- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: TT Premier: Federal error check fails due to K-1 Line 20 with ZERO value (recommended by TT S...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Premier: Federal error check fails due to K-1 Line 20 with ZERO value (recommended by TT Support)

Hello,

I created a K-1 using TT Business for my wife's company and imported it into TT Premier. At first, I called TT Support because the K-1 was created with a Z* STMT on Line 20 and TT Premiere didn't allow characters to be entered for that value. At the end of the support call on 3/13, I was told to enter 0 on Line 20 (Code V) and then TT Premier asked me questions about QBI. Life is good...

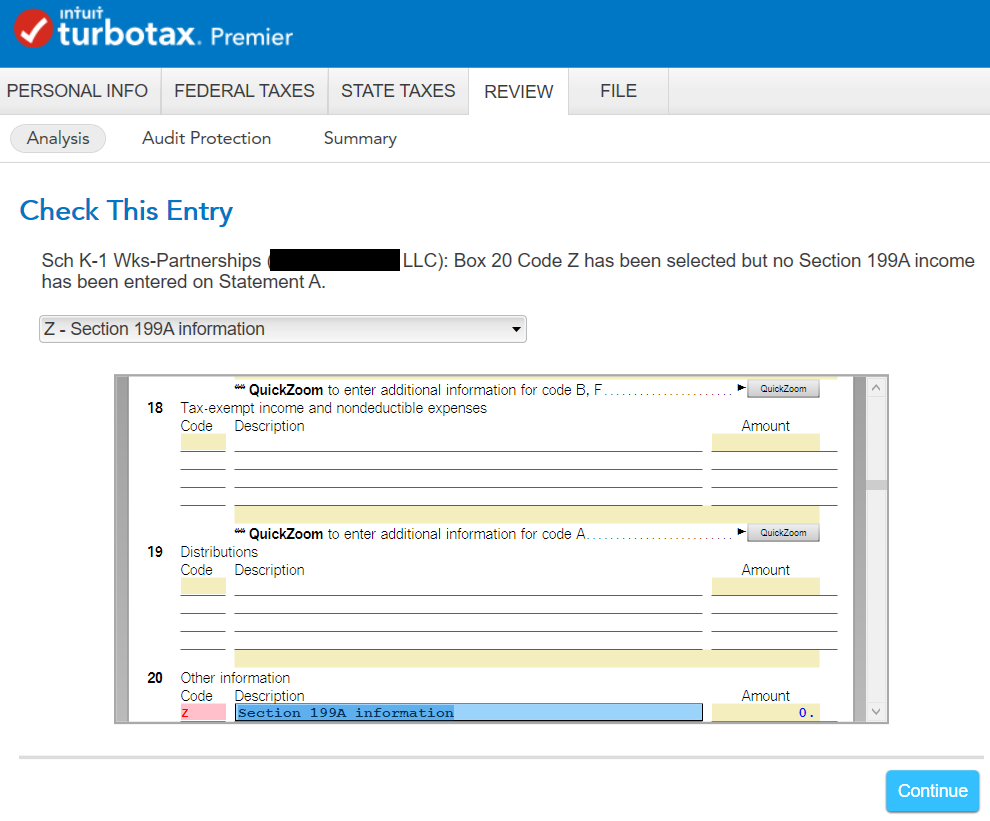

Now I when I am about to file my taxes, TT Premier keeps flagging "Box 20 Code Z has been selected but no Section 199A has been entered in Statement A". But nowhere in the K-1 I got from TT Business there is a value to 199A - only this: "Z - Section 199A information" in the list of possible field codes.

Should I ignore this error check message?

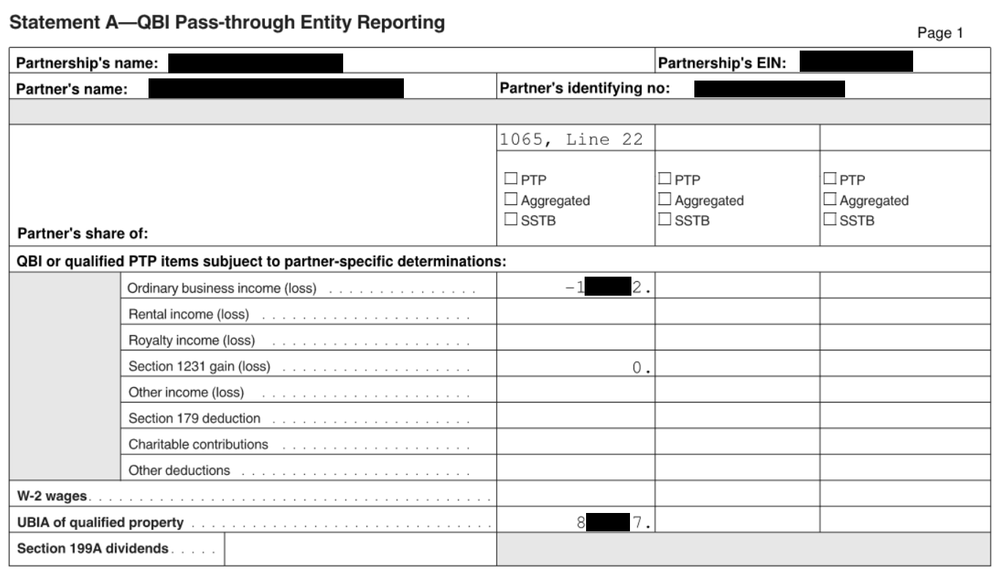

Screenshots:

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Premier: Federal error check fails due to K-1 Line 20 with ZERO value (recommended by TT Support)

Try to delete the zero from the code Z box, and leave it blank. Then Continue through the K-1 entry screens and check that the amounts from your code Z statement are entered correctly.

Also, if you haven't updated your TurboTax Premier Download/CD version lately, in the top menu click Online>>Check for Updates.

If the error still persists, go to Forms mode (icon top right in blue bar) find the partnership K-1 and scroll down more than half way to find the Section D1 Qualified Business Deduction - Statement A Information. Check that area to find your code Z information in the boxes, and look for any "red" shading that would indicate an error. Note that you can also see your box 20 "zero" in Forms mode, and delete that zero. The box should no longer be shaded red after you delete the zero.

If these procedures do not clear the error, you may have to delete the K-1 and re-enter it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Premier: Federal error check fails due to K-1 Line 20 with ZERO value (recommended by TT Support)

Try to delete the zero from the code Z box, and leave it blank. Then Continue through the K-1 entry screens and check that the amounts from your code Z statement are entered correctly.

Also, if you haven't updated your TurboTax Premier Download/CD version lately, in the top menu click Online>>Check for Updates.

If the error still persists, go to Forms mode (icon top right in blue bar) find the partnership K-1 and scroll down more than half way to find the Section D1 Qualified Business Deduction - Statement A Information. Check that area to find your code Z information in the boxes, and look for any "red" shading that would indicate an error. Note that you can also see your box 20 "zero" in Forms mode, and delete that zero. The box should no longer be shaded red after you delete the zero.

If these procedures do not clear the error, you may have to delete the K-1 and re-enter it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Premier: Federal error check fails due to K-1 Line 20 with ZERO value (recommended by TT Support)

Thanks, that worked. I also had forgotten to enter the amount related to "ordinary business income (loss)" from the K-1/Statement A.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

mrshankly01

New Member

cparke3

Level 4

TaxPay3r

Level 2

SL_276651

Level 1

chatenever

New Member