- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: A complicated question that hopefully has a simple answer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A complicated question that hopefully has a simple answer

Hello! Last year my dad's Alzheimers became too much for him to handle his finances, but fortunately we have a power of attorney and so forth.

I found on taking over his finances that he was unaware of how taxes are paid on EE savings bonds he'd been holding in paper form, bringing them into the bank to cash when he needed money. Problem was, quite a few of the bonds he'd sold and still held had already matured, and having never held paper bonds I wasn't aware that the taxes were owed in the year of maturity, not the year of sale.

With his help, I put the bonds into TreasuryDirect, which promptly converted the matured bonds into a "C" bond that wasn't interest bearing.

So I sorted out everything, and refiled his 2016/2017/2018 returns to show the correct savings bond interest income including the freshly converted ones that had matured over the last few years, paid the back taxes and the interest/penalties and then...

...got a 1099-INT with all of the bond interest on it that I'd already amended/refiled and paid.

I *presume* I put all of that into turbotax, and somewhere there's a form or something or other that deducts 1099-INT already paid in a prior year?

Is it also helpful to write a short letter or fill out some form explaining the mechanics of what happened?

I also presume I can sign his returns with the POA (which is all encompassing, every box checked) or do I need to attach the POA? Didn't get that far yet.

Any help on this presumably odd occurrence is most welcome. Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A complicated question that hopefully has a simple answer

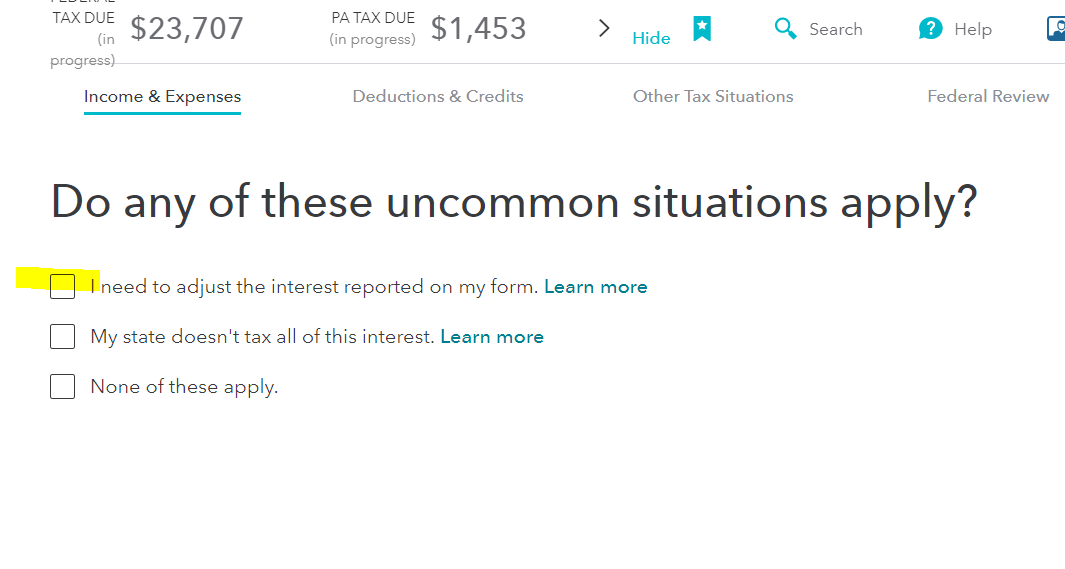

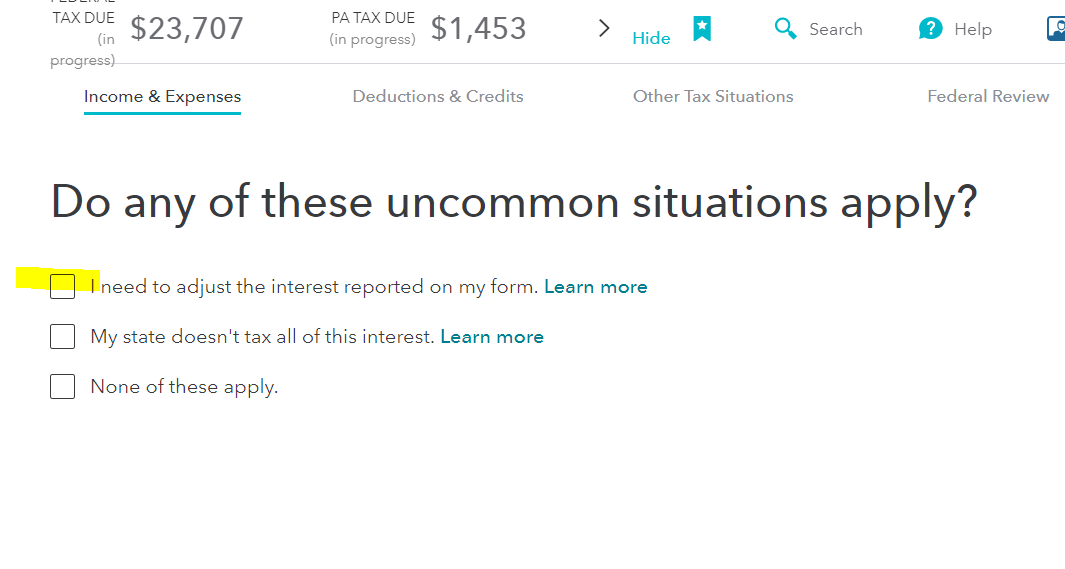

To adjust your reportable interest to reflect only the interest reportable this year in TurboTax, follow these steps:

1. While in your Tax Home,

2. Select Search from the top right side of your screen,

3. Enter 1099-Int,

4. Select Jump to 1099-Int,

5. Follow the On-Screen Prompts to complete this section.

6. When you get to this screen, stating Do any of these uncommon situations apply, check the box:

Hopefully this helps!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A complicated question that hopefully has a simple answer

POA for IRS would be Form 2848 and an explanation is needed for that new 1099INT....there's no form that deducts the amounts from past years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A complicated question that hopefully has a simple answer

I looked at that POA form yesterday and it appears that the taxpayer has to sign it. Which he can't because he's legally disabled from making financial decisions. This is a common catch-22 that I've been able to get around, banks like to do it as well. Looks like the second page has info to report that I'm a family member representative, but I'm not sure if it would still require my dads signature (that he can't legally give) to be in effect.

So in the absence of a method to handle the previously paid interest, do I put all of it in, write a letter and just staple it on the front of the return, and pay the correct amount or pay the full amount and wait for the wheels at the IRS to turn and refund a portion of it as already paid?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A complicated question that hopefully has a simple answer

To adjust your reportable interest to reflect only the interest reportable this year in TurboTax, follow these steps:

1. While in your Tax Home,

2. Select Search from the top right side of your screen,

3. Enter 1099-Int,

4. Select Jump to 1099-Int,

5. Follow the On-Screen Prompts to complete this section.

6. When you get to this screen, stating Do any of these uncommon situations apply, check the box:

Hopefully this helps!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A complicated question that hopefully has a simple answer

Ah hah! So that's where it is! Thank you so much for the tip. I spent hours reading IRS pubs and turbotax knowledgebases but couldn't find anything.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A complicated question that hopefully has a simple answer

If you e-File his return there is no signature.

Try this:

on Schedule B

cumulative bond interest from 1099-INT 1100

less amount paid on amended returns,

2016 -500

2017 -600

Total Interest Line 2: -0-

If you chose to go the statement route, put "See STMT" on the Schedule B.

attach statements to the back of the return, not the front .

Do not enclose any form 1040X.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A complicated question that hopefully has a simple answer

@ReginaM your solution doesn't work (at least with TT 2018, I don't have 2019)

even if you select "previously reported" and enter the amount, there is no effect.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A complicated question that hopefully has a simple answer

I tried it with TT19. I put in the amounts in box 3 and 4, selected I need to make an adjustment as Regina suggested, I put in the same amount from box 3 and clicked "previously reported". Worked as described. The tax owed went up when I put the amount in and back to where it was once I applied the adjustment.

Note that the number you put in to adjust is a positive number and not a negative number, as they point out a negative number ADDS more interest, rather than neutralizes it.

Looks like I've got about 20 more minutes of manual entry of about 14 bonds, and some tweaking of when the interest was earned (august) as they want to whack me for penalties and interest for under withholding. And a short letter of explanation to add to it when I e-file it, on the back.

Pretty sure this ends up in an audit situation. That'd be my first in six decades. Oh well, its all smooth sailing after this as I'll be selling the bonds at maturation and paying the taxes in that year. Hopefully if they do audit it won't go back more than 4 years, as I have zero records for his filings before 2016. Alzheimers is a fun disease. He often made noises about "not needing to file" and got incredibly defensive whenever I asked him about his bonds, since he was taking them to the bank to cash them, getting a regular 1099-INT from the bank, and nobody at the bank knew how to do it and had to call.

So for anyone in a situation like this with paper bonds, they DO require you pay taxes on the interest in the year they mature or the year you sell, whichever comes first. A wise strategy would be to have sold 2-3 of them every year, even if they had another year before maturation. He'd have been fairly tax neutral doing that, with just social security and a small pension. Instead, he treated them as though they weren't taxed until he sold them and he sold sparingly even though the bonds weren't accruing more interest. What ended up happening after I refiled back to 2016 to stop the penalties and interest from accruing and having to eat 5, 4 and 5 $10,000 bonds in the next 3 years as they mature, is that much of the interest he accrued over 30 years got eaten up by taxes, interest and penalties.

So...if you have older relatives that might be playing "shoebox bonds" like my dad, give them a heads up. I'm sure it was just a matter of time before the treasury and IRS caught on and whammed him with a very long and intrusive audit.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

AndrewA87

Level 4

holtm70

Level 2

jakraig

New Member

robadele

New Member

discviking

New Member