- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Injured spouse and stimulus payment

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

Yes!! You are right!!! We all need to rise up and do something! Local news is all I can think of. I did reach out but no response yet. Treasury Department must know this was a big mistake. Want the federal taxes, fine!! But not the stimulus. So wrong!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

[phone number removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

I filed married filing jointly with the injured spouse form 8379 on my 2018 taxes (also my 2019 taxes but those are still being processed). I received a stimulus payment of $526 in my bank account which I eventually figured out was our stimulus minus child support arrears owed by my husband. I THOUGHT it was our WHOLE stimulus payment which should have been $2900 - CS arrears = $526. However, we received a letter from US Dept of the Treasury showing an original stimulus amount of ONLY $1450 - CS arrears of $924 (with NO information on which CS case that goes to and I know he still owes more than $924 in arrears since I have it figured out that we should be done paying the arrears between Sept - Nov this year and of course you can't get anyone on the phone) = $526 that was deposited in my bank account.

Now, after CRYING for over an hour wondering WHY we didn't get our full stimulus $2900 and not being able to figure out why only $924 was taken for CS arrears, I FINALLY came across a CRSREPORT Update from Congress.gov that updates the information from the Stimulus payments from 2008 (using 2007 tax returns). In that 2008 CRSReport it stated that for 2007 tax returns for married filing jointly who also filed the form 8379 the stimulus payments were paid out as 50% of the payment to the uninjured spouse and 50% to the injured spouse. So, I'm now wondering if that $1450 in the notice we received was ONLY my husband's 50% of the stimulus payment and MAYBE I should still be receiving my 50% of the stimulus payment of $1450.

After reading that and having a tiny bit of hope on the situation, I came across your answer to someone else who asked about the Form 8379 & stimulus payment. Your answer was DO NOT submit ANOTHER Form 8379 JUST for the stimulus payment, even though the notice we got says the injured spouse should do so if their portion was taken for the husband's CS arrears.... although, maybe that is MEANT to be for people who haven't previously filed an Injured Spouse Form 8379???

Anyway, my question to you is (finally), am I correct in my "findings" that I (as the injured spouse) SHOULD be getting my full 50% of the stimulus payment of $1450 at some point because I had already filed the Form 8379 with my 2018 tax return? Of course the "Get My Status" or whatever it's called only gives me the status of the payment we already received, so I have no way of knowing if another stimulus payment is in the works.

Sorry I provided SOOO much information before getting to my question, so I hope you actually got to my question. Any assistance/knowledge on this would be SOOOO helpful as I'm beyond frustrated not knowing what the heck is going on.... :o(

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

the IRS has already processed my 8379 as I've received my tax refund. I received a letter stating they offset my stimulus check. Do they have to go through the same process again for the stimulus check?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

The same thing happened to me. I am so confused. Of course the form says to call the IRS, but they aren't taking calls. I filed the Injured Spouse form with my taxes and received my half of the tax return in March. So I am assuming that only half was taken by the offset office for child support (as it is supposed to) and the other half is being held until the tax offset office officially sends it to child support and then hopefully removes my hold and it goes to my direct deposit. However, I have looked high and low, and there is no good explanation of what is happening.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

@tanderson2343 wrote:

Yes!! You are right!!! We all need to rise up and do something! Local news is all I can think of. I did reach out but no response yet. Treasury Department must know this was a big mistake. Want the federal taxes, fine!! But not the stimulus. So wrong!!

The Treasury Department has nothing to do with it - they are just enforcing the law that Congress passed. The CARES act suspends all tax refund offsets except for child support. The IRS says if there is an outstanding 2019 Injured Spouse form in file then they will apply it to the stimulus payment. If they didn't then the IRS should mail a letter in about 2 weeks explaining it with instructions how to dispute it.

Congress wrote the stimulus law that way. Complain to you Congress person.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

TOP is automated. 1 (800) 304-3107

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

You can log into your IRS account and follow the codes on your current tax return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

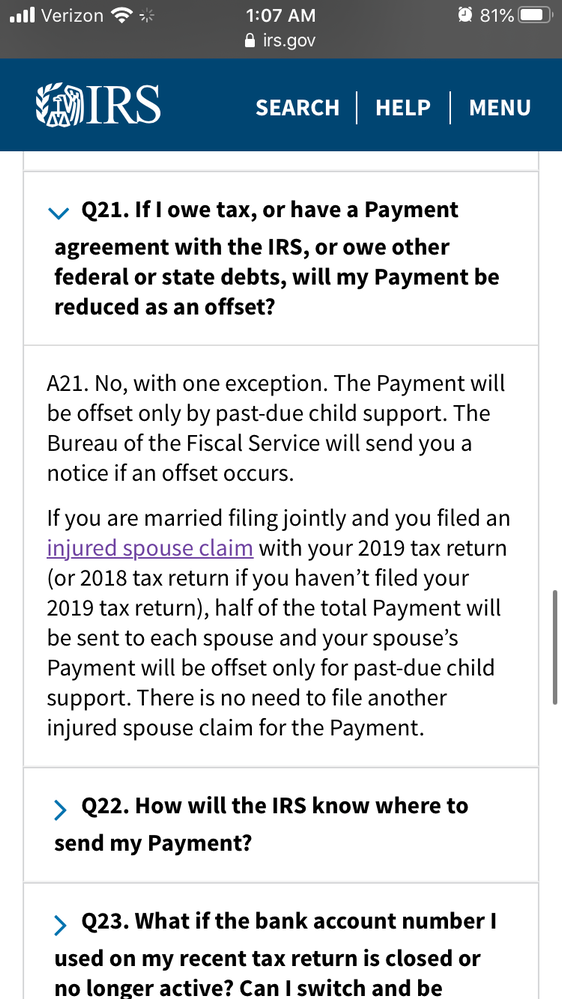

You Not need to file another injured spouse form for the Stimulus check. If you already filed your 2019 taxes with this 8379 Injured Spouse form you are all set. The Economic Stimulus Q & A on the IRS website states this.

Therefore, when you get the letter from the Treasury offset department stating that your portion of the Stimulus was taking for your spouses back child support, it will tell you to fill out an injured spouse form to get your portion back. But if you already filed The Injured Spouse with your 2019 you do not have to do it again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

Yes, I did call to a lady at the Treasury office and they said to fill out another Injured spouse form. And the letter I received states to mail it in, even thou the IRS is not accepting paper taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

Steam is coming out of my ears right now. Just got the mail and our entire stimulus was sent to arrears. So this con artist got 2900 from our stimulus. When we filed 2019 taxes I filled out an injured spouse form. I plan to do another one to get mine and my daughters share back 1200+500. I have downloaded the form and am unsure what year I need to claim this in. Thinking 2020. My husband has never been late on a payment, he got charged 3 years back pay for a woman that showed up after we had been married 10 years with an 11 year old.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

I filled out an injured spouse form for my original taxes do I need to resubmit one for the stimulus check?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

If the irs already processed my form 8379 for the day Reginald 2019 taxes and I already got my return do I have to re fill out another form for the stimulus check?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

This doesnt answer any question besides it saying from what i see that our money is totally gone

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tuffy7999

New Member

Deadspot

New Member

lucasmyamurray

New Member

shi-litz-1994

New Member

cher002

New Member