- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How should I report acceptance of company shares?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report acceptance of company shares?

I was granted company shares in frames of annual long-term incentive plan. The total cost of shares granted to me is around $26k. At the time of vesting the company sold a portion of shares to pay taxes (about $8k). The total cost of shares granted to me was reported by the company as imputed outcome, both taxes and stock were reflected on my W-2. I also received an equivalent of form 1099-B stating the cost of shares sold to cover taxes as short-term proceed (around $8k) and initial cash paid for the security as a cost (around &8k).

I have not sold any shares this year. My question is should I report the acceptance of the shares in any form additionally to W-2? If yes, what should I report as a proceed (total $26k or 26 minus 8)? What should be reported as a cost?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report acceptance of company shares?

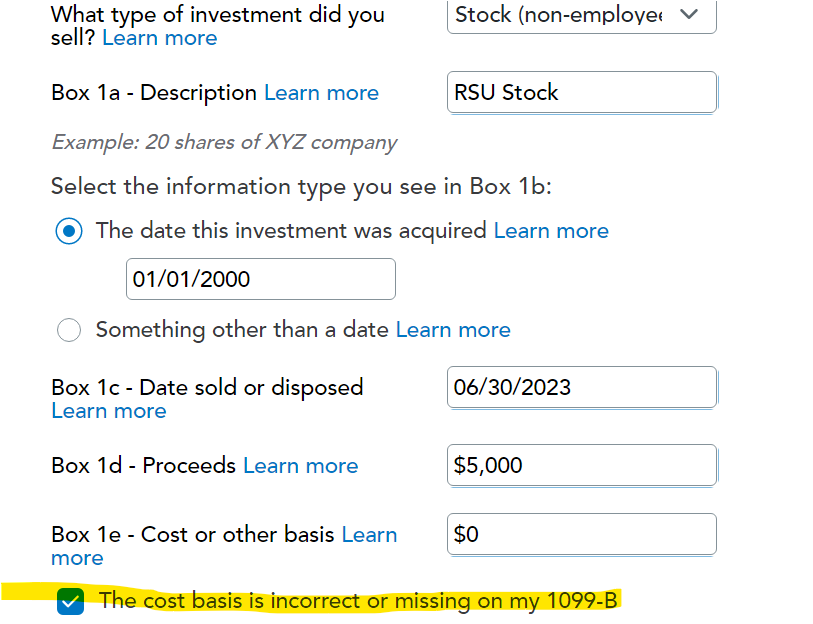

You need to report the sale of the stock in addition to the entering the W-2 form. You enter investment sales in the Wages and Income section of TurboTax, then Investments Sales, then Stocks, cryptocurrency, Mutual Funds, Bonds, etc... Choose Stock, Bonds, Mutual Funds as the type of investment you want to enter. You'll come to a screen where you can enter in your sales proceeds and cost basis.

The restricted stock units (RSU's) are taxable income and as such the value of them is included in your salary wages (box 1), social security wages (box 3) and Medicare wages (box 5) on your W-2 form. Since you have to pay social security and Medicare taxes on the income, and also income taxes, some of the shares are sold by the company to pay those taxes. They are paid in by the company.

You need to report the sale of those shares to report any resulting gain or loss, but the gain or loss is minimal since you buy and sell them almost immediately. So, the gain on sale when you report the Form 1099-B in TurboTax should be minimal. Often, the Form 1099-B will report a minimal amount for the cost basis as you may have paid little or nothing to acquire the shares. However, the income reported on your W-2 form needs to be included in the cost basis of the shares sold, so you may need to adjust the cost basis reported on the Form 1099-B to compensate for that.

A simple way to determine the cost basis of your RSU shares sold is to divide the income for the RSU's as reported on your W-2 form, plus any additional money you may have spent to acquire them, by the number of shares acquired. That will give you the cost of the shares that you can then multiply by the number of shares sold to arrive at their cost basis.

On the stock sale screen, indicate that the cost basis is missing or incorrect and you will have an opportunity to enter the correct cost basis:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report acceptance of company shares?

@ThomasM125 Thanks a lot for your answer! This helps a lot! One additional clarification: I have not sold the shares that I acquired from the company (after a part of this was sold by the company to cover for taxes). In this case do I still need to adjust the cost basis and include the income reported in my W-2 form? Or do I need to do it next year when I sell the shares?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report acceptance of company shares?

You do need to report the sale of the shares for taxes in the current year, even though you haven't sold any of the shares left over. You should receive a Form 1099-B reporting their sale. That is where you make the adjustment to cost basis if the cost basis reported on the Form 1099-B is wrong. In future years when you sell additional shares you also need to adjust the cost basis reported on the Form 1099-B if it does not include the income reported on your W-2 in the current year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pchicke

Returning Member

CWP2023

Level 1

user17523314011

Returning Member

johntheretiree

Level 2

JRS7217

New Member