I would like to report a potential bug that I encountered while preparing my business taxes for my partnership LLC this year while using TurboTax Business 2024.

I entered all the required information and had no errors on Federal or State Tax (CA and NC) review. For NC Partnership returns, the LLC is required to pay taxes on behalf of the non-resident partners. In previous versions of TurboTax Business (prior to 2023), the tax paid by the LLC on behalf of a non-resident partner would be reflected in their NC K-1 (D-403) Part B. However, in the current return, NC K-1 Part B is blank for all partners. Upon reviewing this in the Forms view, it appears that there should be values on Line 6 (income attributable to NC) and Line 9 (tax paid by partnership to NC on behalf of non-resident partner).

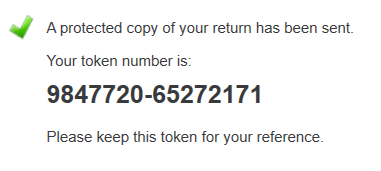

As this could be affecting others as well, would it be possible for someone at Intuit to look over my info and figure out what is wrong? I have shared the diagnostic file under the following token number:

Thank you in advance!