- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Which safe harbor to elect "IRS Notice 2019-07" or "Revenue Procedure 2019-38"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which safe harbor to elect "IRS Notice 2019-07" or "Revenue Procedure 2019-38"?

I have a few residential rental properties in the US. This has been my main source of income for several years now. In order to qualify for QBI deductions, it seems I must choose one of the 2 safe harbors listed on the subject line. Is this correct, or can I still qualify for QBI deductions without electing either one? Even if I don't have to elect a safe harbor to qualify for QBI deductions, is it advantageous to elect one?

If I have to choose one of the 2 safe harbors, then which one is to my advantage? How do I determine which safe harbor is better for me?

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which safe harbor to elect "IRS Notice 2019-07" or "Revenue Procedure 2019-38"?

Rental real estate does not always rise to the level necessary for the qualified business income deduction (QBID). The second notice defines more clearly about the safe harbor on page 5 of Revenue Procedure 2019-38 and helps you to understand the required record keeping to qualify for QBID.

- One option is not better than the other. You see this screen if you indicated that your taxable income might exceed certain levels. Otherwise, the "aggregation" screen does not appear.

- If you do not select either safe harbor methods the next screen will ask you if this is qualified business income. If you select 'Yes' then TurboTax will do the calculations.

- Be sure to select and read the link "More Info about what's considered a qualified business" before you answer.

- See the images below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which safe harbor to elect "IRS Notice 2019-07" or "Revenue Procedure 2019-38"?

No, QBI and DeMinimus Safe Harbor are not related.

Safe harbor gives you the opportunity to expense less expensive assets, rather than depreciating them. The first one is for assets. The second is for improvements.

De Minimis Safe Harbor Election

This election for items $2,500 or less is called the De Minimis Safe Harbor Election. This election is an option you can take each year that lets you write off items $2,500 or less as expenses instead of assets. Expenses typically reduce your income by a larger amount than depreciating an asset over multiple years does. This means you could get a bigger refund.

If you decide to take this option, a form called De Minimis Safe Harbor Election will show up in your tax return. This election will apply to all your businesses, rental properties or farms.

Here are the rules you need to meet to take this election:

- You don't have an applicable financial statement (most people don't).

- You have a consistent process for how you record expenses and assets.

- You record these items as expenses on your books/records.

- The cost of each item as shown on your receipt is $2,500 or less.

Improvements Election

This election is an option you can take each year that lets you write off some building improvements as expenses instead of assets.

Here are the rules you need to meet to take this election:

- Your gross receipts, including all your other income, are $10,000,000 or less.

- Your eligible building has an unadjusted basis of $1,000,000 or less.

- The cost of all repairs, maintenance and improvements is less than or equal to the smallest of these limits:

- 2% of the unadjusted basis of your building or

- $10,000

This election for building improvements is called the Safe Harbor Election for Small Taxpayers. If you decide to take this option, a form called Safe Harbor Election for Small Taxpayers will show up in your tax return. This election will apply to all your businesses, rental properties or farms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which safe harbor to elect "IRS Notice 2019-07" or "Revenue Procedure 2019-38"?

Hi ColeenD3,

Thank you for your response.

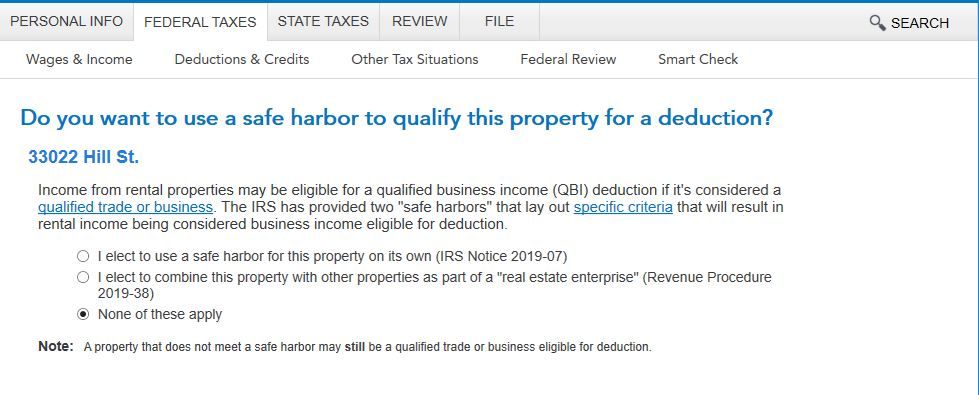

Based on your response, these 2 safe harbor options (i.e. IRS Notice 2019-07 and Revenue Procedure 2019-38) are not applicable to rental property income. If I'm understanding you correctly, then why Turbotax is presenting me with this question to select one of these 2 safe harbor options after I entered the income and expenses for my rental property? Does that mean I should select "None of these apply" for this question? Please see below for the page I am talking about:

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which safe harbor to elect "IRS Notice 2019-07" or "Revenue Procedure 2019-38"?

The safe harbors mention in ColeenD3's response refer to taking an expense for a purchase for a rental property rather than depreciating it as an asset over several years.

You are referring to the "safe harbor" in treating rental property as a business in order to qualify for the Qualified Business Deduction (QBI).

Under the safe harbor, a “rental real estate enterprise” is treated as a trade or business for purposes of Sec. 199A if at least 250 hours of services are performed each tax year with respect to the enterprise.

The choices presented in the screen you submitted are:

- Do you want to elect the Safe Harbor for just the one property?

- Do you want to elect the Safe Harbor for all your properties together (a "rental real estate enterprise")?

- Don't elect and forgo the QBI deduction.

If you meet the qualifications for your rental properties, I would think you would select the second option on the screen and include the income from all your properties for the QBI credit.

In order for the rental income to be considered QBI, each rental real estate enterprise (a rental property or group of similar rental properties, including K-1 rental income) must satisfy these requirements:

- Each enterprise maintains its own books and records to track income and expenses;

- At least 250 hours of rental services are performed per year per enterprise; and

- Contemporaneous records of services performed are kept which includes who performed the service, description of service, the date of the service, and how long it took (who, what, when, and how long).

Please see these TurboTax Help articles for additional information:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which safe harbor to elect "IRS Notice 2019-07" or "Revenue Procedure 2019-38"?

Hi Irene2805,

Thank you for your response. This is now making sense!

The remaining question is this: Assuming I meet the criteria for each rental income to be considered QBI, why is the the 2nd option presented in the screen shot I submitted better than the 1st option? In other words, why is treating all the rental properties as one enterprise better for me than treating each one individually? Is there a difference on QBI deductions allowed?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which safe harbor to elect "IRS Notice 2019-07" or "Revenue Procedure 2019-38"?

Does anyone know the answer to these questions?

1) Why is option 2 (aggregate all properties) better than option 1 (each individual property) for me?

2) I noticed that if I choose any of these 2 safe harbor options, I cannot e-file and must send paper copy. What happens if I do not elect any of these 2 safe harbors and simply allow the program to calculate the QBI deductions.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which safe harbor to elect "IRS Notice 2019-07" or "Revenue Procedure 2019-38"?

Rental real estate does not always rise to the level necessary for the qualified business income deduction (QBID). The second notice defines more clearly about the safe harbor on page 5 of Revenue Procedure 2019-38 and helps you to understand the required record keeping to qualify for QBID.

- One option is not better than the other. You see this screen if you indicated that your taxable income might exceed certain levels. Otherwise, the "aggregation" screen does not appear.

- If you do not select either safe harbor methods the next screen will ask you if this is qualified business income. If you select 'Yes' then TurboTax will do the calculations.

- Be sure to select and read the link "More Info about what's considered a qualified business" before you answer.

- See the images below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which safe harbor to elect "IRS Notice 2019-07" or "Revenue Procedure 2019-38"?

The reason to aggregate, as I understand it, is to ensure you meet the 250 hour threshold. That may be hard to meet for each property individually, but if you aggregate, you only have to meet 250 hours TOTAL.

If you choose to take the QBI deduction for rentals without the safe harbor, it appears that you could possibly be held to higher standards to qualify at a business or trade. This could end up with the deduction being disallowed.

The really ridiculous thing about this is the rationale TT keeps using to stop us from efiling. They say you have to manually sign a declaration that you meet the terms of the safe harbor. THAT IS NOT TRUE! Read the irs reg (www.irs.gov/pub/irs-drop/rp-19-38.pdf). It says NOTHING about the statement being manually signed.

I've been fighting this issue for over a month. TT is not helpful at all on this. Printing and mailing is not an acceptable option. I've been trying to determine which of the other software providers can handle this and efile. As soon as I do, I'll be an ex-TurboTax customer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which safe harbor to elect "IRS Notice 2019-07" or "Revenue Procedure 2019-38"?

Did you find a software that allows efile? Having to print seems ridiculous.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which safe harbor to elect "IRS Notice 2019-07" or "Revenue Procedure 2019-38"?

Tax Slayer allows you to print, sign then upload the safe harbor statement. 20+ years using turbotax and this has now got me to go!

Still have questions?

Make a post