- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Middle Class Tax Refund

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Middle Class Tax Refund

Just deleted, re-entered and resubmitted . Please work!!!! Keep you posted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Middle Class Tax Refund

Me too first time. And i was going to pay 180 so that's weird. But my wifes cousin is doing it for us free of charge this year so thats a plus

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Middle Class Tax Refund

itll work goodluck!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Middle Class Tax Refund

Did you happen to notice if they took anything out of federal for that California middle class tax refund? Just was curious.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Middle Class Tax Refund

It didn’t. Federal was just accepted now waiting on State.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Middle Class Tax Refund

Geez.. all this work for a refund that isn't even taxed by state or fed lol ok just checking. I removed that 1099 and left it off and am amending it when they allow you to in February. Glad, all worked out for you, I didn't want to cap out on my rejections and end up having to do a paper one. And didn't have faith TurboTax would get their stuff together in time. Seeing how none of their assistants were helpful with the issue. Congrats! One less stress for 2023 for ya!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Middle Class Tax Refund

Both were accepted! Thanks everyone for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Middle Class Tax Refund

@Hs9 rejections dont count on your 5 efiles… its 5 successful efiles not rejections. i had 7 before getting accepted

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Middle Class Tax Refund

Both fed and state accepted on Monday, Jan 30 after 4 rejections previously. Made no changes to 1099 - just resubmitted. My thanks to everyone who commented and kept the rest of us informed of the status and resolution of this issue. Very grateful.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Middle Class Tax Refund

I should add that both fed and state were not taxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Middle Class Tax Refund

So you just re submitted even thought it stated you needed to fix it and it was accepted? I keep getting the middle class error? Did you have to delete the 1099 form and re add it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Middle Class Tax Refund

It appears some deleted, then re-entered the 1099. You might want to try that.

It depends. The following will provide the steps to enter the income for federal and remove it for California (CA) where it is not taxable.

Taxable income

The MCTR payment is not taxable for California state income tax purposes. You do not need to claim the payment as income on your California income tax return. The MCTR payments may be considered federal income.

If you determine it is not taxable on your federal return, then keep the document but remove or delete it from your federal return. If it is taxable on your federal return, the when you get to the CA return you can subtract it out using the steps below.

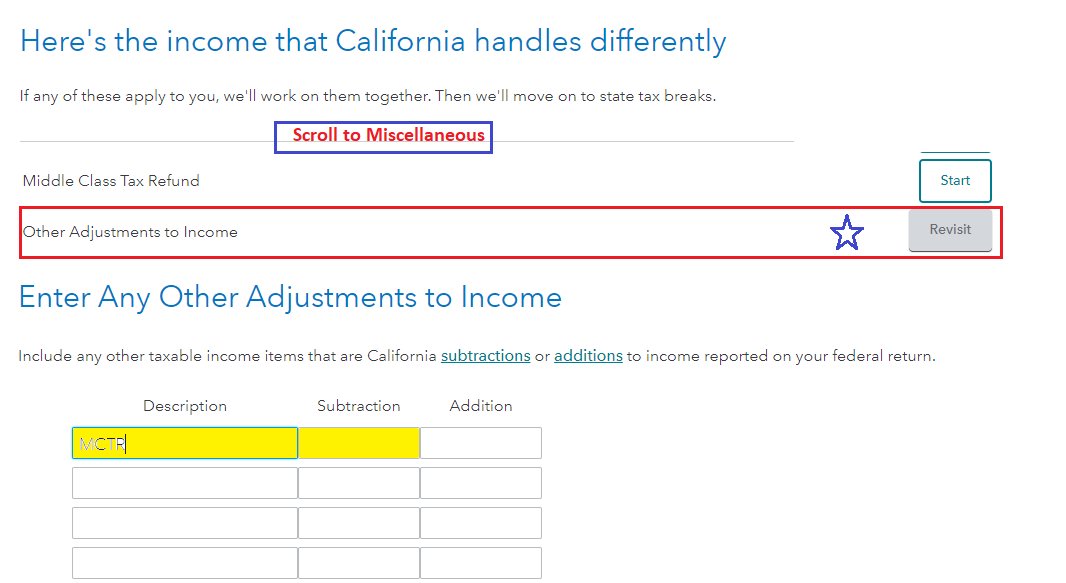

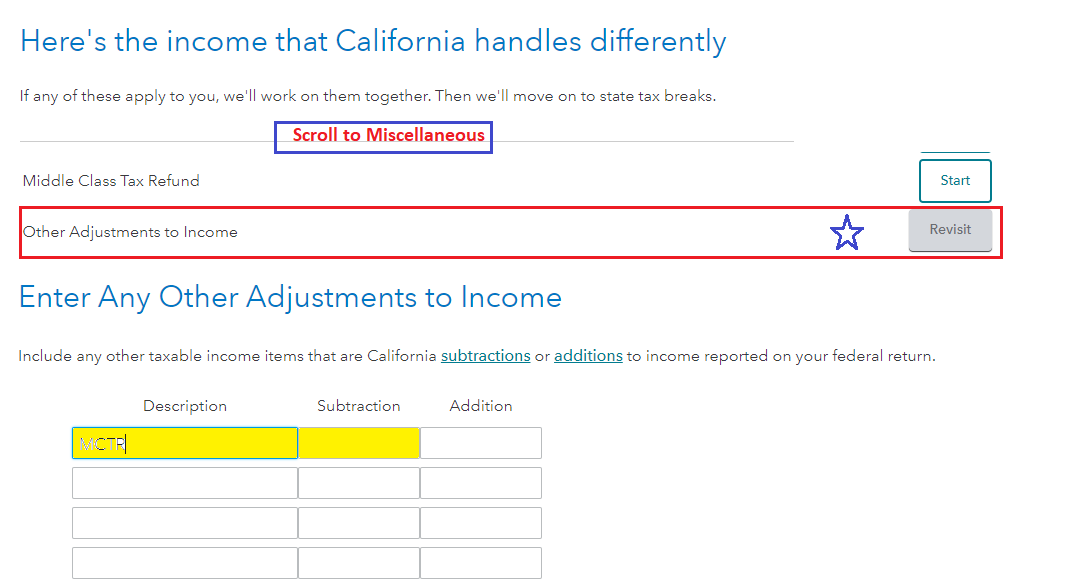

- Complete your CA return until you reach the screen 'Here's the income that CA handles differently'

- Scroll until you see Miscellaneous > continue scrolling to 'Other Adjustments to Income' > Start or Revisit

- Enter your description (MCTR) and enter the amount under the 'Subtraction' column

- Continue to complete your CA return

if you deducted the CA tax on your federal return, as an itemized deduction or as a business expense, then it could be considered taxable income when refunded, if necessary, under the Tax Benefit Rule.

- Tax benefit rule. IRS Publication 525 You must include a recovery in your income in the year you receive it up to the amount by which the deduction or credit you took for the recovered amount reduced your tax in the earlier year. For this purpose, any increase to an amount carried over to the current year that resulted from the deduction or credit is considered to have reduced your tax in the earlier year.

1099-MISC income tax information (CA Update 2022) Individuals who received a California Middle Class Tax Refund (MCTR) of $600 or more will receive a 1099-MISC for this payment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Middle Class Tax Refund

it appears some deleted and then re-entered their 1099. See the information below.

It depends. The following will provide the steps to enter the income for federal and remove it for California (CA) where it is not taxable.

Taxable income

The MCTR payment is not taxable for California state income tax purposes. You do not need to claim the payment as income on your California income tax return. The MCTR payments may be considered federal income.

If you determine it is not taxable on your federal return, then keep the document but remove or delete it from your federal return. If it is taxable on your federal return, the when you get to the CA return you can subtract it out using the steps below.

- Complete your CA return until you reach the screen 'Here's the income that CA handles differently'

- Scroll until you see Miscellaneous > continue scrolling to 'Other Adjustments to Income' > Start or Revisit

- Enter your description (MCTR) and enter the amount under the 'Subtraction' column

- Continue to complete your CA return

if you deducted the CA tax on your federal return, as an itemized deduction or as a business expense, then it could be considered taxable income when refunded, if necessary, under the Tax Benefit Rule.

- Tax benefit rule. IRS Publication 525 You must include a recovery in your income in the year you receive it up to the amount by which the deduction or credit you took for the recovered amount reduced your tax in the earlier year. For this purpose, any increase to an amount carried over to the current year that resulted from the deduction or credit is considered to have reduced your tax in the earlier year.

1099-MISC income tax information (CA Update 2022) Individuals who received a California Middle Class Tax Refund (MCTR) of $600 or more will receive a 1099-MISC for this payment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Middle Class Tax Refund

I am still not seeing the Middle Class Tax Refund question on the TurboTax Online edition. Secondly, both my husband and I are listed on the 1099-Misc. There is no option that shows this refund belongs to the both of us. It makes you select one or the other.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Middle Class Tax Refund

To enter your 1099-Misc for the Middle Class Tax Refund you will select the following:

- Federal

- Wages and Income

- Show More next to Other Common Income

- Start next to the 1099-Misc

- Enter the information from your 1099-Misc

- Continue

- Enter the reason for the 1099-Misc as MCTR

- Then on the next Screen choose This was a California Middle Class Tax Refund

This will exclude it from your taxable income.

For the person, you can enter it as either one of you if both is not showing as this will not affect anything on your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Plenaire

New Member

cassi-f

Level 3

demoll77

Level 2

brewermonica27

New Member

Terry Thompson

Level 2