- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: That is because you have to enter them yourself. Did you...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated taxes paid

Please let me know why my estimated taxes that were paid were not on my 2016 tax return.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated taxes paid

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated taxes paid

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated taxes paid

Where can I enter the Estimated Tax paid?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated taxes paid

Where on the return do I enter my estimated tax paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated taxes paid

@jlbrak3 wrote:

Where can I enter the Estimated Tax paid?

To enter, edit or delete estimated taxes paid (Federal, State, Local) -

Click on Federal Taxes (Personal using Home and Business)

Click on Deductions and Credits

Click on I'll choose what I work on (if shown)

Scroll down to Estimates and Other Taxes Paid

On Estimates, click on the start or update button

Or enter estimates paid in the Search box located in the upper right of the online program screen. Click on Jump to estimates paid

Or click on Tax Tools on the left side of the screen.

Click on Tools

Click on Topic Search

Type in estimated tax payments, click on GO

Federal estimated taxes paid are entered on Form 1040 Schedule 3 Line 8. The totals for Schedule 3 flow to Form 1040 Line 18d

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated taxes paid

couldn't find it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated taxes paid

If you are using TurboTax Online:

- Click on Tax Tools on the left side of the screen

- Click on Tools

- Click on Topic Search

- Type in estimated tax payments, click on Go

If you are using the Desktop/CD version of TurboTax, use this method:

If you made estimated tax payments in 2020 towards your federal, state, or local taxes, enter them in the Estimated and Other Income Taxes Paid section.

- With your return open, search for the term estimated tax payments.

- Select the Jump to link.

- Choose Start next to the type of estimated tax payment you'd like to enter.

- Enter the amount of estimated tax you paid at each of the quarterly due dates.

- If you paid 2019 estimated taxes in 2020, you'll enter just one amount for each state of locality.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated taxes paid

@john proffitt wrote:

couldn't find it

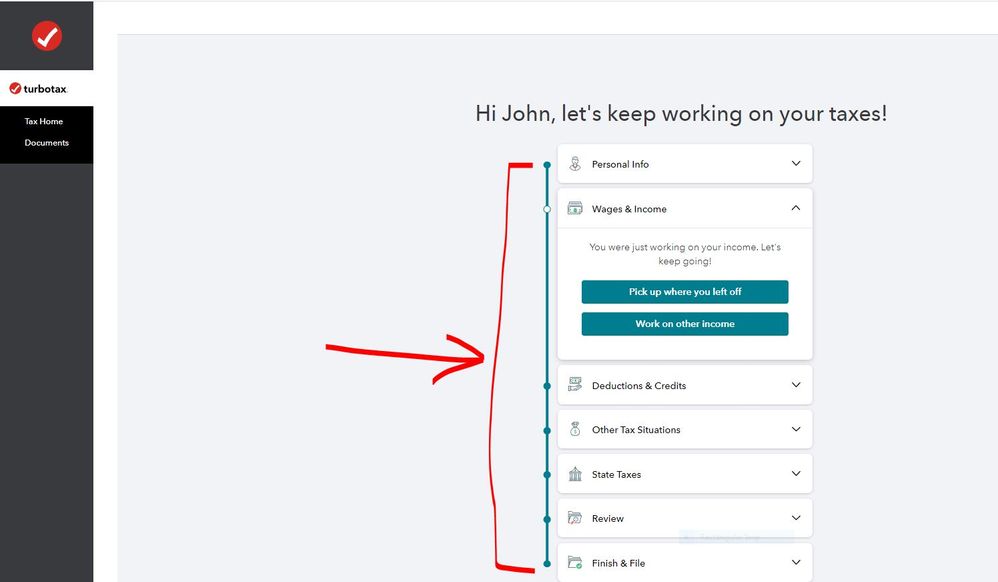

Sign onto your online account. Click one of the boxes on the Tax Home web page, if shown. The links and Search box are only available on your 2020 tax return.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

mag1949

Level 1

ojmn

Returning Member

jkpruitt-0332

New Member

NYC89

New Member

mag1949

Level 1