- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How to fix excess social security tax from 2 employers?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fix excess social security tax from 2 employers?

Hi,

I have 2 employers with the same FED ID. They are the same company but with different unit (hope this makes sense because I have 2 W2's with the same FED ID due to the same company with different unit).

The employer's name format appears like this in each of my W2.

<name of company>

for <some unit>

<some more info about the unit>

There is a section in the W2 called "Employer use only" with some other numbers (which kinda look like FED ID but I can't be sure).

The state IDs are different.

One unit is maxed out at 147K and the others is around 6400 (box3) and around 400 (box4) which results in excess of ~9500 (which over the limit of 9,114 for 2022).

Turbotax kept asking me to get a refund from the employer. I read from this article that Turbotax would automatically adjust if the FED ID are different.

It seems I'm the only one with this problem as I haven't seen a case like this in other thread.

How would I fix this?

Thanks for your help! Also using desktop turbotax here.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fix excess social security tax from 2 employers?

If you have two W-2s with the same EIN that is resulting in your overpaying Social Security tax, then you will not be able to claim the excess amount on your tax return. Instead, you will need to file Form 843 separately to receive the refund of the overpayment.

You can still electronically file your return after adjusting your W-2 as explained in the TurboTax help article below. Take a look at the section for Single Employer and then the section for What if my employer can't or won't cooperate? The article also explains the procedure for filing Form 843 by mail after filing your return electronically.

Can I get a refund for excess Social Security tax withheld?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fix excess social security tax from 2 employers?

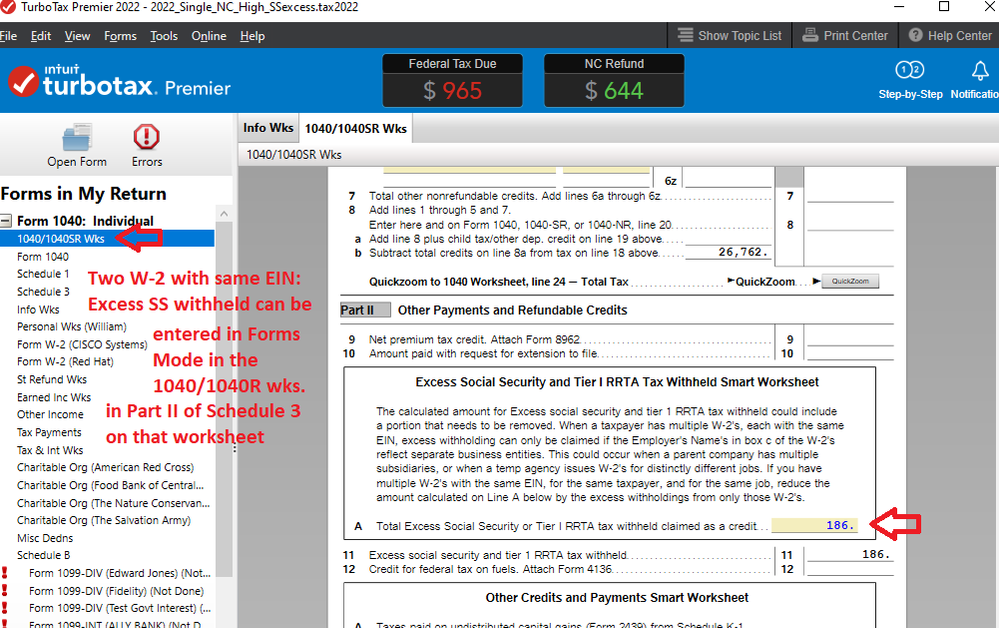

There may be a way to claim it differently, IF you are using the desktop software (Online...you'd have to use the other suggested fix).

Again, only if using the "Desktop" software.

(And I have no idea if this blocks yoru ability to efile....certainly didn't produce an error in my test file during any of the error checks and reviews)

_____________

1) first paying attention to, and writing down, the overpayment amount listed during the interview...

2) Then switching to "Forms Mode" and opening the "1040/1040SR wks"

3) Scrolling waaaaay down to the Schedule 3 section.

4) and just below line 10 on the schedule 3, is a box with the SS Overpayment amount showing as a zero...you replace that with proper overpayment amount from # 1 above.

________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fix excess social security tax from 2 employers?

Appreciate the help, @AnnetteB6!

So just to confirm as the description in that section isn't clear. Based on the single section in that article:

What if my employer can't—or won't—cooperate?

You can correct the Box 4 amount yourself before filing. Simply multiply the amount in Box 3 by a factor of 0.062 and enter that amount or 9,114.00 (whichever is less) in Box 4.

I had entered the first W2 with this info

box 3: 147,000

box 4: 9,114.00

I entered the second W2 (same FED ID but different state ID)

box 3: 6400

box 4: 397

So if I were to follow the instructions above, do I just make box 4, zero? since my first W2 had maxed out social security tax. And then fill out Form 843 and mail it after I efile my 2022 tax?

Is that correct?

Corrected second W2:

box 3: 6400

box 4: 0

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fix excess social security tax from 2 employers?

Thanks for the help @SteamTrain!

That is interesting and looks like a faster approach than filing Form 843 by mail, although I'm a bit risk adverse at the moment due to being late in the filing my taxes. Also as you mentioned, it may not allow me to e-file, I may have to test this once I get all my forms filled out.

Now I have to wonder why would Turbotax suggestions never mention this including this page?

My odd case is sort of in the "single employer" even though I have 2 W2s from the same employer under different unit (with same FED ID, state ID different).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fix excess social security tax from 2 employers?

TTX had a way to deal with it more easily a few years ago...this also happens with folks who have two (or more) employers...but a W-2 "Pay Agent" is used to send out the W2- forms...the EIN is the same on those too.

What I think happened too often, was that too many folks double-entered their single W-2 forms, or Two spouses, working at the same employer, entered both W-2 forms as-if it belonged to only one of them...and claimed the SS overpay refund improperly. If that happens too often for people confused about what they are doing, then allowing the easy in-software fix, created more problems than it corrected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fix excess social security tax from 2 employers?

After I e-filed my 2022 last year, I ended up forgetting to fill out and file Form 843 to claim my extra social security contribution (amount was around 397 I think). I just happened to remember it as I'm about to file my 2023 tax.

I have 2 questions:

Does filing 2023 tax required Form 843 as I start to import my 2022 files into 2023 tax return?

Can I still file 2022 Form 843 independently of filing my 2023 tax return?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fix excess social security tax from 2 employers?

I really don't know much about the form 843. I, personally, don't even know if the form 843 is the right one to be used.

I read some of the instructions, and it said it can be filed within 3 years of the original filing of your tax return.

I don't think it affects your 2023 filing in any way....so you should be able to just mail in that form 843 when you're ready...but just get it done in the next couple months.

About Form 843, Claim for Refund and Request for Abatement | Internal Revenue Service (irs.gov)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

KarenL

Employee Tax Expert

henkelcameron8

New Member

cdtucker629

New Member

dabbsj58

New Member

lewholt2

New Member