- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: My W2 is incorrect and the company no longer exists. What should I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My W2 is incorrect and the company no longer exists. What should I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My W2 is incorrect and the company no longer exists. What should I do?

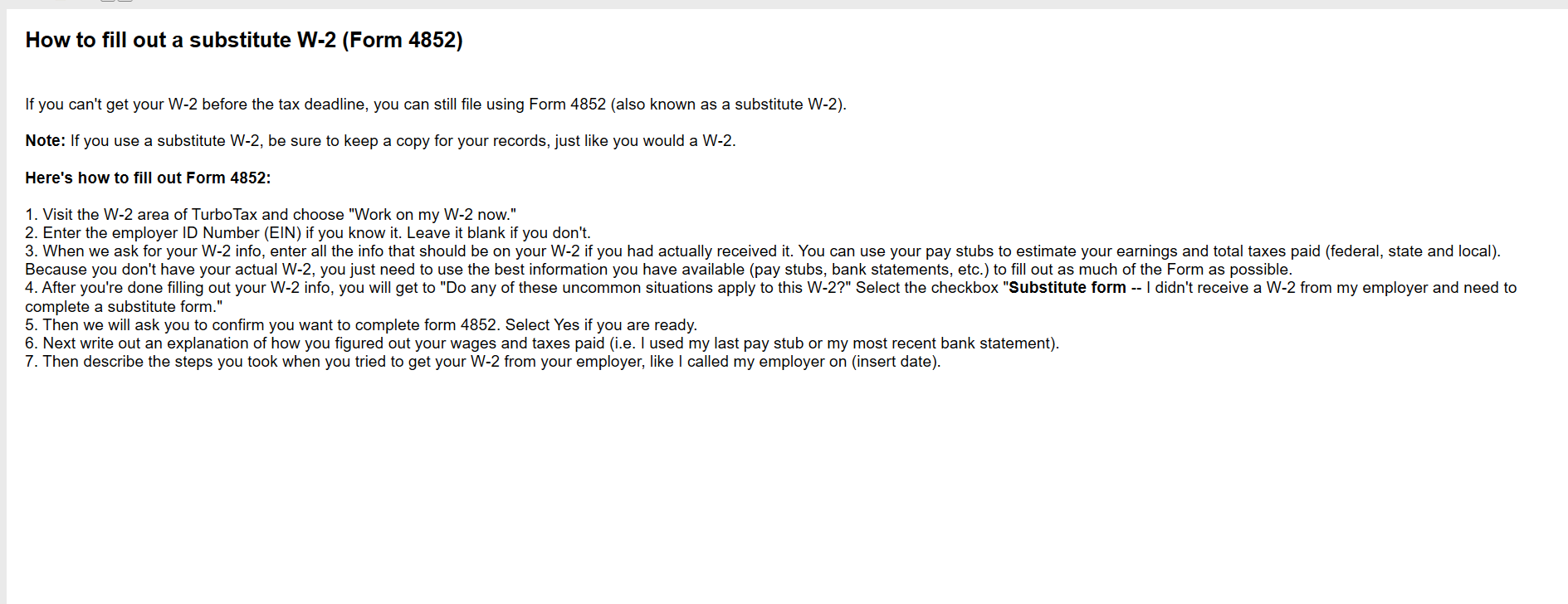

You would need to file a substitute W-2 Form 4852 with an explanation. The IRS requests that you wait until February 14 to prepare this form and file a substitute W-2. You also are supposed to attempt to make an effort to get the form. If the company is out of business, you would need to indicate on your tax forms. When you enter this form in TurboTax, you would enter it as if it is a W-2.

Here are the steps in TurboTax online:

- Sign in to your TurboTax account and select Pick up where you left off

- At the right upper corner, in the search box, type in "w2" and Enter

- Select Jump to w2

- Follow prompts

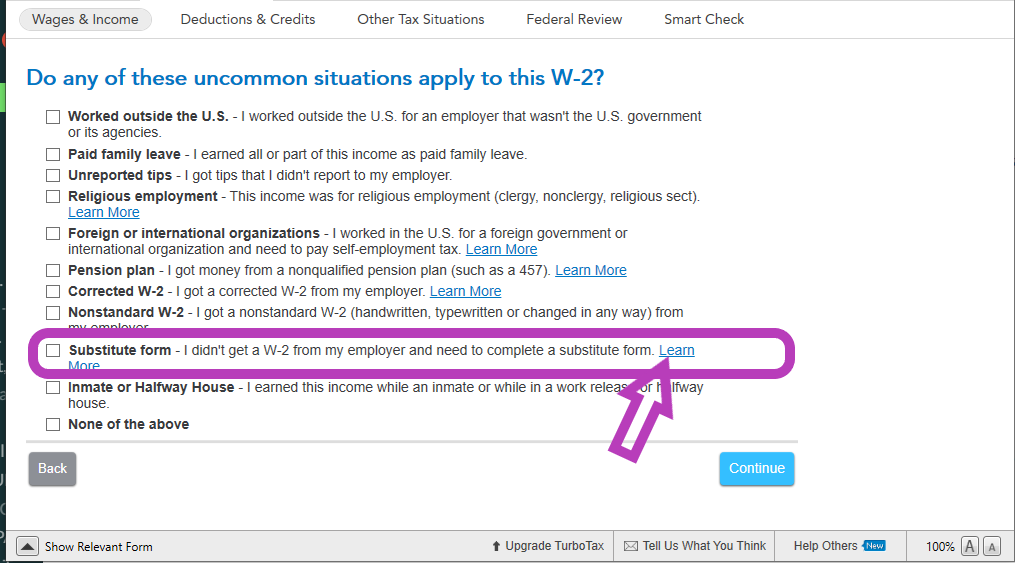

- On-screen Do any of these uncommon situations apply to this W-2?, select Substitute form

- Follow prompts

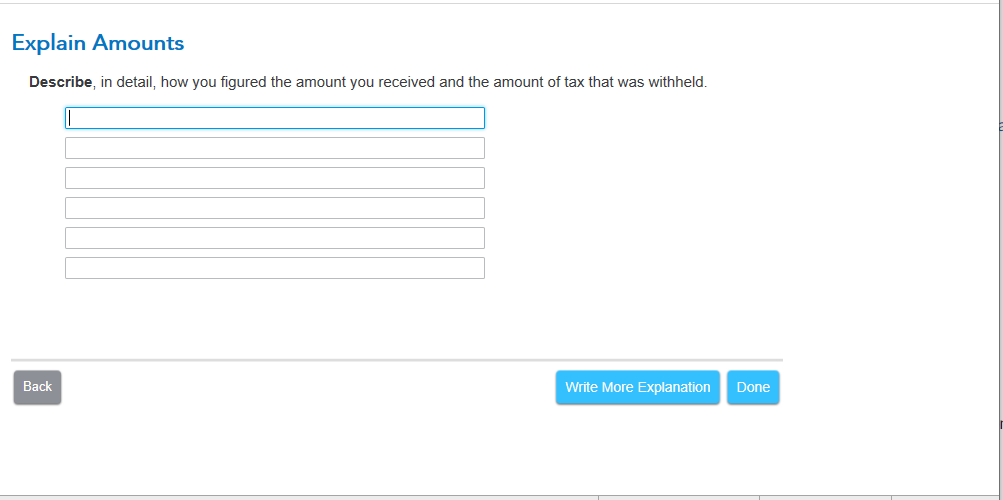

- On-screen, Explain Amounts, provide reasons why you cannot contact your employer.

- See the images below

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My W2 is incorrect and the company no longer exists. What should I do?

You would need to file a substitute W-2 Form 4852 with an explanation. The IRS requests that you wait until February 14 to prepare this form and file a substitute W-2. You also are supposed to attempt to make an effort to get the form. If the company is out of business, you would need to indicate on your tax forms. When you enter this form in TurboTax, you would enter it as if it is a W-2.

Here are the steps in TurboTax online:

- Sign in to your TurboTax account and select Pick up where you left off

- At the right upper corner, in the search box, type in "w2" and Enter

- Select Jump to w2

- Follow prompts

- On-screen Do any of these uncommon situations apply to this W-2?, select Substitute form

- Follow prompts

- On-screen, Explain Amounts, provide reasons why you cannot contact your employer.

- See the images below

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Darirish

New Member

audreyrosemary11

Level 2

audreyrosemary11

Level 2

audreyrosemary11

Level 2

dkshoup

New Member