- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: QBI Entry from K1- 1041 ('STMT' for value)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI Entry from K1- 1041 ('STMT' for value)

I am entering a K1 (Form 1041) from an Inheritance/Estate for a personal return.

The K-1 states that the QBI needs to be calculated, so there is 'STMT' instead of a value. ABC Investors is a partnership that invests in real estate.

Please explain the correct way to calculate and enter QBI based on the below information...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI Entry from K1- 1041 ('STMT' for value)

You have four entries that need to be made in Box 14 (I Code) in TurboTax.

The program will do the calculations for you; all you have to do is select the dropdown codes and enter each figure (see screenshot).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI Entry from K1- 1041 ('STMT' for value)

What about the 5th item - Ordinary Income? See the 5th item below the 4 items you showed in my original image.

Also, how does TurboTax figure out if it needs to consolidate for QBI or not?

How would I compare consolidated QBI vs not?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI Entry from K1- 1041 ('STMT' for value)

The drop down items you referenced are not available in turbotax home and Business 2019 for Mac.

IA, IB, and IC do not exist. I only have I) Section 199A Information

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI Entry from K1- 1041 ('STMT' for value)

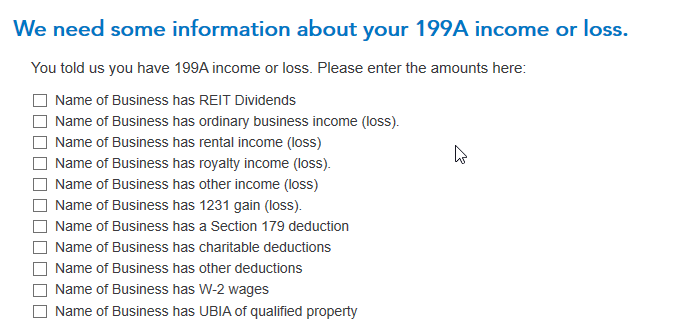

The K-1 entry has changed since 2018. For 2019, when you enter your K-1 into TurboTax, on the screen with box 14 you enter your code I and code Z, but you don't need to enter any amounts on that screen. Continue on through the interview, and after a couple of screens asking about your qualified business income, you'll come to the screen "We need some information about your 199A income or loss" (see screenshot later in this post).

Your Section 199A Statement amounts will go on that screen. When you select a line on that screen, the boxes will "open up" to enter both your Section 199A amounts. Note that the "Unadjusted basis" number you have goes on the UBIA of qualified property line.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here is the screenshot for the "We need some information about your 199A income or loss" screen where you enter the information from your K-1:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

alicia-bmgl-herrick

New Member

stephen-eschner

New Member

bb66

Level 1

sierrahiker

Level 2

SydRab5726

New Member