- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Injured spouse and stimulus payment

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

@Ahriel @No questions are being answered by the supposed tax professionals but when they are receiving payment they talk your ears off🤦🏾♀️

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

@Doubleh914 Here is the petition to sign! It may not work but it’s definitely worth a shot!!

http://chng.it/Rn9MMmfY9X

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

@OlsenTM did you file electronically with your taxes? Or did you send in after you filed? I’m trying to figure out why I haven’t received a letter yet to get my taxes back I filed taxes in February and mailed my form certified mail, text message said it was received on March 13th. Curious why some people’s injured spouse forms are being processed but some aren’t.. makes me curious. My husband didn’t earn income so I’m praying we get my whole refund back.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

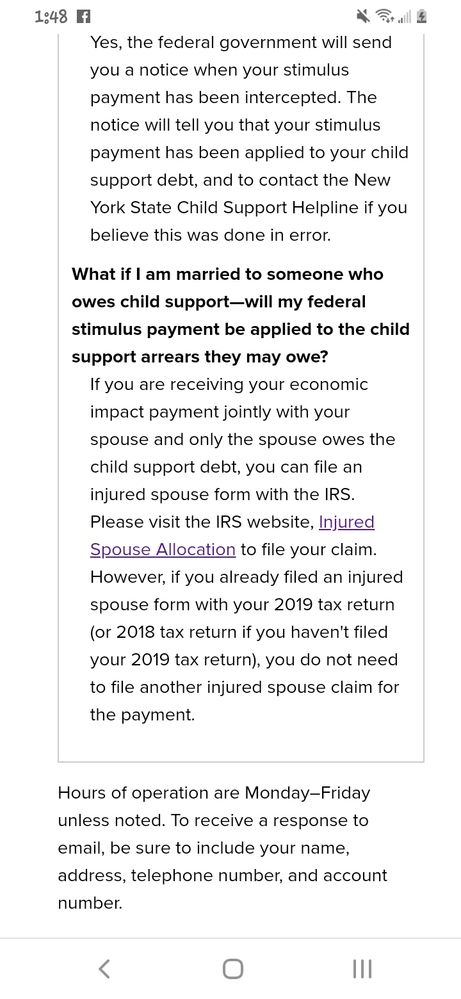

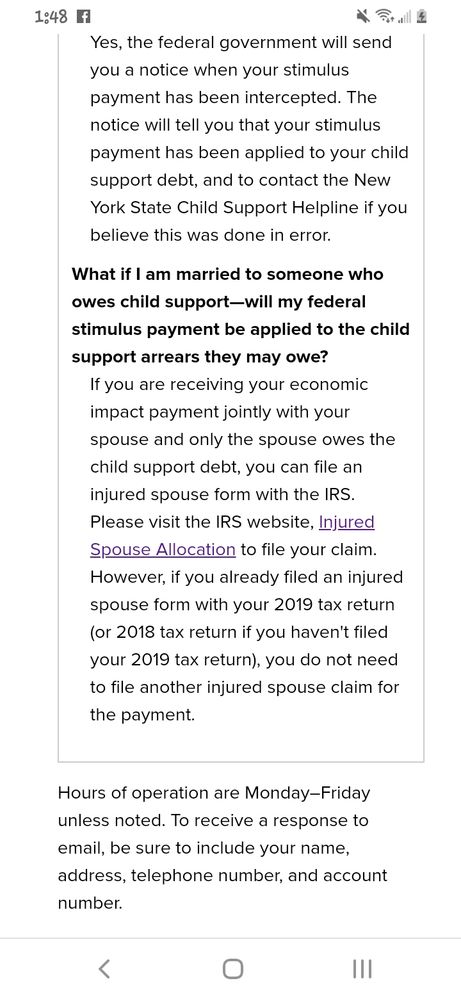

New York child support website.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

New York child support website.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

Filing form 8379 how and where do I put the amount for the stimulus check

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

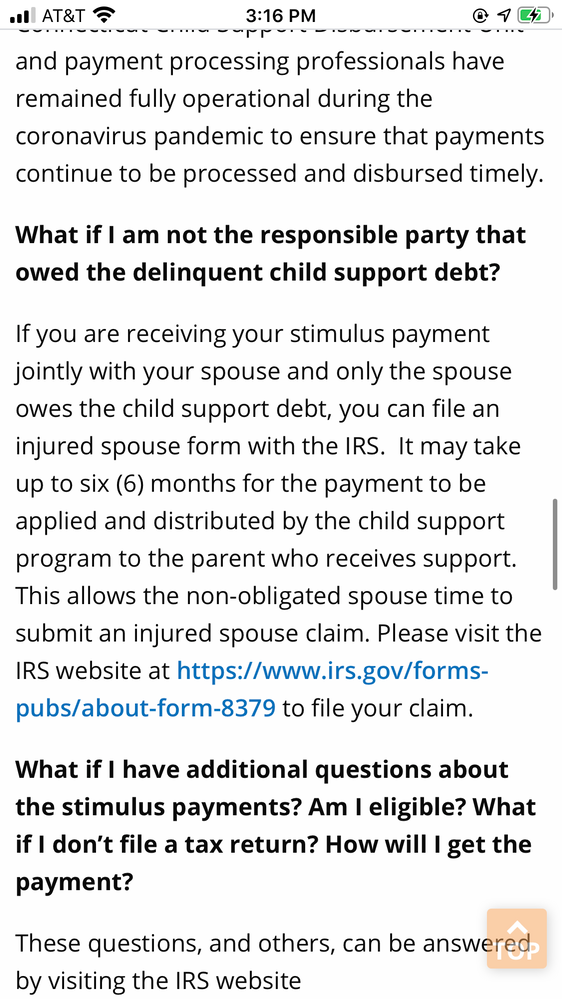

This what Connecticut site says the form has to be refilled out. This is clear and understandable there is hope I will receive the monies owed to me and my son but it will take time I am okay with that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

I'm the same yesterday I got a letter from the Treasury Department addressed to me and my wife and she got a letter just addressed to her about her back child support. for her 2 daughter that are 21 and 24. I have had to file an injured spouse 8379 for the past 15 years (about 2 years after we were married). She was a stay at home mom (unemployed) for our 2 daughters, after she got out of the Airforce and I was still active duty Navy being deployed. So it takes me 12 weeks to get my tax returns and now God knows how long it take to get the stimulus check back. Why is it only $1700? I thought it was $1200 for each adult and $500 for each child? So am I going to get $2200, my $1700 plus $500 for each of our daughters. I was a government employee for over 30yrs and retired and a disabled Veteran. this is ridiculous. So I guess all I can do is watch my credit score go in the toilet. Very Respectfully, Sean

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

I not sure for stimulus but do it using info from 2019 income tax. Form is on irs. gov

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

@cscrisson Wow first off let me thank you for your service!! Second I am so sorry you are going through this as well! This is such a disgrace and so unfair to all of us innocent spouses and our children! I pray that our money comes back to us and this is all fixed but like you said all we can do is sit and wait why our credits go down the dumps 😡😡

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

I have news the U.S treasury answered and stated to me that once the IRS opens back up whomever filed Injured Spouse will receive their monies back. It can take up to 8 weeks of course due to the IRS being shut down. And, she also stated if you want to send another Form it wouldn’t hurt but it isn’t necessary. In Connecticut they are not disbursing any of the offset money for 6 months to give people like us time to claim our money back.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

Update: I spoke to the child support office in our state and they told me that they were told we do not need to file two injured spouse forms. Although they also recommended I do so to be "safe rather than sorry", I am not going to file another one because anyone here who has filed form 8379 before knows it takes 11-14 weeks to process each time and that will only prolong or possibly restart the process. The IRS website itself says not to file a second injured spouse form if you already did with your taxes. They told me also that just like tax refunds, the money goes into a hold for six months and so we should have time to fix it.

I then spoke to the U.S Department of Treasury as that is whom the letters are from and they informed me that they have no control over it and that it is the IRS we need to speak with directly to correct this issue. They hinted at the possibility of the IRS call center opening up back week but could not promise me they actually would.

That's all I've got for now! Will let you know if I find out more.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

I did file electronically on Feb 3rd. I got mine back on April 8th. I never got a letter for my taxes, I only got the letters for the stimulus payments being taken. I called CS office they said they haven't received any of the money yet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

I am in the same boat. My husband and I have 5 children together so you do the math on how much I should have gotten with the kids not including his $1,200. I file the injured spouse form electronically with my taxes every single year and have done so for the past 10 years so if the IRS saw that, they shouldn't have intercepted the stimulus payments for my husband's child support debt. Funny thing is when we call the TOPS number it says no offsets or debts owed for him.

I am currently on hold with the Treasury Department Bureau of Fiscal Services to see if they can tell me anything (I have been on hold for an hour and half and no response...). I have not received my tax return because they normally take about 11 weeks to process when you file the form and that wouldn't be until May 13th (not sure how some of you have gotten your refunds so quickly but kuddos on that)! I will DEFINITELY raise hell if my refund is taken! I can understand them taking his $1,200 but he is a disabled vet, has no income, and therefore I normally receive all of the tax refund because it is MY HARD EARNED MONEY! Therefore, none of my stimulus payment should go to his child support. Honestly, I believe the stimulus payment should be exempt from all debts owed because we need this to live during this pandemic and feed our children!

I also only received a letter yesterday addressed to both of us and the amount showed less than $2,000 that was used to offset the debt so I am not even sure what's up with that.

I signed the petition on change.org and hope someone answers at the Treasury Department. I will keep checking this thread...

Signed,

Pissed & concerned for all injured spouse filers!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lucasmyamurray

New Member

shi-litz-1994

New Member

cher002

New Member

cloudberri000

Returning Member

hwilliams7

Employee Tax Expert