- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: New Exclusion of up to $10,200 of Unemployment Compensation

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

After 15 years of paying for turbotax, it will be my last they are so focused on their FRE FREE FREE campaign they are ignoring those that pay. Well maybe then i will stop funding them with my purchase each year. I will be switching to taxact next year. so turbotax since you decided to ignore those that paid for software then goodbye. your lack of communication and stupid update that just says wait is unacceptable. if you communcated properly and set expectations i would have been fine. instead you hide CHOW

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

@kategordon wrote:

Mine is online and Turbo Tax says my adjustment has been already made that Im eligible and amts have been changed...yet they have not been changed...I wonder if this is an IT glich???!

Did you enter Unemployment Compensation in the correct section of the program?

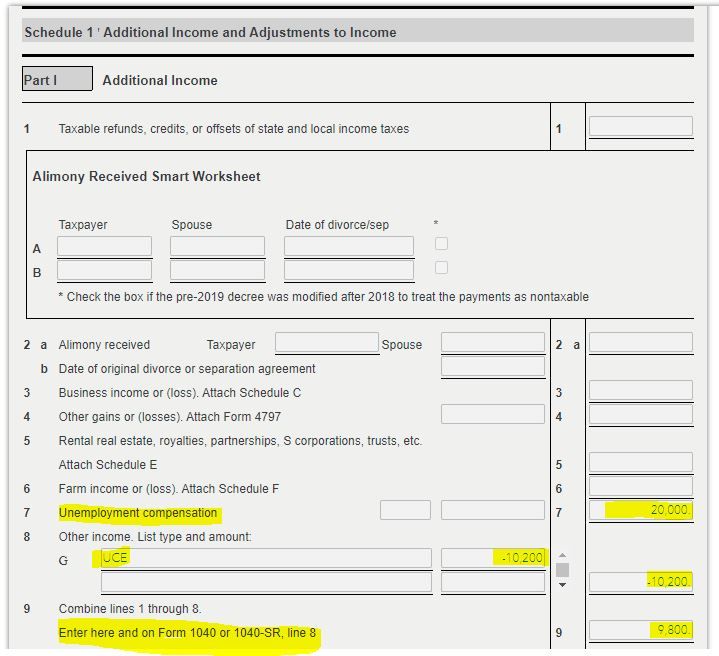

Look at your tax return on Schedule 1 Line 7 for the UC that was entered. On Line 8 will be the exclusion amount entered as a negative number.

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

Im certainly going to give this a try. Thank you very much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

I've filed my taxes on March 5th before the bill was passed and owed money to thr IRS due to the unemployment bemefits I've received. Do i need to amend my tax return once Turbotax implements this deduction? I assume I'd be due a refund if I'd be taxed less on my unemployment benefits, thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

@Jakemcsally wrote:

I've filed my taxes on March 5th before the bill was passed and owed money to thr IRS due to the unemployment bemefits I've received. Do i need to amend my tax return once Turbotax implements this deduction? I assume I'd be due a refund if I'd be taxed less on my unemployment benefits, thanks.

The IRS requests that you do not file an amended tax return for the unemployment compensation exclusion at this time.

IRS website - https://www.irs.gov/newsroom/irs-statement-american-rescue-plan-act-of-2021

For those who received unemployment benefits last year and have already filed their 2020 tax return, the IRS emphasizes they should not file an amended return at this time, until the IRS issues additional guidance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

The IRS Commissioner testified before Congress on Thursday and said that those who filed prior to the new unemployment exemption law will get refunds automatically without the need to file an amended return.

See for example, https://www.accountingtoday.com/articles/irs-to-automatically-process-refunds-on-jobless-benefit-pay...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

Is this the proper way to handle the $10,200. exemption or is turbotax going to come out with update to handle?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

Happy to relay that TurboTax has implemented the changes. (I'm using IRS freefile version) I'd entered my Unemployment income prior to the updates, and the system now automatically handles the $1200 exclusion. (You still enter your Form 1099-G issued by your state -- your UI -- then the reduction is calculated separately, as others noted above.) Hope this helps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

They have not implemented the changes in their digital software, it remains unchanged. Cannot file, though I have already paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

I've been using the Home and Business version since at least the late 90's. For the most part I've been pretty satisfied. But, I'm really scratching my head over this one.

I'm not sure if this is just another tone deaf corporation that can't keep their Paying customers updated.

To update a free version before taking care of PAID costumers is simply amazing!

I will surely be taking a hard look at what else is available next year before simply buying this again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

Well, yesterday I was grumbling about those having a professional version of TT having the updates before the "free file" versions. Now today, shoe's on the other foot, with those having apparent paid versions grumbling at reports that those of us using the free file version somehow getting preferential treatment. Hmmm..... Rather than jumping to more..... , might be better to try again (after logging out), or just call Turbotax help for updates. (Did see alerts that there are still pending updates to various state programs afoot, and that too could be holding up some updates. Then too there could be additional tax issues affecting the more specialized tax programs....)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

Yes me too !

I have been using TurboTax Premier for long time and with this lack of support updating and the error I experience 1603 last week I’m definitely disappointed .

All im saying TurboTax Premier(investors) is more expensive then HRBlock Deluxe (for investors) and HRBlock more efficient!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

@havai To paraphrase Abraham Lincoln -

“You can satisfy all the people some of the time and some of the people all the time, but you cannot satisfy all the people all the time.”

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

Have no idea where to post this, yet this might well affect a lot of TurboTax users, if you are one of the 9.2 MILLION filers of 2019 returns that are still not processed (according to the IRS itself, as of March 6th), you may be unable to have your 2020 returns accepted if you file electronically and use your submitted 2019 return AGI. In such cases, the IRS directs that you submit an AGI for 2019 as "0" when you get to the verification steps.

Happy to relay in my case, my paper return (from over 4 months ago) has yet to be processed, (not even in the system yet) and so I entered "0" for agi for 2019 -- and happy to report it today worked (so far - return accepted). Have not seen this issue covered as yet anywhere else in TurboTax help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

Turbo Tax,

Please just post an updated ETA for the update for $10,200 unemployment exemption to be available for your desktop CD /DVD version of Home and Business.

You would get a lot less complaints if you would keep your paying customers informed on the progress.

Communication is the key!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

eschneck

New Member

pennylaramore1961

New Member

lc3035

New Member

elliott-mercatus

New Member

IFoxHoleI

Level 2