- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 8829 line 2 C The lesser of the square footage of your office

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8829 line 2 C The lesser of the square footage of your office

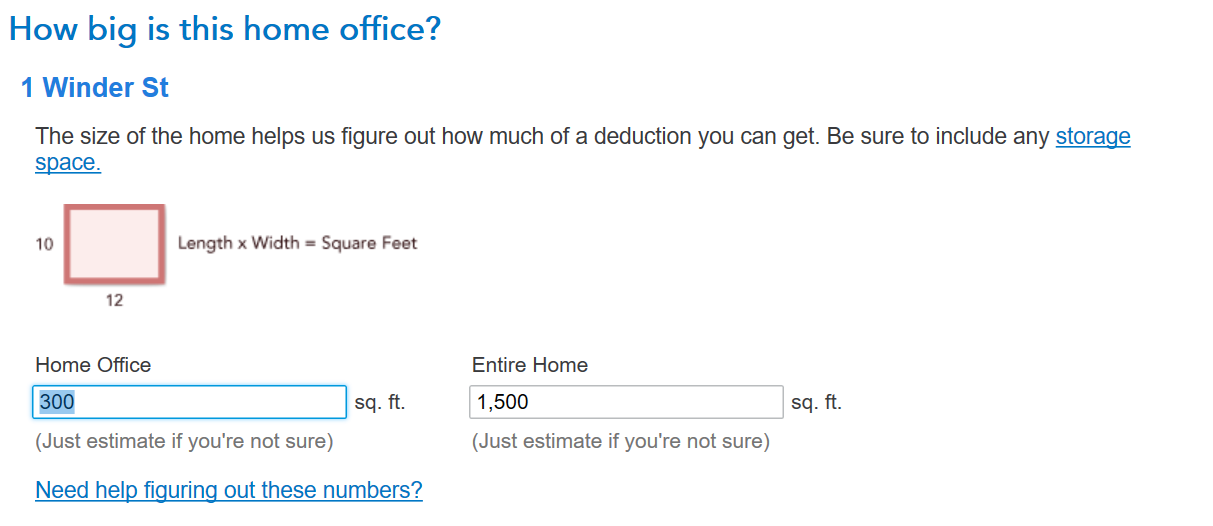

It clearly needs to be 300 as this is the max you can write off with simplified method.. But no matter what I change it to, it says it is error or wrong. It is like there is no right answer and it is holding me back from filing. How do i fix this error???

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8829 line 2 C The lesser of the square footage of your office

Same problem in 2022. Never had this problem before (last 20+ years). I deleted the forms and tried again after recent update, but still won't accept 300 or any value in this field as correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8829 line 2 C The lesser of the square footage of your office

It might be that when you entered your office and home square footage, before you were asked if you wanted to take the simplified method, you may have entered less than 300 square feet. So, you need to go back through your home office entries to make sure you didn't enter anything less than 300 square feet.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8829 line 2 C The lesser of the square footage of your office

The issue, which was never a problem in the past, appears to be that I have two home offices. Turbotax, in my experience this year, will no longer allow a standard deduction for two separate home offices. So, I took the standard deduction on one, and detailed deductions on the other, and everything worked. Saved me a few dollars too, but required more work.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sabreejayden

New Member

kalyna-hanover

New Member

dchialtas

New Member

BABYWMS

Level 1

OldFatDog

Level 3