- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Where do I enter fellowship income when a 1099 misc was not issued in TT desktop?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter fellowship income when a 1099 misc was not issued in TT desktop?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter fellowship income when a 1099 misc was not issued in TT desktop?

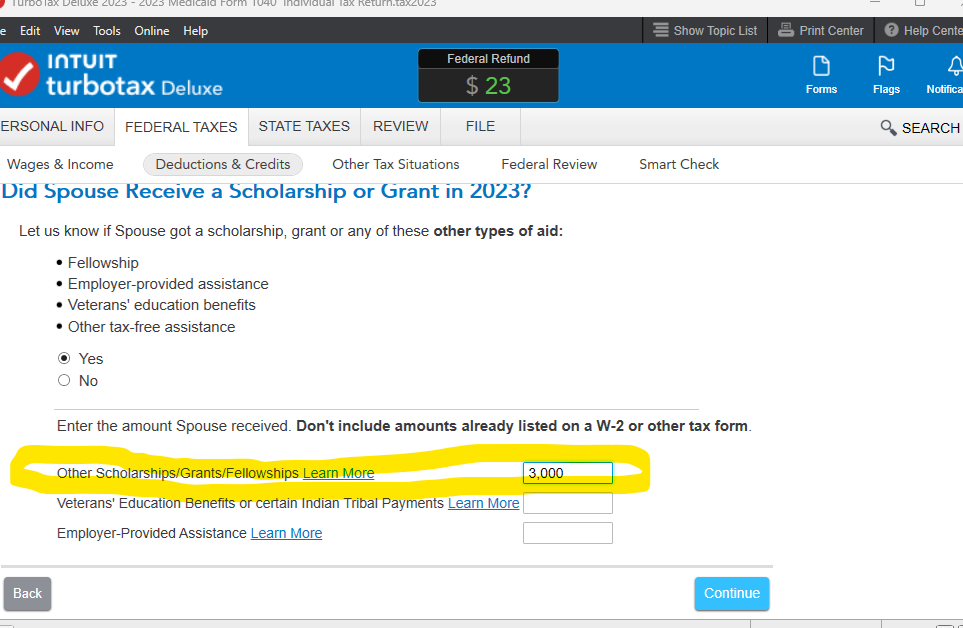

You can enter the amount of the fellowship by using the Education Section under Deductions & Credits

Go To-

Deductions & Credits

Education

Expenses and Scholarships (Form 1098-T) START

Go through the Education interview, it will ask for school information and expenses first, but finally you will land on the screen to enter the Fellowship.

This will report the scholarship on Schedule 1 line 8r

“ certain non-tuition fellowship and stipend payments not reported to you on Form W-2 are treated as taxable compensation “…..

“These include amounts paid to you to aid you in the pursuit of graduate or postdoctoral study and included in your gross income under the rules discussed in this chapter. Taxable amounts not reported to you on Form W-2 are generally included in gross income as discussed later under Reporting Scholarships and Fellowship Grants.”…

“ Include any taxable amount not reported to you in box 1 of Form W-2 on Schedule 1 (Form 1040), line 8r.”

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Danielvaneker93

New Member

ilenearg

Level 2

trust812

Level 4

pchicke

Returning Member

Tangerinedream88

New Member