- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem with IRA contribution not deleted in Forms

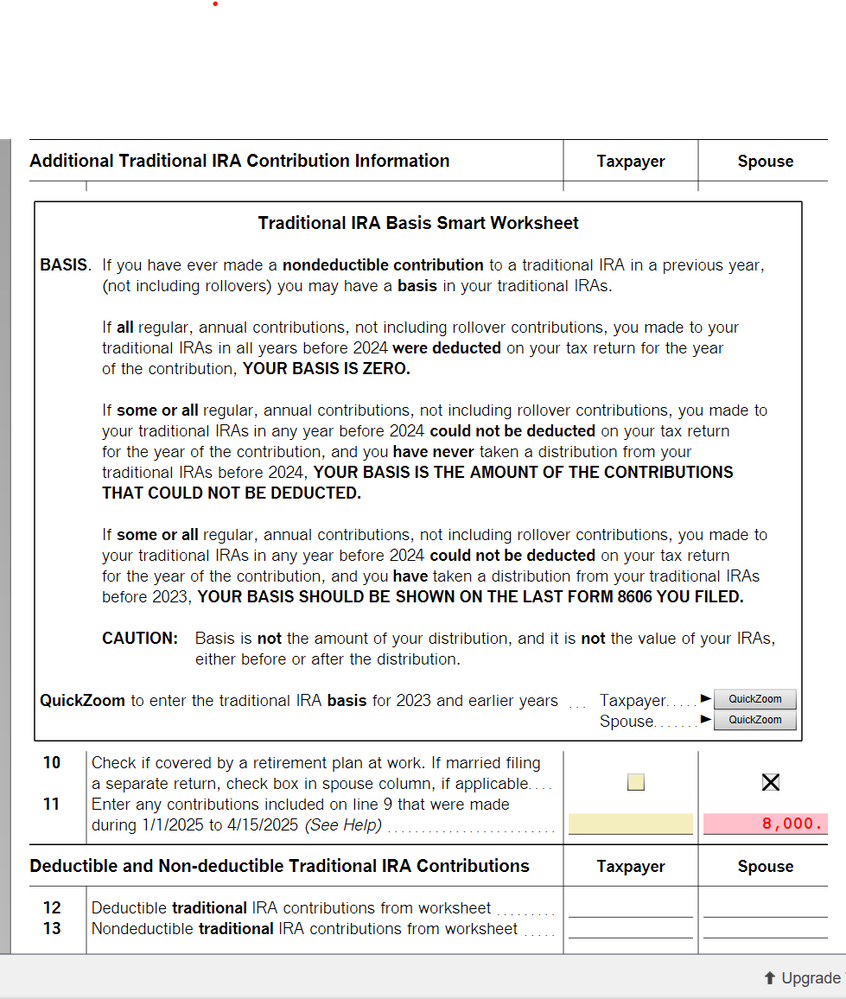

I entered a 8K for an IRA contribution to be made in 2025 but TT ended up not giving a deduction for it so I changed my mind. I removed the 8K from the screen in TT (under Traditional and Roth Contributions). On the summary screen for Your 2024 Deductions and Credits, TT displays 0 for Traditional and Roth contributions, but the form still shows 8K.

How do I fix the form?

posted

Friday

last updated

April 04, 2025

5:04 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem with IRA contribution not deleted in Forms

Please go back into the IRA contribution interview:

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “Traditional IRA”

- Continue until the "Tell us how much you contributed" screen and delete the entry under "Tell us how much of the above total contribution for 2024 you contributed between January 1, 2025 and April 15th, 2025".

- Select "Back" until you are back on the "Traditional IRA an Roth IRA" screen

- Deselect “Traditional IRA” and click "Continue"

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Saturday

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post