- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: When I enter the reason for the 1099-NEC (lawsuit settlement) and then continue to the next page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter the reason for the 1099-NEC (lawsuit settlement) and then continue to the next page

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter the reason for the 1099-NEC (lawsuit settlement) and then continue to the next page

If an error continues to populate, it is important that you answer the questions that follow the entry screen for the 1099-MISC to have your settlement flow to your tax return. If answered correctly, this income will flow to Other Income.

Please follow the instructions below:

- Open or continue your return, if you're not already in it.

- Search for 1099-misc and select the Jump-to link.

- Edit your 1099-MISC.

- Continue past the amounts already entered.

- Describe the reason for this 1099-MISC.

- Answer This Money Was From a Lawsuit Settlement on the screen Does one of these uncommon situations apply?

- Answer No, it was not back wages for the next question.

- Answer No for the question Did you have another 1099-MISC?

- Your 1099-MISC will flow to Other Income.

Next, please make sure to delete any Schedule C or associated self-employment forms in your return.

- Search for Schedule C with the magnifying glass tool on the top of the page.

- Select the Jump to Schedule C link in the search results.

- Select No to the question Did you have any self-employment income or expenses?

- Click on Tools.

- Click on Delete a Form.

- Scroll down to your forms and look for Schedule C and any self-employment forms (such as Schedule SE) you need to remove and click Delete.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter the reason for the 1099-NEC (lawsuit settlement) and then continue to the next page

This response has nothing to do with with 1099-NEC form. I have the same issue this year (2023) and have answered all of the questions and still get the same Missing Info notice. If I don't modify the information it will delete the form. There is nothing to tell me what is missing and I have answered everything that it is asking for. What next?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter the reason for the 1099-NEC (lawsuit settlement) and then continue to the next page

Did you enter the Payor ID in your 1099-NEC entry? Did you answer Yes or No to the question 'Was the lawsuit settlement for back wages?'.

Since we can't see your return in this forum, where are you seeing the 'Missing Info' notice? If it displays it on the Income Topics page, it's just a display issue and won't affect your return. If it's in the Federal Review, the area of missing info should be highlighted for you to make an entry.

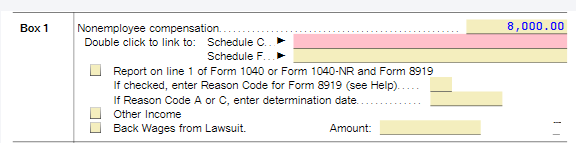

If TurboTax is showing a blank entry for Schedule C, you can check the box for 'Other Income' if your settlement did not include back wages.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter the reason for the 1099-NEC (lawsuit settlement) and then continue to the next page

I went back and used lawsuit settlement and if wage related, entered YES and $0.00 and it took it and listed it as other income. Could there be a bug when Lawsuit settlement is used and related to back wages is checked as NO?

I am going to use this for now but will need to review manually because I am not sure taxes are being calculated correctly now.

I have had problems now the last 2 years and may consider switching from TT. I have been using since TT first came out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter the reason for the 1099-NEC (lawsuit settlement) and then continue to the next page

I want to make sure TT is calculating my taxes for my 1099-NEC. I believe there is a "bug" in this portion of the application.

I have filled out everything properly on the pages. I have a couple of images that I have included. I do not know how to add a screen shot here other than from the camera image above.

I tried to enter with wages yes and $0.00 as wages but it calculates as ordinary income at my current rate of 24% vs. 15.3 that should be calculated with the 1099-NEC and not part of wages.

I have the screen shots of how I input the information, which to me all looks correct. I do not have a Schedule C that was created so no place to check on that.

Please advise.

Thanks!

[PII Removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter the reason for the 1099-NEC (lawsuit settlement) and then continue to the next page

The fact that the lawsuit or legal award was reported on Form 1099-NEC may or may not be correct. The real question is whether this is to represent money that was earned or from work (you indicated it was not on your screens shown).

- If the award was for work performed than it would be reported on Schedule C and self employment tax would be included with your personal income tax (Schedule C would be part of your return and this form is associated with that income).

- If the award was not for work, but for other reasons, then it would not be subject to self employment tax, only your personal income tax. In this situation it should have been reported on Form 1099-MISC. You can report it as follows (delete the 1099-NEC entry, keep the form and the lawsuit settlement documents).

- Go to the Wages and Income section of TurboTax

- Scroll to Less Common Income > Select Miscellaneous Income, 1099-A, 1099-C

- Select Other reportable Income > Enter a description (Legal Settlement) and the amount

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter the reason for the 1099-NEC (lawsuit settlement) and then continue to the next page

I will try this later today. I am out at the moment. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter the reason for the 1099-NEC (lawsuit settlement) and then continue to the next page

I did this as you said and the $ amount for taxes owed is still the same. I also worked it as 1099-MISC and got the same results. Is this how it should be for a lawsuit settlement? I was under the impression that the tax on this should be 15.3% instead of the current personal income tax.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter the reason for the 1099-NEC (lawsuit settlement) and then continue to the next page

@DianeW777 See previous post,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter the reason for the 1099-NEC (lawsuit settlement) and then continue to the next page

If the amount is added to your current income, it will be taxed at your regular tax rate. As long as you do not see any tax on line 23 of your 1040 or Schedule 2, Line 4, then you are not paying self employment tax on it (15.3%), which would be an additional tax if it was considered as self employment income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter the reason for the 1099-NEC (lawsuit settlement) and then continue to the next page

Thank you. I do not see anything on line 23 other than a small amount which I will have to see why that is there, Also when I do this under your suggested method, I no longer have PA State taxes due on this. Is that correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter the reason for the 1099-NEC (lawsuit settlement) and then continue to the next page

For Pennsylvania (PA) it depends on the type of settlement: Delay damages received in connection with a court judgment or settlement is taxable compensation. Federal-taxable punitive damages received for personal physical injury or physical sickness, whether received by suit or by settlement is not taxable compensation.

- PA Taxable and Nontaxable Legal Settlements (search settlement)

Check your PA return for this income and watch for a place to add it under compensation. Since it is taxable for federal it should show up on the PA return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter the reason for the 1099-NEC (lawsuit settlement) and then continue to the next page

I’m having the same problem received a 1099 nec for a settlement but it comes up missing info

I do not own a business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter the reason for the 1099-NEC (lawsuit settlement) and then continue to the next page

Form 1099-NEC is generally intended to be used for nonemployee compensation that is earned by a contractor or other self-employed individual. If you received a payment that was reported on a Form 1099-NEC, but you didn't receive the income for work as self-employed on an ongoing basis, you can enter it in TurboTax and identify the reason for the payment:

- In Wages and Income, select Other Common Income and See More

- Select Form 1099-NEC

- Answer the questions that appear, and enter a description of the reason for the payment

- At the screen, "Does one of these uncommon situations apply?", select "This was a lawsuit settlement" if that is the best choice, or enter that it was from a one-time activity (so that it doesn't incorrectly get identified as self-employment income).

- Answer the question regarding whether any of the payment was for back wages

See this thread for another discussion of this topic.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

candycrush88

New Member

unclesamiamnot

New Member

VJR-M

Level 1

Tdevs

Level 1

vitenite1

Level 1