- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: E-file rejected due to ForeignTaxesPaidOrAccruedDt on Form 1116

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-file rejected due to ForeignTaxesPaidOrAccruedDt on Form 1116

@rhugg3 The solution you are giving sounds like it is for a completely different issue. The issue that was directly relevant to me was that when using the simplified AMT calculation for foreign tax credit, the country field is left blank on the AMT version of form 1116, but the IRS in their e-file xml specs made it required. The country is not "various"; it is "RIC". Also, I use the online version of TurboTax and as far as I know I cannot edit the worksheets directly; everything is populated by going through the TurboTax interview questions.

In any case, I have already filed by mail since TurboTax gave me the message saying I couldn't e-file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-file rejected due to ForeignTaxesPaidOrAccruedDt on Form 1116

Sorry I have the premier version. Only trying to help you. Have a nice day.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-file rejected due to ForeignTaxesPaidOrAccruedDt on Form 1116

@rhugg3 No worries; this thread has become quite confusing with several different issues being brought up. Have a good day!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-file rejected due to ForeignTaxesPaidOrAccruedDt on Form 1116

I also changed the calculation method from the simplified AMT calculation for foreign tax credit to the so called complicated method. Then I e-filed my return and it is accepted by IRS on the same day.

I am really quite happy about it!

Now just for sure, I did some research on the so called the FTC AMT calculation method, and I found a pdf file at IRS website:

https://www.irs.gov/pub/irs-utl/int_p_062.pdf

It mentioned the FTC AMT calculation method.

It seems to me that there are really no differences between the simplified vs complicated method for the calculation if the foreign tax credit is not huge and if you do not have so called carry-forward or carry-back foreign tax credit situation.

Anyway, I learnt a lot from this message board, and I thank you all for contributing solution ideas to this topic.

Good luck to you all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-file rejected due to ForeignTaxesPaidOrAccruedDt on Form 1116

OC59's solution worked for me as well. 1) elect to itemize instead of take foreign tax credit, and then 2) go back and change back to elect foreign tax credit. it definitely worked for me. would not have expected it to work without trying it, yet another hidden turbotax gem....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-file rejected due to ForeignTaxesPaidOrAccruedDt on Form 1116

Hi everyone. Newbie here on the forum, but I have been following this thread for days trying to get my taxes e-filed. Just wanted to share something that worked for me...so far.

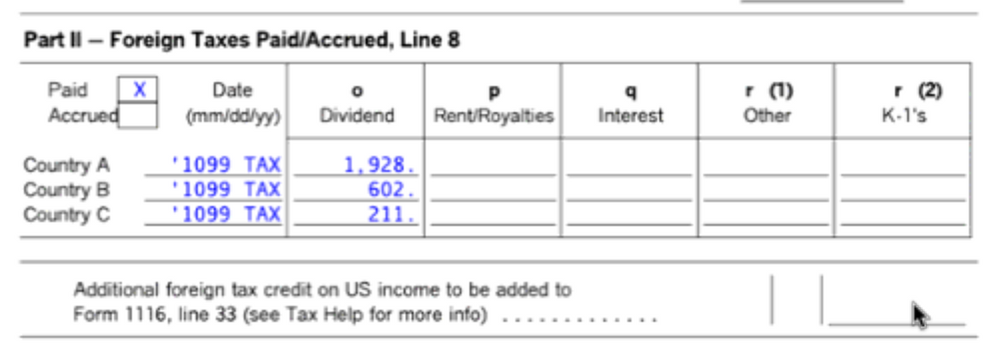

I changed the paid/accrued dates on From 1116 from Various to '1099 TAX' (following the lead on something I saw a CPA do last year on my Mom's 2019 identical form) and so far the return is in pending status. Yesterday, when I had a date, it was immediately rejected within 5 minutes, so I am hopeful. Here is a screen shot. I'll let you all know if it is accepted. Notice I had to put a single quote ahead of the 1099 Tax to get TT to accept the text instead of a date. Not sure why this is working, but I saw a CPA do it last year...so I am just following.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-file rejected due to ForeignTaxesPaidOrAccruedDt on Form 1116

foreign taxes paid on my canadian national railway stock. its my only foreign holding and turbotax is very unfriendly in making me manually fill out an 1116. I don't understanmd how to do it. If turbotax doesnt fix this in the 2021 software, I don't think I'll use turbotax in 2022 and going forward

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-file rejected due to ForeignTaxesPaidOrAccruedDt on Form 1116

I got this error message:

| What happened |

| /Return/ReturnData/IRS1116/ForeignTaxCreditSource/USTaxWithheldOnDividendAmt - Data in the return is missing or invalid. Please double check your entries. |

My situation:

I had a 1116 generated by Vanguard VEU foreign tax paid from a Fidelity account.

I fixed this by:

Going to 1116 Comp Wks, Part II Foreign Taxes Paid/Accrued Line 8

Changing the date for Country A from Various to 12/31/2020 as suggested in this thread

E-file accepted about 10 mins after e-filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-file rejected due to ForeignTaxesPaidOrAccruedDt on Form 1116

Return accepted, Oh yeah!

This form 1116 was for the “passive category” of foreign investment income with 3 countries listed, 1 specific named country (column A), Various (column B), and RIC (column C). Using ‘1099 Tax’ worked in lieu of a date and the return was accepted. Good luck. Hopefully smoother next year!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-file rejected due to ForeignTaxesPaidOrAccruedDt on Form 1116

After numerous rejections, I went to "Foreign Tax Credit Computation Worksheet, Part II", and changed "various" (under Date on Country A line) to 12/31/2020 and "Bingo" the federal return was accepted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-file rejected due to ForeignTaxesPaidOrAccruedDt on Form 1116

After being rejected multiple times and speaking with a Turbo Tax representative I reentered everything and tried again. Another rejection. This time I changed the Various selections to 12/31/2020 and Voila

Return Was Accepted!!!

Disappointed that Turbo Tax didn't resolve the problem!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-file rejected due to ForeignTaxesPaidOrAccruedDt on Form 1116

I experienced the same Form 1116 situation. TurboTax error check revealed everything ok. But I got four IRS rejections which have also affected my state tax efile. Last resort was to surf for similar experience. Found a slew of same TT experiences. But that doesn't resolve the problem. Hope that TurboTax will initiate action to remove the problem at TT or IRS end.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-file rejected due to ForeignTaxesPaidOrAccruedDt on Form 1116

My rejection email included the following message,

"/Return/ReturnData/IRS1116/ForeignTaxCreditSource/USTaxWithheldOnDividendAmt - Data in the return is missing or invalid. Please double check your entries."

I am glad I came upon this thread after having my return rejected 3 or 4 times. Following advice I read here, I change the date entry in Form 1116, Part II - Foreign Taxes Paid or Accrued, (l) from "various" to "12/31/20".

My return was accepted!!

Good luck to all who are stuck in this little minefield!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-file rejected due to ForeignTaxesPaidOrAccruedDt on Form 1116

Bravo and many thanks. I changed the Form 1116 date to end of year, and, bingo, the IRS accepted my return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-file rejected due to ForeignTaxesPaidOrAccruedDt on Form 1116

Every year, Foreign Tax Credit form 1116 never works initially, until it is correct later by Turbo Tax. I t appears that the amount accrued and used and entered in Part II used to determine the amount to be used for line 8 is never automatically transferred to line 9. Manual Override with that number to line 9 is considered an error, and not accepted by the IRS. A perpetual problem.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

karen_dell-apa

New Member

LeipersForks

New Member

kimberly-franks

New Member

elgallomoro81

New Member

Angelgirl_59

New Member