- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 1099-R Split

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Split

Code C: (Current year conversion from IRA to Roth IRA)

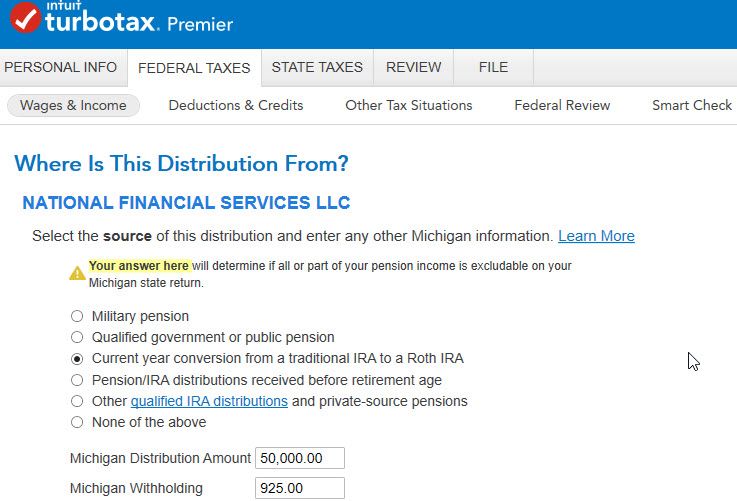

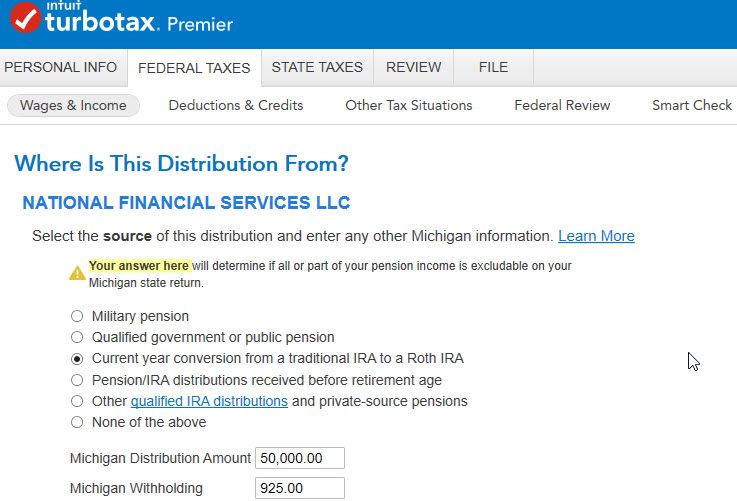

I am working on the 1099-R section of the federal return. I do not understand how to fill this out. The 1099-R shows $50K removed form the IRA. $20K went into a savings account. $30K was conversion into a Roth. What do I put down for Michigan conversion amount? 20K, 30K or 50K?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Split

Please enter $50,000 as the MI distribution amount and 30,000 as the MI conversion amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Split

But there is only one line to to enter the distribution value on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Split

Please enter $50,000 as the MI distribution amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

corinneL

Level 2

tresus95

New Member

pbmcgrath

New Member

colin_mccrossin

Level 2

hedgie

Returning Member