay personal expenses.

how to take distributions. write a check from the S-corp to yourselves personally. preferably 1 to each of you in same amount. in the area for of the check for description write "distribution" (not really necessary). Really no different than a payroll check except you get no deduction for this and there ares no payroll taxes taken out. deposit check into a personal account like the one used to receive your payroll checks. from there you write checks to pay personal expenses.

since it seems that $40K has not been reduce by the nondeductible expenses then your taxable income from the S-Corp is the $40K+ your salaries. 17V is for purposes of 199A/ QBI

your K-1s are entered in your 1040 exactly as is

should be amounts on these lines in part III - each 1/2 of the book total

1 (increases basis)

16C (no effect on your taxable income but does reduce basis) this is your personal expenses which might more properly be reflected on 16D as distributions. same effect as 16C

17V should have 2 or 3 numbers - no affect on basis. or taxable income from the S-Corp. The info is used to calculate any QBI/199A deduction form 8995

a) line 1 profit

b) wages paid including yours

c) and if you have depreciable property the unadjusted basis immediately after acquisition (UBIA)

better hurry. unless you are in California a properly extended calendar year S-Corp return for 2022 is due 9/15/2023

file late and there is a penalty of about $400/month for ech month or fraction thereof that it is late.

I would also suggest talking to a tax pro for guidance. things like a retirement plan. paying health insurance through the s-corp, (it must be done a certain way) even an FSA/HSA for you and your employees

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S Corp 1120S Form K1 - non deductible expenses and is it taxable on personal return and how listed items on our Shareholders Basis Worksheet looks like

Thank you for all your assistance. It was helpful and very informative.

I want to make sure I understand what you wrote. Thanks for the screenshots as well.

So, we will not list these items as non deductible on the K1. We will enter the shareholders cash distribution accordingly and if everything is done correctly, the K1 should list the following

Line 1 Ordinary Income $20,275.00

Line 17code: V* Employees wages $37,000.00

Line 16 code D $26,500.00 our portion of shareholder distribution

Yes we are aware the tax deadline is Friday Sept 15th. This is the only issue holding us back. Everything else has been entered in.

On a separate note: what would apply to Nondeductible expenses when it comes to calculating shareholders basis. Can you either provide a link on some samples so we know for the future as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S Corp 1120S Form K1 - non deductible expenses and is it taxable on personal return and how listed items on our Shareholders Basis Worksheet looks like

So I'm not real clear that you are preparing this correctly:

- If your facts provided are reflecting the lines on form 7203, you need to revisit that form.

- Your beginning basis figure on line 1 I must assume is correct.

- You shouldn't have anything on line 2 based on your facts.

- Line 3a will be your $20,275

- Line 5 will be $95,275

- Line 6 will be your share of the distribution $26,500

- And then the rest of the form should be completed with the applicable lines; if necessary

- Based on the above, absent any other facts, you will have stock basis at the end of the year of $68,775.

- Not sure why you are wanting to reflect the $26,500 as nondeductible. Just show these as distributions.

- What I am not sure of is whether the income figure you are showing includes the $26,500 as a deduction or not.

- Since you are paying yourself a wage, can't say whether this will be considered reasonable if questioned by the IRS, but at the moment, since your distribution does not exceed your stock basis, it is not taxable and does not get reported on your personal tax return as income.

- Not sure what software you are using, but just show the personal expenses as a distribution to yourself and not as an expense (nondeductible expense).

- Going forward, just remember to keep your business records clean and void of any personal expenses.

- As stated previously, not sure what software you are using, but to take a distribution (not a wage), you would just Debit the distribution account and Credit cash. Also make sure that all distributions are equal. Since you are married filing a joint return, doubtful unequal distributions would be fatal; plus you could fix it upon audit. But best to avoid this in the first place.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S Corp 1120S Form K1 - non deductible expenses and is it taxable on personal return and how listed items on our Shareholders Basis Worksheet looks like

STOP STOP STOP paying personal expenses from the company account IMMEDIATELY. You should take a draw, put it in your personal checking account and pay personal bills from the personal account. If you are ever audited the IRS can & will audit all your personal accounts as well as the business accounts because you comingiled them...they will roast you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S Corp 1120S Form K1 - non deductible expenses and is it taxable on personal return and how listed items on our Shareholders Basis Worksheet looks like

We did. Trust us, we learned our lesson.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

anon30

Level 3

Cespitia88

New Member

David265

Level 2

wmattifordcsp

New Member

zzno3o

New Member