- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Partial year rental handling in TurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial year rental handling in TurboTax

I found the partial year rental house is always confusing in TT...

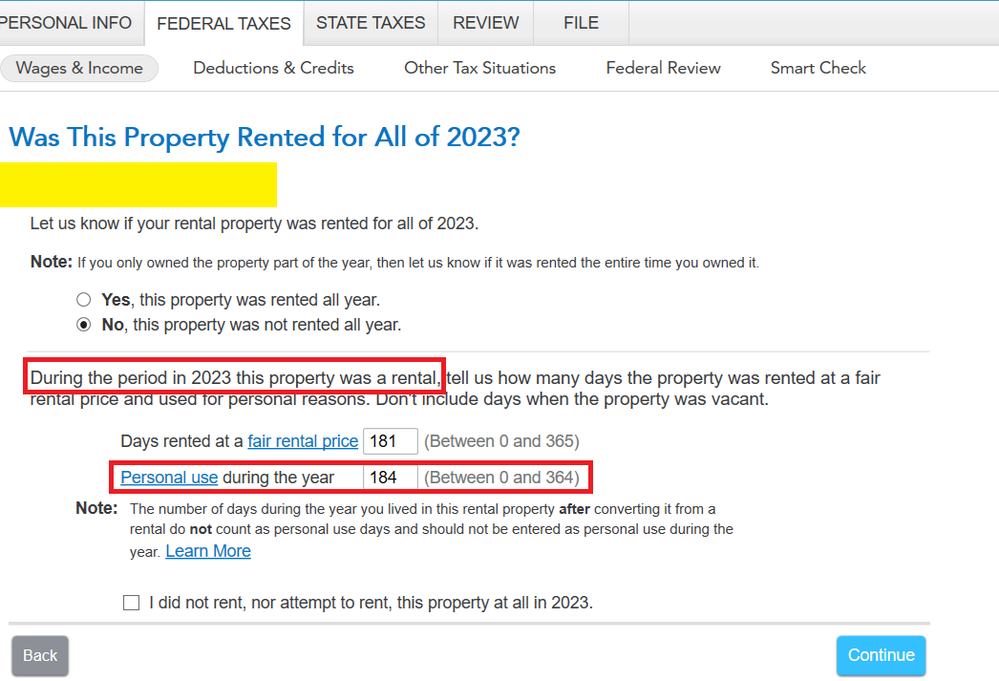

We rented out our home until June 30, 2023 (181 days since Jan 1st) and then converted it back to our primary house. How do I correctly enter it in TT (see the picture)?

Method 1 -- put "184" in the red rectangle.

Or, method 2 -- put "0" in the red rectangle.

I initially used method 1 but then realized if I do that then TT will prorate all the repair cost. E.g. if I tell TT the repair cost is $2,000 then TT will only enter about $1,000 in schedule E. However TT will prorate my property tax correctly for me -- e.g. if the whole-year property tax is $10,000 then TT will enter about $5,000 in schedule E.

After reading the texts more carefully, TT was asking about "during the period... this property was a rental" and this makes me thinking I should put "0" there (method 2). However if I do this then TT will directly enter everything I told it in schedule E and I need to manually prorate everything before entering into TT. E.g. if the whole year property tax is $10,000 then TT will directly enter $10,000 in schedule E. Same for the repair.

I think method 2 is the right way to go but I'd like to confirm it.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial year rental handling in TurboTax

0

See https://www.irs.gov/instructions/i1040se#en_US_2023_publink24332td0e847

Do not count as personal use:

Any days you used the unit as your main home before or after renting it or offering it for rent, if you rented or tried to rent it for at least 12 consecutive months (or for a period of less than 12 consecutive months at the end of which you sold or exchanged it).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial year rental handling in TurboTax

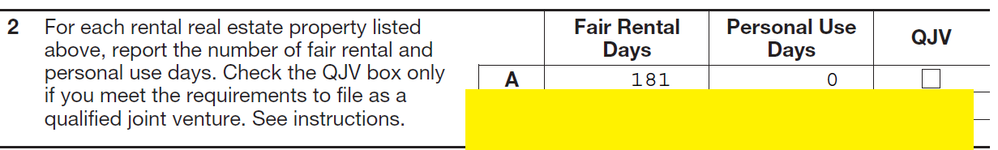

Actually I think this is not a TT-specific question. I guess my real question is -- in my situation, should the "Personal Use Days" in schedule E be 0 or 184?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial year rental handling in TurboTax

0

See https://www.irs.gov/instructions/i1040se#en_US_2023_publink24332td0e847

Do not count as personal use:

Any days you used the unit as your main home before or after renting it or offering it for rent, if you rented or tried to rent it for at least 12 consecutive months (or for a period of less than 12 consecutive months at the end of which you sold or exchanged it).

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

AS80

Returning Member

pwash

New Member

abarmot

Level 1

NICAAC

Level 1

lllbby

Level 2