- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Stimulus Payment impacts refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Payment impacts refund

I am using TT 2020 Premier Desktop to do an estimated return.

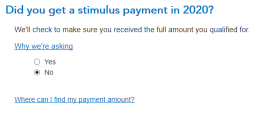

I came across a section that asks about the stimulus payment.

If you answer "yes" it wants you to enter an amount.

Example 2020 refund 100.00

I entered 12.00 which was the amount that was deposited into my account.

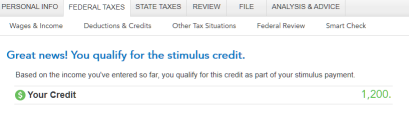

The next screen shows Great News "Your Credit" 1200.00

But my 2020 refund drops to 88.00

I thought there was no impact on refund or amount owed.

Am I missing something here?

Is this portion of TT not complete yet?

Is this amount what preparer has to pay back?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Payment impacts refund

it's a little hard to follow your question with the screen shot provided, but let me take a shot at it.

Turbo Tax begins presuming you did NOT receive your stimulus, so the meter (and Line 30 of Form 1040) assumes a $1200 additional refund due. Once you fill out the Stimulus section, it will adjust both Line 30 and the Meter. Since you put in your stimulus received to date as $12.00, it will reduce the refund by the same amount.

In other words, when you begin your return and ONLY complete the MyInfo section, the meter will immediately show a $1200 refund - because it knows you were due that much in stimulus and it is waiting for you to enter how much stimulus you actually received, which will reduce that estimated refund.

is that the issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Payment impacts refund

it's a little hard to follow your question with the screen shot provided, but let me take a shot at it.

Turbo Tax begins presuming you did NOT receive your stimulus, so the meter (and Line 30 of Form 1040) assumes a $1200 additional refund due. Once you fill out the Stimulus section, it will adjust both Line 30 and the Meter. Since you put in your stimulus received to date as $12.00, it will reduce the refund by the same amount.

In other words, when you begin your return and ONLY complete the MyInfo section, the meter will immediately show a $1200 refund - because it knows you were due that much in stimulus and it is waiting for you to enter how much stimulus you actually received, which will reduce that estimated refund.

is that the issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Payment impacts refund

I think I got what you are saying.

The 12.00 is the actual amount I received. (FYI)

I just looked at the 1040-SR lines.

Now I understand it. I think.

Thanks

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jennabaldwin02

New Member

adamleev

New Member

kwenholz-gmail-c

New Member

sarahannleamy

New Member

skatedogg132

Returning Member