- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: TurboTax Premier shows $29,200 for the 2023 MFJ Standard Deduction instead of $27,700

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

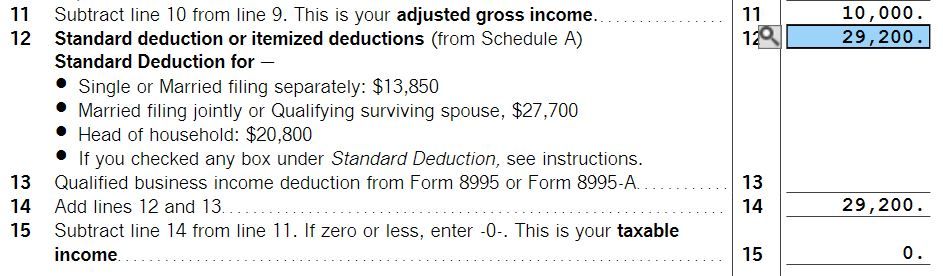

TurboTax Premier shows $29,200 for the 2023 MFJ Standard Deduction instead of $27,700

I'm using TTAX Premier on Windows 10, Version [phone number removed]

It's showing $29,200 for the MFJ 2023 Standard Deduction instead of $27,700

My Schedule A shows $0 for itemized deductions on Line 17

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier shows $29,200 for the 2023 MFJ Standard Deduction instead of $27,700

You are filing as Married Filing Jointly and one of you is age 65 or older so an additional $1,500 is added to your Standard Deduction.

Standard deductions for 2023

Single - $13,850 add $1,850 if age 65 or older

Married Filing Separately - $13,850 add $1,500 if age 65 or older

Married Filing Jointly - $27,700 add $1,500 for each spouse age 65 or older

Head of Household - $20,800 add $1,850 if age 65 or older

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier shows $29,200 for the 2023 MFJ Standard Deduction instead of $27,700

Is one of you age 65 or older?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier shows $29,200 for the 2023 MFJ Standard Deduction instead of $27,700

Not sure about his client, but I'm getting the $29,200 as well. Both TP and SP are under 65. This does not happen on every return. My sister also uses the software in her business, and she has the same issue. I've tried to change it, but it won't let me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier shows $29,200 for the 2023 MFJ Standard Deduction instead of $27,700

@Bks2089 wrote:

Not sure about his client, but I'm getting the $29,200 as well. Both TP and SP are under 65. This does not happen on every return. My sister also uses the software in her business, and she has the same issue. I've tried to change it, but it won't let me.

Check the dates of birth to make sure that they are correct for being under the age of 65. DOB format is MM/DD/YYYY

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier shows $29,200 for the 2023 MFJ Standard Deduction instead of $27,700

Thank you! I had the same question and began to panic as I had already filed my federal forms. But, yes, my husband turned 65 in 2023 so question answered!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

msniffen10

New Member

ibaiden

New Member

Sarmis

New Member

dafeliks

New Member

abuzooz-zee87

New Member